In an unprecedented move that reverberates through the international financial markets, the United States has opted to impose a hefty 39% tariff on the importation of gold bars—specifically, those weighing one kilogram and 100 ounces—originating from Switzerland. This startling development promises to send shockwaves through the global bullion market, unsettling the finely balanced dynamics of gold trade.

The roots of this dramatic shift can be traced back to a key decision documented in a correspondence from the U.S. Customs and Border Protection (CBP), dated the 31st of July, 2025. This missive marked the reclassification of these essential bullion commodities, pivotal to the operational machinery of the Comex futures market, from their previous status as “unwrought, nonmonetary gold” to “semi-manufactured”. Such a reclassification subjects these imports to the newly imposed duties, departing from their previous exemption from tariff impositions in preceding rounds.

This development draws further gravity from its timing and broader economic implications, coming in the wake of a comprehensive tariff package levied on all goods of Swiss origin. This larger package itself emerged following the rejection by the United States of a Swiss proposition. Switzerland had offered to implement a more modest 10% tariff, coupled with the enticing promise of $150 billion directed towards investments bound for the U.S., proposals which Washington ultimately declined.

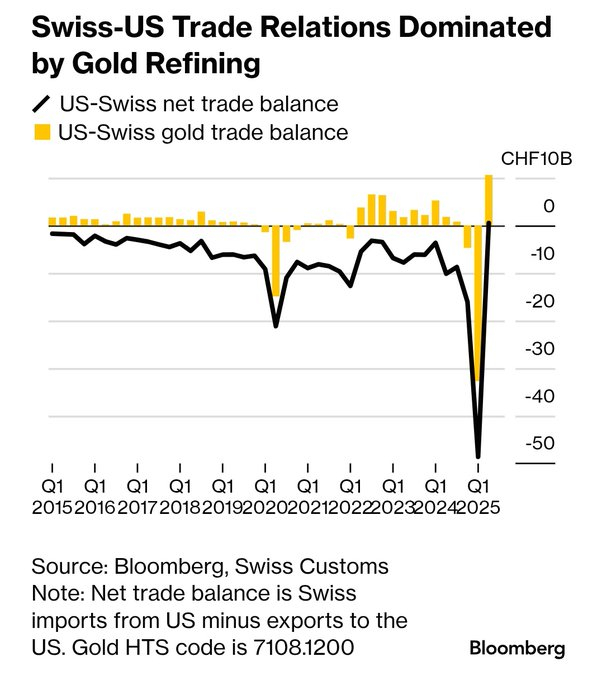

Switzerland’s standing as the globe’s preeminent hub for gold refining adds another layer of complexity to this economic narrative. Over a year leading up to June 2025, Switzerland’s gold exports to the United States approached a monumental value of $61.5 billion. The implications of the new tariffs are staggering, potentially appending nearly $24 billion in duties to this significant trade flow.

This development has elicited reactions across the spectrum of stakeholders involved in the Swiss-U.S. gold trade. Christoph Wild, at the helm of the Swiss Association of Manufacturers and Traders of Precious Metals, lamented this turn of events as yet another hurdle for the already strained Swiss-American gold trade relations, casting doubts on the economic viability of future exports under this new tariff regime.

The immediate aftermath of this ruling witnessed a tumultuous response in the bullion market, epitomized by a soaring surge in gold futures in New York, which breached the $3,500 per troy ounce mark, reaching an all-time high of $3,534 on the 8th of August before experiencing a slight pullback. Analysts have attributed this rally to a confluence of factors, not least the shock of the tariff announcement alongside gold’s enduring appeal as a haven amid escalating trade tensions and a backdrop of geopolitical flux.

This sequence of events has not only led to profound market reactions but also triggered a wave of uncertainty, with some traders voicing concerns over the potential for the CBP’s decision to be an error, anticipating possible legal disputes. The immediate consequence has been a palpable disruption in the logistics of gold shipments, with some consignments grounded in limbo, awaiting clarity.

Switzerland’s critical position within the intricate supply chain of global bullion trade now stands at a crossroads. The country operates at the heart of a triangular logistical network, where raw gold is refined and cast into kilo and 100-ounce bars for the U.S. market, alongside 400-ounce bars catered towards London, before these products are dispatched to fulfill contracts with Comex and replenish central bank reserves.

Analysts and strategists, including UBS’s Joni Teves, have raised concerns regarding the viability of U.S. trading activities should tariffs on these crucial deliverable products remain enforced over the long term. Moreover, the implications of the CBP’s clarification extend beyond Swiss borders, encompassing all gold bars of the specified weights imported into the U.S., thereby amplifying the potential for disruption across global trade flows.

In response to these challenges, Switzerland is purportedly engaged in negotiations with Washington, aiming to mitigate the impact of these tariffs. The ongoing dialogue is shrouded in uncertainty, with the global gold market eagerly awaiting further clarification from the White House. This clarification holds the key to predicting whether the market will stabilize or gear up for extended periods of uncertainty and volatility.

In the interim, a wide array of industry stakeholders—from banking institutions to refining entities—are bracing for potential upheavals, both in terms of market pricing and the physical logistics of gold supply chains. This scenario underscores the intricate interplay between trade policies and the global commodities market, highlighting how shifts in the geopolitical and economic landscapes can have far-reaching consequences on global supply chains and market stability.