In the early hours of a crisp Monday morning, the global financial markets experienced a slight tremor as both spot and futures gold saw a decline of over 1%, a significant movement for traders and investors who monitor these shifts closely. This decrease was largely attributed to a newfound optimism regarding a possible de-escalation in the ongoing Ukraine conflict, which in turn reduced the demand for gold, traditionally seen as a safe haven during times of geopolitical uncertainty. Simultaneously, this burgeoning hope also exerted downward pressure on the prices of other commodities.

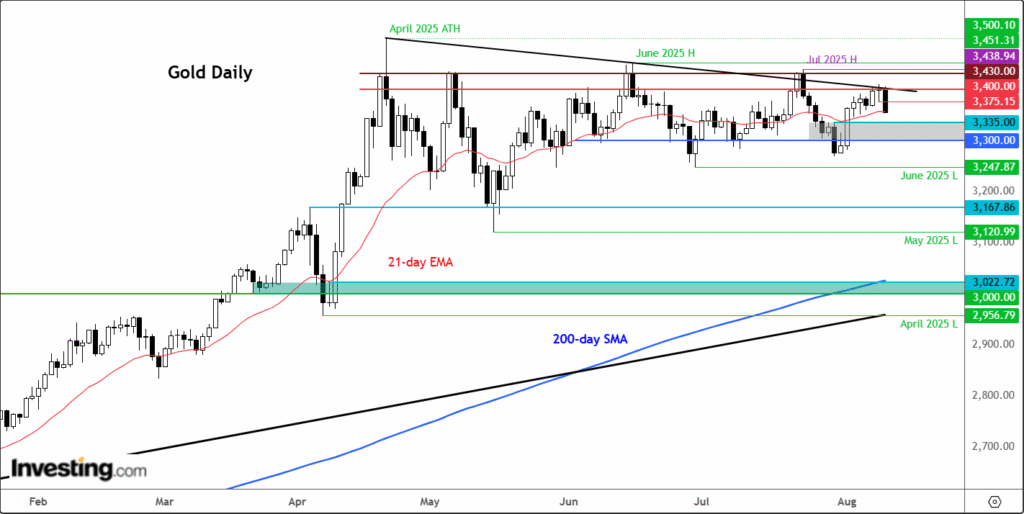

Just the previous week had concluded on a somewhat bewildering note. Discussions surrounding the imposition of tariffs on gold had inadvertently propelled its futures to unprecedented highs. However, spot gold maintained a more reserved trajectory, just barely missing the critical $3,400 threshold. This price point is eagerly watched by market participants, marking a significant barrier that could prelude the release of Tuesday’s crucial Non-Farm Payroll (NFP) data. This announcement is poised to be a determinant in the foreseeable market trends, potentially influencing the Federal Reserve’s stance on interest rates, bond yields, and by extension, the valuation of gold.

The decline observed on Monday essentially negated the gains accrued over the previous week. These gains were primarily stimulated by a depreciating US dollar and comparatively softer economic data, despite the stock market’s vivacity and a prevailing risk-on sentiment among investors. The market’s current recalibration of positions could be traced back to an announcement by President Donald Trump on his planned meeting with Vladimir Putin in Alaska on the 15th of August, which is aimed at negotiating a potential resolution to the war.

Despite the day’s retreat in prices, gold continues to oscillate within a familiar range. The enduring ambiguity surrounding trade negotiations paired with the anticipation of two, possibly three, interest rate cuts before the year’s end, beginning in September, offers some support against a more significant downturn.

The imminence of the US inflation data release positions it at the epicenter of market speculation this week. Following the NFP data, the market’s attention will pivot to Thursday’s Producer Price Index (PPI) and then to a series of inflation-related releases later in the week. These include the Consumer Price Index (CPI), retail sales figures, and several other key indicators that offer insights into consumer sentiment and overall economic health.

Given the Federal Reserve’s dual mandate to foster employment and ensure price stability, the CPI—a measure closely scrutinized by the markets—assumes considerable significance. There is a keen interest in discerning whether the inflation figures will reflect the anticipated effects of higher tariffs and escalating input costs on the consumer. Notably, the CPI has persistently fallen short of projections for the last five months, a trend that might be on the cusp of a turnaround.

The anticipation surrounding the Fed’s inflation targeting strategy, alongside a detailed examination of retail sales data for indications of potential consumer exhaustion, lays the groundwork for an intricate market narrative. This evolving story is further complicated by the possibility of stagnation juxtaposed with rising inflation, a scenario that historically boosts gold’s appeal as a hedge against uncertainty.

Looking forward, the possibility of the Federal Reserve initiating a rate cut as soon as September, with subsequent adjustments potentially in the offing, remains a subject of intense speculation. The prevailing economic indicators, including softer employment figures, weaker ISM readings, and a tepid services sector, collectively bolster the argument for a more dovish monetary policy stance. Several Fed officials have already alluded to the likelihood of multiple rate cuts throughout the year amidst persistent inflation concerns, an environment that could sustain gold’s allure even as equity markets demonstrate robust performance.

From a technical perspective, gold’s price action continues to be dictated by a descending trend line that has been in play since the peak observed in April. Despite recent movements, gold prices are tethered to a series of support and resistance levels that provide traders with critical indicators for future price directions.

In a financial landscape that is as volatile as it is unpredictable, investing tools and resources offered by platforms like InvestingPro could prove invaluable. These tools, driven by decades of financial data and sophisticated machine learning models, empower investors with insights and analytics tailored for high-stakes decision-making. Whether assessing stock potential or determining fair value estimates, these platforms aim to enhance the investing experience with a blend of precision and innovation.

As the market navigates through an intricate web of economic releases, policy decisions, and geopolitical developments, the lure of gold—rooted in its historical stability—remains a focal point for both seasoned and novice investors alike. In this ever-evolving narrative, the precious metal continues to exemplify both the challenges and opportunities inherent in the pursuit of financial security and growth.