The Swiss Franc’s journey through the financial markets has not been as buoyant as usual, stirring curiosity and concern alike among investors and market analysts. Historically recognized for its stability and often sought after as a safe haven during turbulent times, the Franc has experienced a notable dip in its performance, particularly noticeable from the early days of July onwards. This downturn in its fortunes has continued well into August, putting the currency under the spotlight for various reasons.

The decline in the Swiss Franc’s allure can be attributed to several factors working in tandem. Notably, rising yields in the United States, coupled with a relative easing of geopolitical tensions, have prompted investors to turn their gaze away from traditional safe havens, including the Franc. This shift in investor sentiment is mirrored in the currency pairs USD/CHF (United States Dollar/Swiss Franc) and EUR/CHF (Euro/Swiss Franc), which display bullish trends, despite the Franc’s lacklustre performance.

One major event on the horizon, with the potential to significantly influence the direction of the Swiss Franc, is the upcoming U.S. inflation report. Market observers are closely eyeing this report, as it is expected to shed light on future Federal Reserve policy decisions, possibly affecting global interest rates and investor strategies. The dynamics between U.S. economic indicators, such as inflation rates and the Federal Reserve’s monetary policies, have historically shared a strong correlation with the Franc’s value. Thus, the anticipation around the U.S. Consumer Price Index (CPI) report has only intensified the focus on the Franc and its potential movements.

#### The Enigma of the Franc’s Underperformance

The Swiss Franc’s recent phase of underperformance is rather unusual, considering its longstanding reputation as a fortress of stability. The currency started to falter in early July, a trend exacerbated by a confluence of factors including higher U.S. Treasury yields and a less volatile geopolitical climate. Additionally, fears regarding the worst possible outcomes of U.S. tariff policy have subsided, further diminishing the Franc’s appeal as a safe haven.

### Analyzing the Underlying Factors

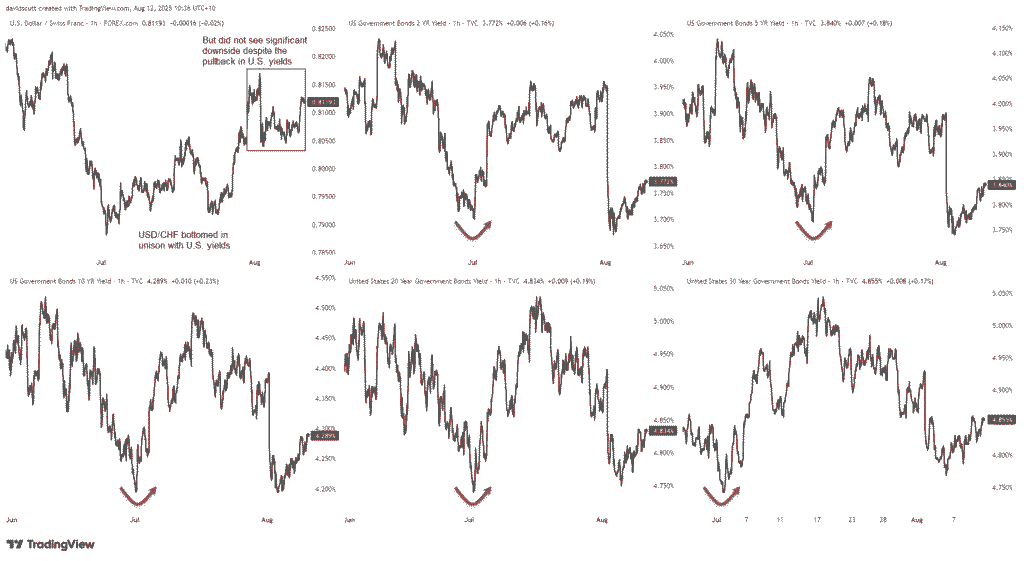

The onset of the Franc’s downtrend coincided with a recovery in the U.S. dollar, driven by rising U.S. Treasury yields. This development marked a significant pivot in the currency markets, as evidenced by various technical charts and analyses. For instance, a notable correlation can be observed between the USD/CHF pair and movements in U.S. Treasury yields, highlighting the impact of U.S. economic indicators on the Franc.

Yet, the crucial question that arises is whether this downturn represents a temporary setback for the Franc or signifies a deeper, more structural reversal in its fortunes. Historical context suggests that the Franc has undergone similar phases of correction before regaining its strength, supported by its long-term appeal as a reliable safe haven.

### The U.S. Inflation Report: A Decisive Moment

The upcoming U.S. CPI report is poised to be a watershed moment for the Swiss Franc. A higher-than-expected inflation rate could bolster the USD/CHF pair, as it might lead to a reassessment of the Federal Reserve’s rate cut expectations, potentially causing U.S. Treasury yields to rise. Conversely, a lower inflation figure could enhance the Franc’s attractiveness by fuelling speculation of prolonged monetary easing by the Fed.

This nuanced interplay between U.S. economic policies, inflation rates, and the Swiss Franc’s valuation underscores the complex dynamics at play in the global financial markets. As investors and traders brace for the CPI report’s release, the focus is not just on the immediate impact on currency pairs but also on the broader implications for interest rate policies and international investments.

### Broader Market Implications

Beyond the immediate repercussions for USD/CHF and EUR/CHF pairs, the Swiss Franc’s trajectory in the wake of the U.S. inflation report could influence its performance against other major currencies, such as the Japanese yen and the Euro. The Franc’s volatility in response to shifts in Fed rate cut expectations could potentially offer trading opportunities, albeit with a careful consideration of the risks involved, especially around major economic announcements.

### Conclusion

As the financial markets await the U.S. inflation report with bated breath, the Swiss Franc finds itself at a critical juncture. The outcome of the CPI report holds the key to the Franc’s near-term direction, with significant implications for currency pairs, interest rates, and global investment flows. Amidst this uncertainty, one thing remains clear: the Swiss Franc’s status as a barometer of investor sentiment and a pivotal player in the global financial landscape is unchallenged, testament to its enduring legacy as a symbol of stability and security in an ever-changing world.