In the realm of global finance, the currency exchange market serves as a barometer of economic health and investor sentiment worldwide. Among the myriad of currency pairs traded, the USD/JPY, representing the exchange between the United States Dollar and the Japanese Yen, holds a position of particular interest for investors and analysts alike. In recent developments, this currency pair has shown promising signs of upward movement, backed by technical analyses and awaiting crucial economic data from the United States.

As investors worldwide hold their breath for the release of the US Consumer Price Index (CPI), the anticipation builds upon the backdrop of July’s nonfarm payrolls, which fell short of expectations. This upcoming CPI data is of paramount importance as it serves as a critical gauge of inflationary pressures within the US economy. Given the current market sentiments, there is an increasing speculation that the Federal Reserve might consider a rate cut in September, contingent upon the inflation figures. Thus, the financial markets are on the edge, keenly awaiting confirmation from the upcoming data release.

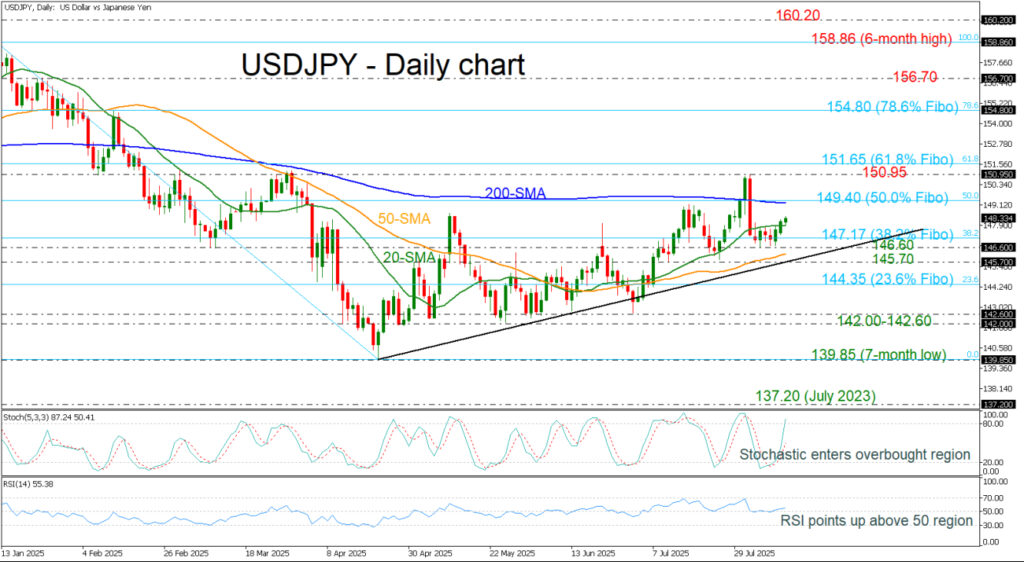

Diving deeper into the technical landscape of the USD/JPY pair, there has been a notable breach of the 20-day Simple Moving Average (SMA), a bullish signal for traders and analysts. Looking ahead, the next significant resistance zone is identified around 149.40. This level is not arbitrary but is rather a confluence of the 200-day SMA and the 50.0% Fibonacci retracement, calculated from the pair’s slide from 158.86 down to 139.85. Should the pair’s ascent persist, the focal target becomes the crest at 150.95, a peak that has previously been tested.

Conversely, the terrain beneath holds its immediate support at the 38.2% Fibonacci level of 147.17. A break below this threshold could unveil further support levels at 146.60 and a short-term trendline near 145.70. Should the pair weaken further, crossing below the 23.6% Fibonacci at 144.35, the market stance might transition to a neutral perspective from its current bullish bias.

From the perspective of momentum indicators, there is a tangible bullish bias. The stochastic oscillator marches higher within overbought territories, and the Relative Strength Index (RSI) steadfastly holds above the midpoint of 50. These indicators collectively signal the potential for continued upward movement in the USD/JPY pair, lending confidence to investors looking for growth opportunities.

To encapsulate, as the financial realm stands on the cusp of pivotal US inflation data, the USD/JPY currency pair remains buoyed by positive sentiments. Technical indicators align, suggesting that the path ahead could very well be marked by further gains. This juncture in the financial markets underscores the intricate dance between economic indicators, investor sentiment, and the ever-vigilant eye of technical analysis.

In the broader scheme, this unfolding narrative around the USD/JPY is a microcosm of the global financial markets’ complexities. Currency pairs act as the lifeblood of international trade and investment, and their fluctuations can offer a mirror to the world’s economic health. For those new to this saga, it’s essential to understand that behind each tick on the exchange charts lies a web of economic policies, investor expectations, and real-world events.

As we await the US CPI release, the implications extend beyond the shores of the United States, affecting global markets and shaping investment strategies. The USD/JPY pair, in particular, signifies not just a battle of currency strengths but a reflection of geopolitical and economic shifts on a global scale.

For investors, analysts, and enthusiasts keenly observing this space, the upcoming period promises a blend of anticipation and strategy, as the interplay of data releases and market sentiment unfolds. Whether the Federal Reserve opts for a rate cut following the CPI figures will significantly influence the direction of the USD/JPY pair and, by extension, the pulse of the global financial markets.