The Australian economy is under the microscope this week, facing critical scrutiny with forthcoming data on wages and jobs. Such revelations hold the potential to precipitate earlier than anticipated cuts to interest rates by the Reserve Bank of Australia (RBA), especially if signs of labour market fragility persist. This scenario sets the stage for financial markets, with the Australian dollar (AUD) navigating through turbulent waters against its major counterparts.

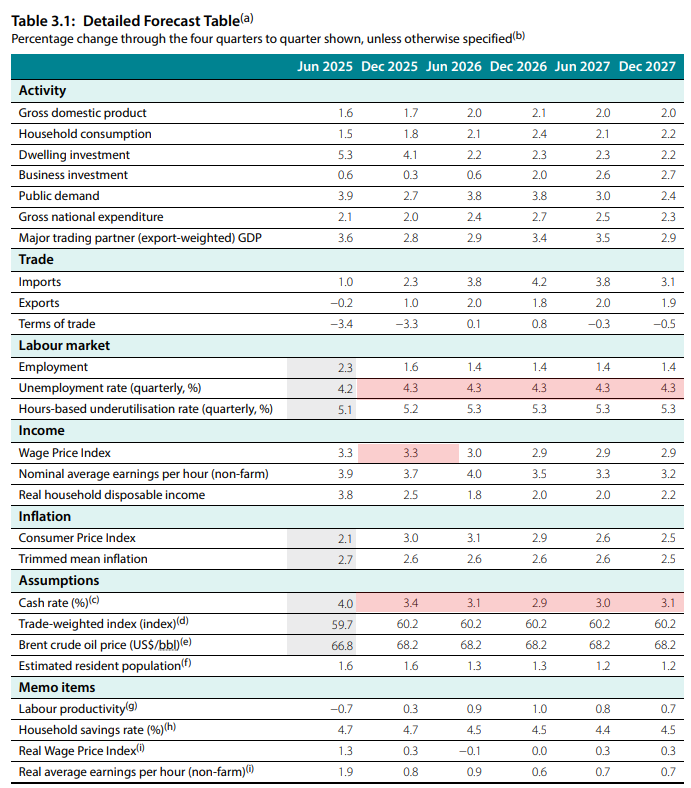

The RBA has cast its projections, envisioning the unemployment rate cresting at 4.3%. However, any unexpected deteriorations in employment figures could hasten the timeline for interest rate reductions, casting a shadow over the AUD’s performance. Notably, the AUD against the euro depicts a bull flag configuration, signaling bullish momentum with targets at 1.8100 and subsequently at 1.8400. Meanwhile, the AUD’s struggle against the British pound remains within a well-established range, hinting at potential opportunities for traders to capitalize on, dependant on the directional movement.

The Significance of the Australian Dollar in the Global Economic Landscape

The Australian dollar is encountering a pivotal 24-hour period, marked by forthcoming wage and employment data, poised to influence the RBA’s monetary policy considerations. Given the RBA’s optimistic stance that unemployment rates have peaked, any verification of labour market weaknesses could instigate a quicker pace of interest rate cuts, exerting pressure on the AUD.

Showcasing resilience, EUR/AUD adheres to a bull flag pattern, with the 50-day moving average serving as a support threshold for buyers. Concurrently, GBP/AUD meanders within a defined range offering both breakout and fade strategies, contingent on unfolding price actions. Additionally, upcoming jobs figures from the UK and euro area later in the week could introduce further volatility for the AUD crosses.

Examining the Labour Market Data: A Closer Look

Though trading AUD FX crosses might not always captivate traders, their often predictable behaviour can appeal to those seeking to mitigate undue forex market volatility. With the US inflation data already disclosed, attention pivots towards Australia, where imminent wages and unemployment statistics are due. These reports are especially crucial, as the RBA’s latest forecasts are predicated on the belief that the unemployment rate – currently pegged at 4.3% – has reached its zenith.

Under the RBA’s assumptions, the need for further rate cuts is underscored, especially with the anticipation of reducing the cash rate below 3%. Any adverse labour market trends, therefore, have the capacity to accelerate rate cut schedules, undermining the AUD’s value. This emphasis on employment data underscores its significance over mere employment change figures, offering a nuanced perspective for traders navigating this data release.

EUR/AUD and GBP/AUD: Charting the Course

The EUR/AUD pair demands attention, nestled within a bull flag formation that hints at an eventual resumption of its upward trajectory. Attempts at a bullish breakout have so far been thwarted, yet the ongoing defense of the 50-day moving average teases speculative opportunities for bullish positions.

Conversely, GBP/AUD finds itself testing the upper echelons of its recent trading range, with outcomes from the Bank of England’s recent hawkish stance influencing its trajectory. The dichotomy of bull and bear setups presents varied strategies for traders, hinging on the pair’s movement within or beyond its prevalent range.

What Lies Ahead for the Australian Dollar

As global markets brace for Australia’s labour market data, the implications for monetary policy and the subsequent reactions within the forex sphere underscore the AUD’s vulnerability to domestic economic signals. With the backdrop of anticipated GDP figures from the UK and euro area, the scene is set for a week of heightened volatility and strategic positioning among AUD traders.

In essence, the unfolding economic narratives from Down Under will not only shape immediate trading strategies but also cast a long-term shadow over the AUD’s resilience and the RBA’s policy trajectory. As traders and analysts alike parse through the intricacies of Australia’s economic health, the global financial community watches closely, keen to understand the implications of these developments on broader market dynamics.