In recent times, the cryptocurrency market has seen a surge of activity, with investors keenly attempting to drive the prices to unprecedented heights. Unfortunately, these efforts have, for the moment, not resulted in achieving new milestones. At this juncture, indications of a possible double peak in the market are emerging—though this isn’t a definitive signal of a forthcoming major downturn, it highlights a phase of uncertainty where the balance of power between buyers and sellers will dictate the future trajectory of market prices.

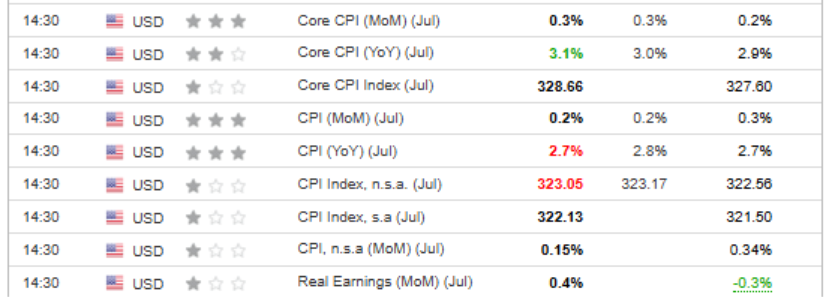

Amidst these market dynamics, the HYPER project has been garnering significant attention. This innovative venture seeks to harness the robust security attributes associated with Bitcoin while simultaneously offering the enhanced transaction speed and reduced costs associated with more advanced networks like Solana. The initiative’s novel approach involves raising funds through an Initial Coin Offering (ICO), and it is on the verge of securing $10 million in funding. Interestingly, this development comes in the wake of mixed signals from the US economic sphere, where recent reports illustrated a performance slightly under expectations, coupled with a core inflation figure that surpassed the target, thereby fueling speculation about the likelihood of further interest rate adjustments and offering momentary support to the US dollar.

The HYPER project evidently taps into one of the quintessential challenges facing Bitcoin: its relatively limited efficiency for day-to-day transactions due to high fees and slower processing times. By leveraging Bitcoin’s second layer and integrating the Solana Virtual Machine, HYPER is positioned to offer a seamless movement of BTC across the primary and secondary layers, thereby promising a significant step forward in transactions efficiency without compromising on the trust and security Bitcoin is renowned for.

Despite the fact that the pre-sale of HYPER is ongoing without a definitive closure date, its capacity for scaling up based on investor interest paints a promising future. Herein lies an amalgamation of Bitcoin’s solid foundation as a store of value and the pioneering transactional capabilities necessitated by modern-day demands.

Turning our gaze to the broader cryptocurrency landscape, Bitcoin’s journey appears momentarily hamstrung as it navigates resistance near its historical zenith of $123,000. This resistance has led to speculative discussions about the potential for a double-top formation—a classical reversal pattern. However, the fervent defense of key support levels underscores the persistent optimism within the investor community, with sights still set on eventually breaching the $130,000 mark.

The narrative surrounding Ethereum equally highlights a market in flux, emerging from a period of relative stagnation to a robust rally fueled by strong demand, smashing through the $4,000 resistance level. This resurgence is a testament to Ethereum’s enduring appeal and the sustained appetite among investors for assets that offer both innovative capabilities and substantial growth potential.

Against this backdrop, InvestingPro offers a suite of tools designed to empower investors with nuanced insights and data-driven decision-making capabilities. From the AI-powered ProPicks to the comprehensive Financial Health Score and an advanced stock screener, these resources aim to refine and enhance the investment process, ensuring that market participants are well-equipped to navigate the intricate dynamics of the financial markets.

In sum, while the cryptocurrency market continues to navigate through periods of volatility and uncertainty, innovative projects like HYPER signify the relentless pursuit of advancement and efficiency in the blockchain domain. Coupled with the analytical prowess provided by platforms like InvestingPro, investors are better positioned than ever to unlock the potential of this evolving landscape, even as they tread carefully amidst the risks inherent to financial market participation. It is crucial, however, to approach investment decisions with due diligence and a keen awareness of the volatile nature of crypto assets, recognizing that the responsibility for such decisions ultimately rests with the investor themselves.