In the realm of global finance, the dynamics of currency exchange rates offer a vivid insight into the interplay between geopolitical events, trade policies, and market sentiments. A pertinent example of this phenomenon occurred on a recent Wednesday when the USD/JPY currency pair witnessed a notable ascent to 148.00. This movement was primarily initiated as the Japanese yen experienced a decline in its previously gained stature, primarily due to a surge in global risk assets which, in turn, diminished the demand for the yen as a traditionally favoured safe-haven currency.

This event aligned closely with the release of US inflation data, which played a pivotal role in shaping market expectations. Said data provided a robust indication towards the anticipation of rate adjustments by the Federal Reserve in the upcoming month, stirring the financial markets into a state of heightened speculation and activity.

Digging deeper into the factors contributing to these market movements, it becomes evident that international trade agreements and policy decisions hold considerable sway. In this context, a noteworthy development was the improvement in manufacturing sentiment within Japan for a consecutive second month, during August. This positive shift was significantly bolstered by a trade agreement with the United States, under which the US agreed to reduce tariffs on Japanese automobiles and a selection of other goods to 15%, reciprocated by Tokyo through a commitment to a $550 billion investment package. This agreement not only exemplified the intertwined nature of global economies but also highlighted the strategic economic partnerships and their impact on market trends.

Moreover, Japan’s domestic economic landscape presented a mixed picture. July saw producer price growth decelerate to an 11-month low, illustrating the mounting pressures faced by Japanese firms amidst higher US tariffs. Such indicators reflect the broader challenges and considerations within international trade dynamics, including tariff impositions and trade negotiations.

Amidst these economic undercurrents, the dilemma over monetary policy direction remains a significant talking point within Japan. The Bank of Japan (BoJ) finds itself at a crossroads, with its policymakers seemingly divided over the trajectory and pace of future interest rate adjustments. While a faction within the BoJ leans towards sustaining an accommodative monetary stance, highlighting the potential risks to the central bank’s economic prognostications, another segment seems inclined towards policy tightening. This divide underscores the complexities of central banking decisions in an unpredictable global economic environment.

Turning the lens towards the yen’s standing in the capital markets, it’s observed that the appetite for safe-haven assets, a category traditionally including the yen, shows signs of waning. Skepticism regarding the Bank of Japan’s policy direction further exacerbates the currency’s diminished allure, casting a shadow over its future prospects.

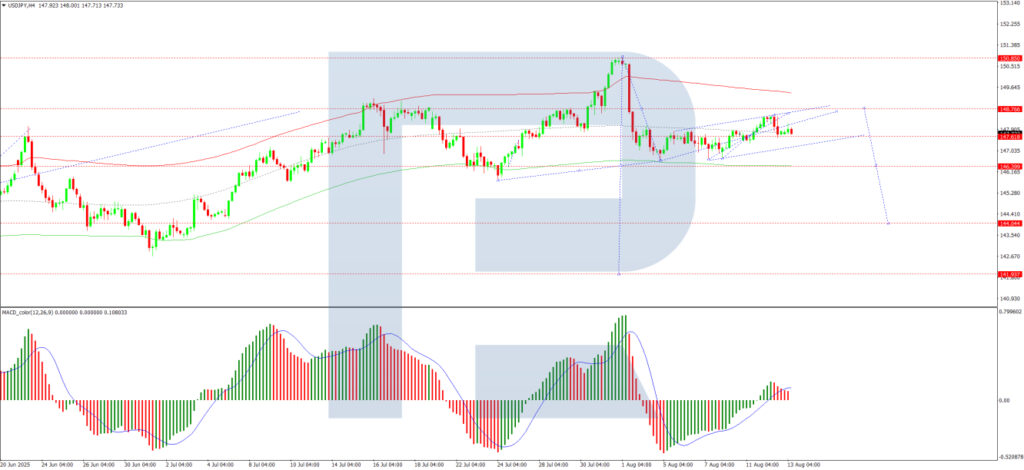

An analytical dive into the technical aspects of the USD/JPY pair offers a more granular view of its trajectory. A corrective wave suggests a potential advancement towards 148.60, with an intermediate pullback to 147.52 predicted, before yet another upswing materializes. This scenario, underpinned by indicators such as the MACD, with its signal line traversing above zero and on an upward trend, sheds light on the expected market movements. Additionally, the pair’s consolidation phase around 148.00 and the likelihood of fluctuations as indicated by tools like the Stochastic oscillator provide traders and analysts with fodder for speculation and forecast.

In conclusion, the USD/JPY currency pair’s recent behaviour, influenced by a confluence of factors ranging from US inflation data, trade policies, and monetary policy uncertainties, to technical indicators, underscores the multifaceted nature of forex markets. As the globe watches and traders navigate through this landscape, the signals emanating from the Bank of Japan and forthcoming US economic data will be crucial determinants of the path that lies ahead. It’s a narrative that encapsulates the complexity, interdependence, and the ever-evolving dynamics of global financial markets, offering a riveting glimpse into the forces that drive the world’s economies.

Disclaimer: The insights provided in this analysis are derived from various sources and do not constitute trading advice. The author and publisher accept no responsibility for any trading losses incurred as a result of acting on these recommendations.