In the intricate tapestry of the global economy, the United States stands as a dominant thread, with its economic policies and cycles influencing the fabric of international markets. Currently, the US is perched on the cusp of a critical juncture, navigating through what could be described as a period of economic deceleration. This stage, colloquially termed as ‘Running It Cold’, is perceived to be a prelude to a strategic pivot anticipated around 2026 — a pivot aiming to stimulate the economy, a strategy that might echo the rallying cry of ‘Running It Hot’, reminiscent of plans touted by Donald Trump.

For those not enmeshed in the daily vicissitudes of economic news, this situation warrants a step back to unravel the layers, beginning with an understanding of what it means to ‘Run It Cold’. In essence, this approach involves the deliberate tempering of economic activity to curb inflation and address other economic imbalances. Contrastingly, ‘Running It Hot’ refers to policies designed to stimulate economic growth, often accepting the risk of higher inflation as a collateral outcome.

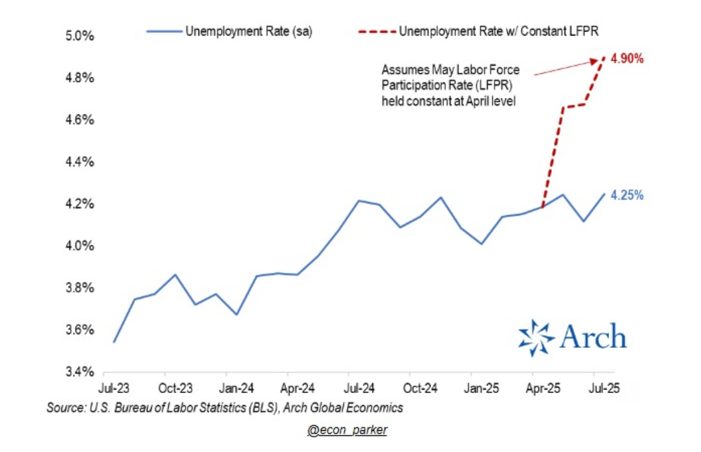

Recent data suggest that the US economy might indeed be entering this cooler phase. Job creation, a vital indicator of economic health, has shown signs of palpable sluggishness. Over the past three months, the average monthly job addition has barely touched 35,000 — a figure starkly low and generally only witnessed during recessions. This anemic job growth is partly a consequence of a tight labor supply, exacerbated by new immigration policies and a stagnant labor force participation rate. If not for these factors, the unemployment rate could have ostensibly surged to 4.9%, painting a dire picture of economic vitality.

Moreover, the pace of job creation within cyclical industries — those significantly influenced by the economic climate, such as manufacturing and transportation — has dwindled to a mere 0.3%. This hiring freeze in the cyclical private sector hints at underlying weaknesses not immediately evident in surface-level metrics.

Adding to the economic strain is the fiscal scenario. The US primary deficit, a measure of fiscal health, stands at 1.54% of GDP, lagging behind previous years’ figures. The imposition of tariffs, nearly $30 billion in July alone, could introduce an additional fiscal drag approaching $150 billion by year’s end, potentially reducing the primary deficit from $1 trillion in 2024 to $850 billion in 2025. This combination of reduced hiring, weak real income growth, consumer spending, and the impending tax hike from tariffs sets the stage for what could be a challenging few months ahead for the US economy.

Looking forward, the potential for policy responses looms large. Speculation abounds that the Federal Reserve might implement rate cuts if the economic pressure intensifies, a move that could set the stage for a dramatic shift in policy direction. Donald Trump has alluded to harnessing tariff revenues to fund tax cuts for lower-income consumers, a fiscal maneuver aimed at stimulating the economy ahead of the 2026 midterm elections.

This backdrop of economic strategies calls for a nuanced approach to investment, particularly highlighting the significance of Inflation Risk Premia (IRP) and Policymaker Protest Assets (PPA). The former, IRP, offers investors a hedge against inflation, whereas PPAs serve as a safeguard against unorthodox policy measures, providing a buffer through assets traditionally seen as less susceptible to policy-induced volatilities, such as precious metals and specific US-denominated assets.

Previous instances of ‘Running It Hot’ policies, notably during 2003-2006 and 2013-2019, aimed to rally the economy from the troughs of the 2001 and the Global Financial Crisis, respectively. These attempts were characterized by inflation-targeted measures devoid of tariffs, attacks on the Federal Reserve’s independence, or adversarial global policy stances. Such an environment proved fertile for investments in equities and real estate, highlighting the potential benefits of assets producing nominal income.

Look back on historical performance, with PPAs like gold and silver offering robust returns during periods of policy uncertainty, underscoring their value as part of a diversified investment strategy. The evolving economic landscape, marked by the current slowdown and the anticipation of a potential fiscal and monetary stimulus, suggests a pivotal moment for investors. Embracing a mix of traditional investments and PPAs could equip investors to navigate through both the ‘Running It Cold’ phase and the potential ‘Running It Hot’ policy barrage in the coming years.

In summation, as the US economy trudges through this cooler period, the horizon holds the prospect of a heated upturn. Investors, armed with insight and adaptability, may well find opportunities amidst the challenges, leveraging strategic asset allocations to weather the transitory slowdown and capitalize on the eventual revival. The economic journey from ‘Running It Cold’ to ‘Running It Hot’ encapsulates the cyclical nature of economies, offering a stark reminder of the perpetual motion that defines global markets.