In recent times, the oil market has been traversing a rather static phase, with the principal benchmarks, West Texas Intermediate (WTI) and Brent crude, showing scant indication of making any significant strides upwards. This prevailing stagnancy is underpinned by a market structure forecast, suggesting that come 2025 and 2026, there is likely to be an oversupply of crude oil relative to its demand. This outlook manages to keep any bullish fervor in check, capping the potential for price surges.

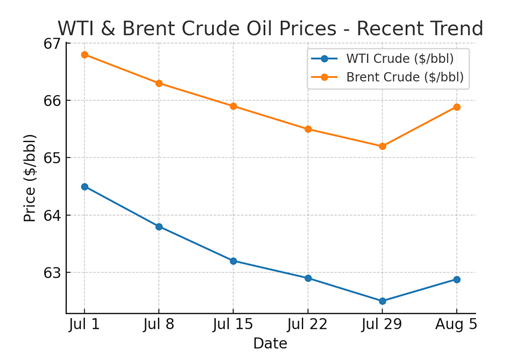

As observed over the previous month, WTI has been fluctuating around the $62 to $63 per barrel mark, while Brent has been slightly higher at around $65 to $66 per barrel. Such movements have seen intermittent spurts of rallying, which, however, were promptly met with selling, thereby underscoring the market’s current equilibrium state. This was exemplified in recent price adjustments where WTI experienced a modest increase of 0.4% to $62.88, and Brent mirrored this with a 0.4% hike to $65.89, further illustrating the balance between immediate buying interests and the overarching bearish outlook.

Amidst this backdrop, geopolitical dynamics continue to play a critical role in influencing market sentiment. Notably, advancements in trade negotiations between the United States and Russia bear the potential to further saturate the oil supply, thus exerting downward pressure on prices. Conversely, escalations in U.S. tariffs pose the risk of impairing global manufacturing and trade, which could dampen oil demand. These factors, coupled with the keen monitoring of inventory and consumption metrics, leave the market susceptible to bouts of volatility should there be any significant deviations from current trends.

Market positioning aligns with a cautious stance, evidenced by a reduction in speculative long positions in recent weeks. This suggests that investors are veering towards a strategy that is more tactical than directional in nature, awaiting clearer signals on global economic growth and trade policies before making definitive moves. In this climate, crude oil prices are anticipated to hover within their present range, with a potential inclination towards lower levels.

From a technical standpoint, the oil market is confronting critical support thresholds. Should WTI prices decisively dip below $62, it could trigger a cascade of selling activity, potentially driving prices towards the $60 per barrel territory. On the flip side, if prices manage to sustain above these levels in conjunction with a favourable turn in global economic indicators, it could pave the way for a market rebound.

Diving deeper into the scenario, it’s important to consider the broader implications of these dynamics on global economies and the energy sector at large. The prospect of an oversupply in oil by the mid-2020s suggests a transformative period for energy markets, compelling producers and investors to recalibrate their strategies in anticipation of changing demand patterns. Moreover, the interconnectedness of oil prices with geopolitical tensions and trade policies underscores the volatile nature of global markets and the need for agile responses to shifting economic landscapes.

In reflecting on the historical context, the oil industry has been pivotal in shaping economic trajectories. Its cyclical nature, marked by peaks and troughs, has had far-reaching effects on global growth rates, influencing policy decisions and investment flows. The current juncture, characterized by the interplay of supply forecasts, geopolitical moves, and market positioning, continues this legacy, moulding the contours of the future energy landscape.

Understanding these developments necessitates an appreciation of the intricate balance between supply and demand, the impact of external geopolitical and economic factors, and the strategies employed by market participants to navigate uncertainties. The unfolding narrative of oil prices, set against a backdrop of anticipated oversupply and fluctuating market sentiment, offers a compelling glimpse into the complex interdependencies shaping the global economy. As the situation evolves, monitoring these dynamics will be crucial for stakeholders across the spectrum, from policymakers to investors to consumers, in forecasting future trends and aligning strategies accordingly.