In recent financial market developments, US index futures have soared to unprecedented levels, with European markets echoing this upward trajectory during the initial half of Thursday’s session. Adding to the buoyant atmosphere, Bitcoin surged to a new zenith, surpassing the $124.5K mark before experiencing a slight downturn owing to profit-taking. Meanwhile, Ethereum neared its own historical peak, underscoring the palpable excitement across the cryptocurrency domain.

The American dollar, however, found itself in a less favourable position, contributing to a notable dip in currency pairs, particularly with a significant retreat to just around the 146.00 mark. Market participants are now keenly awaiting the imminent release of critical inflation data, with pivotal employment and consumer sentiment surveys from the University of Michigan (UoM) scheduled for Friday’s session. Amidst these developments, the inclination towards dip buying persists, fueled by robust momentum and escalating anticipations of multiple interest rate adjustments in the ensuing months.

The Federal Reserve’s upcoming policy decisions are highly anticipated, given the array of economic indicators due for review – including another employment report, inflation data, and a series of macroeconomic updates. Recent figures, such as a disappointing labour market report accompanied by substantial downward revisions to previous months’ data, and an inflation rate matching expectations, are bolstering the argument in favour of a rate reduction in September. Presently, the markets have wholly factored in a 25 basis point cut for September, with further adjustments possible in October and December.

Despite the chatter about a more aggressive approach by the Federal Reserve, skepticism remains. It’s argued that a 50 basis point cut in September might be overreaching, despite assertions from some quarters, including the US Treasury Secretary, suggesting that interest rates are significantly higher than they ought to be. Nonetheless, without a clear signal from Federal Reserve officials or a dramatic deterioration in employment figures, the likelihood of such a substantial reduction appears slim.

As we proceed, more inflation-related reports are on the horizon, with particular attention on statistics that will influence the Federal Reserve’s preferred inflation measuring instruments. The most recent data revealed a moderate increase in prices, indicating manageable inflationary pressures. This situates the Federal Reserve in a position where it could adjust policy without excessively inflating costs.

Looking forward, all eyes are on the forthcoming economic indicators, especially the reports on personal consumption expenditures – key determinants of the Fed’s inflation outlook. Additionally, the weekly job claims data, especially the continuing claims figure which recently saw an uptick, will also be under scrutiny.

The end of the week will spotlight consumer sentiment and geopolitical events. The University of Michigan’s survey on consumer expectations is anticipated, alongside revised consumer spending reports. Moreover, the political arena could introduce a wildcard, with the upcoming meeting between President Trump and President Putin. Stakeholders are cautiously optimistic about potential progress towards peace in Ukraine, although the complicated nature of the conflict warrants a temperate expectation.

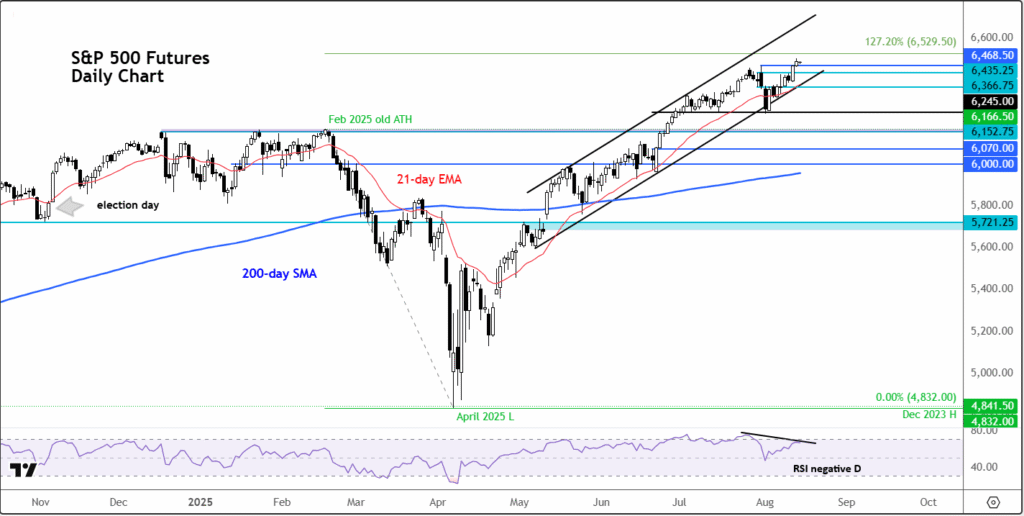

From a technical standpoint, the S&P 500 futures have demonstrated remarkable resilience, embodying a strong bullish trend. Previous resistance levels have transformed into support markers, indicative of a market that rewards buying on the dips. As the index forges new highs, traders turn to Fibonacci extension levels and psychological round numbers for clues on possible resistance points.

InvestingPro members have access to an array of sophisticated tools designed to facilitate informed and prompt investment decisions. This suite of features includes AI-driven stock picks, a comprehensive fair value model, a specialized financial market AI, a concise financial health score, and an advanced stock screener, among others. These resources are geared towards enhancing the efficiency and efficacy of investment strategies.

In essence, the current financial landscape presents both opportunities and challenges. Investors navigating this terrain must remain vigilant, taking into account the dynamic macroeconomic indicators and geopolitical developments that could sway market sentiments. As always, the importance of informed decision-making, bolstered by robust analytical tools, cannot be overstated in the pursuit of investment success.

Disclaimer: It’s imperative to acknowledge that this discourse aims to provide general market insights and should not be construed as investment advice. The financial markets are inherently unpredictable, with each investment decision carrying its own set of risks. Consequently, investors are advised to undertake thorough research or consult professional advisors to tailor strategies best suited to their investment profiles.