As we progress through the latter part of August 2025, the curtain slowly draws on the earnings season for the second quarter in the United States, marking a period of significant financial disclosures from some of the country’s largest corporations. With the majority of these titans of industry having already unveiled their performance metrics, attention narrows to a select few, with Walmart set to report on the 21st of August, followed by NVIDIA on the 27th. Notably, NVIDIA’s announcement is keenly awaited, as it marks the conclusion of financial updates from the influential cohort known as the “big seven.”

The narrative of this earnings season unfolds with a predominantly optimistic tone. Despite a few instances falling short of expectations, one notable example being Tesla, the broader landscape sees a robust performance continuum, with many corporations not only meeting but surpassing anticipated financial metrics. This resilience has infused vigor into the bull market, propelling major US stock indices to ascend to new zeniths, further solidifying investor confidence.

Our analysis today puts a spotlight on three behemoths, each boasting a market capitalization exceeding the $100 billion mark, which have distinguished themselves through commendable financial prowess.

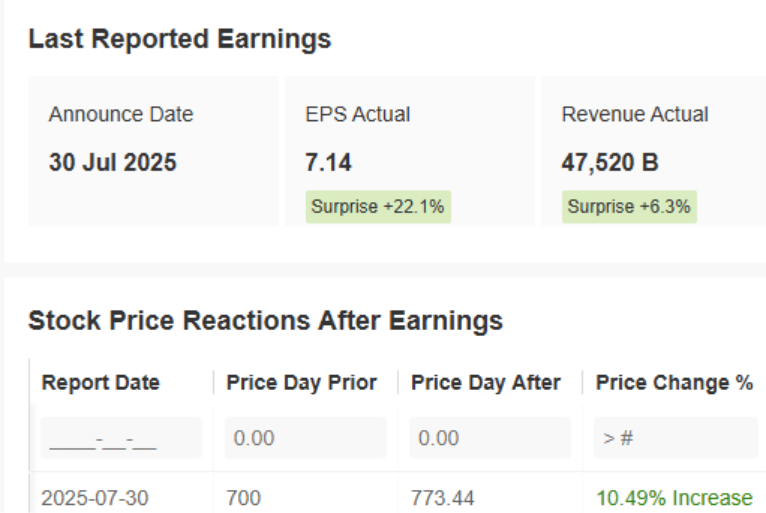

Meta Platforms Inc took center stage with its financial revelations made on July 30th, which were met with considerable investor enthusiasm, as evidenced by a double-digit percentage leap in its stock price. This surge was predominantly fuelled by the company’s earnings per share, which far exceeded market expectations. Under the leadership of Mark Zuckerberg, Meta Platforms has been on a remarkable upward trajectory, with its stock price approaching the $800 mark. However, a cautionary perspective suggests a potential 15% market correction, offering a dual narrative of a potential warning and an opportunity for investors to capitalize on a favorable market entry point.

Alphabet Inc has also entered the limelight, showcasing strong financial health, thereby propelling its stock to new heights. The beating of earnings per share and revenue predictions, in conjunction with an improvement from the previous quarter’s performance, underscores Alphabet’s fiscal robustness. Furthermore, the company’s announcement of a substantial $85 billion capital expenditure pledge underscores its ambition to secure a vanguard position in the burgeoning realm of artificial intelligence. Yet, this significant capital outlay has ignited discussions around the sustainability of profit margins amidst such aggressive expansion strategies.

Johnson & Johnson, an indomitable presence in the healthcare sector, maintained its sturdy market stance with the latest earnings surpassing both earnings and revenue forecasts by a margin of 3–4%. This performance elicited a fervent response from investors, propelling the stock upward by more than 5%. Similar to Alphabet, aspirations are set towards achieving record highs, with the projections aligning closely with the fair value estimates provided by InvestingPro. It’s also important to underscore Johnson & Johnson’s stature as a venerable dividend-paying stock, adding another layer of attraction for investors.

In the broader narrative, with only Walmart and NVIDIA left to report, the underlying currents of this earnings season appear to set a positive tone for the market. The strong showings from pivotal market players have not only sustained but also bolstered the bull market’s momentum, ushering indices to unprecedented levels. The sustainability of this market enthusiasm into the subsequent quarter remains tethered to the forthcoming financial unveilings and the market’s reception thereof.

In the ever-evolving investment landscape, the utility of comprehensive and sophisticated tools cannot be overstated. InvestingPro offers an arsenal of resources designed to empower investors with enhanced decision-making capabilities. These include ProPicks AI, which leverages vast financial datasets and machine learning to identify high-potential stocks, and the Fair Value Score, providing a professional-grade estimation of a stock’s intrinsic worth. Moreover, WarrenAI, a generative AI tailored for financial market analysis, alongside the Financial Health Score and an advanced stock screener, augments an investor’s capability to navigate through the market’s complexities.

As we stand on the precipice of future financial disclosures and market reactions, the onus is on investors to harness these tools to distill insights and forge strategies that not only navigate but also capitalize on the dynamic market landscape.