In a landmark moment for the cryptocurrency world, Bitcoin soared to unprecedented heights yesterday, shattering previous records by climbing to an eye-watering $124,447. This surge was fuelled by a wave of optimism that swept the market over the week. Yet no sooner had Bitcoin achieved this milestone than it witnessed a significant pullback, prompted by investors taking profits at these historic levels.

The financial landscape this week was influenced by the latest data from the United States, which pointed towards a weaker-than-expected performance, prompting speculation about the Federal Reserve’s next moves. Market participants began to anticipate the start of a rate reduction process by the Fed, an expectation further bolstered by the announcement of the US President’s backing for a new decree. This decree opens the doors for investments in cryptocurrency assets, including Bitcoin, through 401(k) retirement plans. These developments injected a fresh impetus into Bitcoin’s trajectory, driving it to new highs in the first part of the week.

Despite the initial euphoria, the latter part of the week saw a shift in the market’s mood. An announcement of unexpectedly high data from the US, particularly in producer prices, acted as a cold shower on the surging Bitcoin market. This unexpected news tempered expectations of imminent rate cuts by the Fed, underscoring the cryptocurrency’s sensitivity to the central bank’s policies.

Adding to the woes was a significant announcement by US Treasury Secretary Scott Bessent. Initially, Bessent stated, “The Treasury has no Bitcoin purchase plan”, a declaration that led to a rapid erosion of around $55 billion in Bitcoin’s market value in a mere 40 minutes. The shockwaves sent through the market by this statement were further amplified by Bessent’s later retraction, where he admitted that purchasing Bitcoin through budget-neutral means was still a matter under consideration.

The introduction of the Strategic Bitcoin Reserve plan earlier in the year by presidential decree had paved a new potential path for Bitcoin’s incorporation into national financial strategies. Yet, tangible steps towards its realization remained elusive. According to the latest figures, the US Treasury’s Bitcoin holdings stand at 198,012 BTC, valued approximately at $23.5 billion.

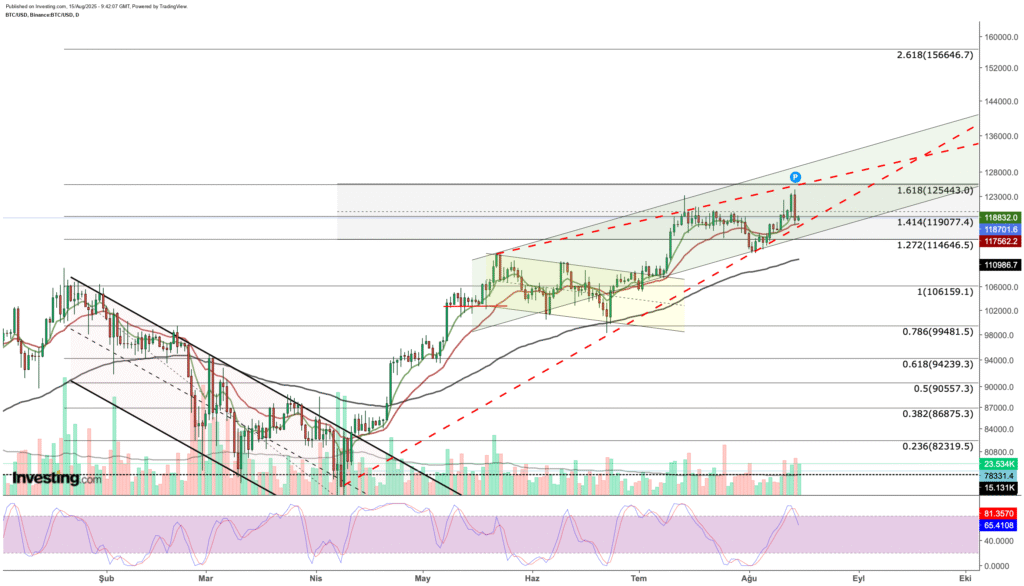

Despite the whirlwind of events this week driving volatility, Bitcoin has managed to maintain its overall bullish trend. The cryptocurrency’s value experienced a correction after peaking, dipping roughly 5% before finding support around $117,800. It subsequently made a modest recovery, moving towards $119,000 and effectively closing the price gap at $118,335 in the Chicago Mercantile Exchange futures.

Analyses of Bitcoin’s trajectory suggest it is currently navigating within an ascending channel, guided by vital support and resistance levels drawn from Fibonacci sequence and trend analysis. The $119,000 mark emerges as a pivotal level for Bitcoin’s future direction, with key support spotted just below at $117,500. A breach of this support might drive the price down to $114,600, and prolong selling pressure could see tests of the three-month exponential moving average at $11,980, potentially triggering a new bearish trend.

Conversely, sustaining above $117,500 could position Bitcoin for an attempt to breach $125,440 and venture towards higher plateaus, in alignment with end-of-year forecasts upwards of $156,000. The decisive factor likely hinges on the Federal Reserve’s rate cut initiatives and forthcoming macroeconomic data. This, coupled with a calming of geopolitical tensions, could fortify Bitcoin’s bullish outlook for the remaining year.

An intriguing subplot to the ongoing narrative is the scheduled meeting between former US President Trump and Russian President Putin in Alaska, a discussion that might also sway market sentiments and risk perceptions globally.

In conclusion, Bitcoin’s journey this week encapsulates the volatile but unswerving path of cryptocurrencies in the financial markets. While immediate movements have been swayed by policy announcements and economic indicators, the underlying trend for Bitcoin remains upward. As investors navigate these turbulent waters, the intersection of traditional financial mechanisms with the burgeoning world of cryptocurrencies continues to unfold, promising an intriguing future for Bitcoin and its ilk.