In recent times, much like the late comedian Rodney Dangerfield who often lamented receiving “no respect,” the United States dollar has found itself in a somewhat similar predicament. Criticism and skepticism towards the dollar have emerged from various quarters. Some members affiliated with the former Trump administration have expressed a desire for a depreciating dollar value. Meanwhile, global competitors of the United States eye opportunities to diminish the dollar’s dominance as the principal reserve currency. Furthermore, prophets of doom have been vocal about an impending dollar cataclysm, triggered by the colossal deficits in US trade and federal government budgets. Despite these swirling currents of doubt, there are compelling reasons to maintain a positive outlook on the future of the dollar.

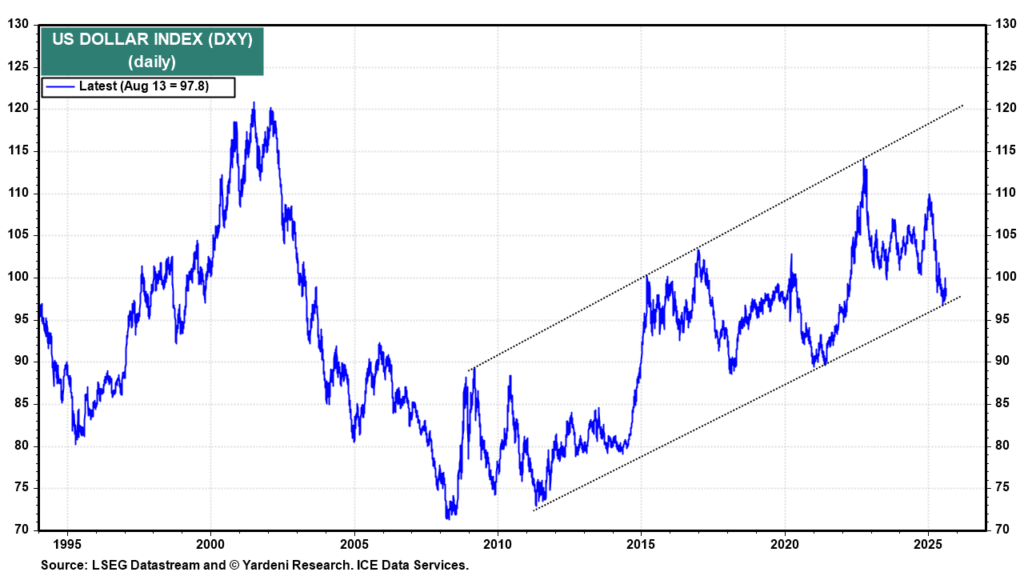

First and foremost, the Dollar Index (DXY), a barometer that gauges the value of the United States dollar relative to a basket of six significant international currencies – namely the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc – continues to reflect an ascending trajectory for the dollar. The euro, which constitutes nearly 58% of the DXY’s composition, is often mooted as a potential successor to the dollar’s hegemony. However, such a transition appears unlikely in the foreseeable future, preserving the dollar’s status as the premier reserve currency.

A pivotal factor securing the dollar’s esteemed position is the unparalleled scale and diversity of the United States capital markets. These markets are a beacon for global investors, drawn by their liquidity and the comparative safety they offer. This attractiveness is evidenced by the record net capital inflows to the United States, amounting to $1.76 trillion over the twelve months leading to May, as captured in recent data. This influx underscores the global investment community’s faith in the American financial landscape.

Analyzing these net capital inflows reveals that private foreign accounts, rather than official foreign accounts, have been the main contributors. The recent surge to a record $1.7 trillion highlights the robust appeal of U.S. financial instruments amongst private global investors. Specifically, these accounts have displayed a fervent appetite for American equities and bonds, with record net purchases amounting to $597 billion and $941 billion respectively in the past year up to May. Such figures are testament to the unwavering attraction of U.S. financial markets.

A further illustration of this confidence is the record holding of $9.0 trillion in U.S. Treasuries by private foreign accounts as of May. While holdings by foreign official accounts have plateaued at around $4.0 trillion since 2012, the sharp uptick in private demand underscores the expanding global wealth and its consequential search for safe investment havens, with U.S. Treasuries being the gold standard.

When it comes to the allocation of global foreign exchange reserves, the U.S. dollar continues to lead by a substantial margin, comprising 57.7% according to recent figures from the International Monetary Fund (IMF). The euro trails at 20.1%, with the yen contributing a meager 5.1%, further highlighting the dollar’s unrivaled dominance in international finance.

However, recent trends have shown a slight shift with gold’s share in international reserves increasing, especially after the United States froze Russia’s reserves following its invasion of Ukraine in 2022. This move has prompted central banks in countries less aligned with U.S. interests to augment their gold reserves and reduce their dollar holdings, concurrently boosting gold prices. This shift, though notable, has not significantly undermined the dollar’s esteemed position but serves as a reminder of the evolving dynamics in global reserve currencies and the geopolitical influences on currency valuations.

The tale of the U.S. dollar, thus, is not merely about numbers and economics; it mirrors the ebb and flow of international relations, the shifts in global power structures, and the intricate dance between national policies and global market perceptions. As the narrative unfolds, the resilience of the dollar amidst these challenges remains a testament to the fundamental strengths of the U.S. economy and its financial institutions. It’s a narrative that speaks volumes about the dollar’s journey, revealing both its vulnerabilities and its enduring appeal in an ever-changing economic landscape.