The gold mining sector recently delivered stellar quarterly results that were unparalleled in its history. This impressive performance was primarily propelled by the soaring prices of gold, which culminated in a series of record-breaking outcomes for the industry, including unparalleled revenues, unit profits, bottom-line earnings, and operating cashflows. This period marks the eighth consecutive quarter showcasing significant profit growth, predominantly in the high double digits, for the gold miners. Despite these robust fundamentals, gold stocks have not fully reflected this success, remaining considerably undervalued.

At the heart of this sector’s performance tracking stands the GDX, the VanEck Vectors Gold Miners ETF, established in May 2006. Being the first ETF of its kind, GDX has effectively retained a dominating presence in the market, with its net assets significantly outstripping those of its closest competing ETF by more than tenfold. The importance of GDX as a barometer for the sector’s health cannot be overstated, offering a comprehensive view into the world’s leading gold miners who significantly influence its weighting.

The industry is often segmented based on annual gold production rates, from small juniors producing under 300,000 ounces to super majors whose output exceptionally exceeds 2 million ounces. These various scales of operation provide insight into the diversity and complexity of the gold mining sector, reflecting the varying impacts of global gold prices on each segment’s profitability.

In 2025, the sector, especially the majors indexed by GDX, has seen its value surge by over 70%, significantly outpacing gold’s own impressive performance. This period of success traces back to the early days of October 2023, marking the beginning of a powerful cyclical bull run for gold, propelling its value by as much as 88.6% without experiencing any major corrections. However, gold stocks have seen a lag in performance due to distractions from the AI stock bubble, drawing investor attention and capital elsewhere. Despite this, a shift is occurring, with gold stocks beginning to catch up and GDX nearing record highs not seen in almost 14 years.

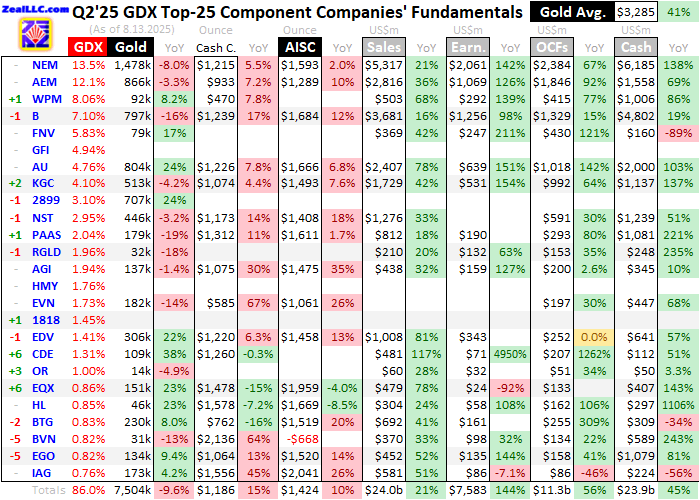

The analytical effort to dissect and understand the quarterly results of the 25 largest components of GDX is monumental. These companies, forming 86% of GDX’s total weighting, range from super majors to larger mid-tiers, and their performances are pivotal in assessing the sector’s health. The comprehensive analysis covering operational and financial metrics casts light on the real successes and challenges faced by these miners.

In the latest quarter of 2025, record average gold prices were the key driver behind the historic performance of these major gold miners. The average price of gold reached a staggering $3,285, catalyzing a chain of record-breaking financial achievements for these companies. Their operational efficiency, despite varying costs and production scales, highlights the sector’s resilience and the strong market fundamentals underpinning its growth.

However, extracting and understanding these results is not without its challenges. The reporting standards vary widely, with companies in different geographies following different accounting principles, sometimes obscuring vital operational data. Particularly, reporting practices of certain companies in countries like China and South Africa add layers of complexity to the analysis, with some opting for less frequent reporting periods, inherently causing delays in data availability and impacting quarter-to-quarter comparability within GDX’s top 25 constituents.

The enduring success story of gold miners, especially evidenced in their latest quarterly results, is underpinned by solid financial disciplines, operational efficiencies, and, most importantly, the rallying gold prices. The formidable increase in gold prices has not only enhanced profitability but has also cushioned the impact of rising operational costs. These costs, including both cash costs and all-in sustaining costs (AISC), serve as critical indicators of mineral extraction’s viability and profitability. Remarkably, the sector has managed to keep these costs well below the prevailing gold prices, ensuring substantial profitability margins.

Looking ahead, the potential for the gold mining sector remains immense. With gold prices setting new records and operational efficiencies being maximized, the conditions are ripe for sustained growth and profitability. This remarkable financial health is poised to attract increased investor attention, potentially correcting the undervaluation of gold stocks and aligning their market values more closely with the sector’s underlying fundamentals.

As we advance, the trajectory for gold and the mining sector is optimistic, with both market indicators and operational results signaling a continuation of this growth phase. The remarkable achievements of the last quarter not only underscore the sector’s resilience and potential for continued success but also highlight the opportunities for investors willing to look beyond the immediate allure of other market sectors, such as tech stocks. Gold, with its enduring value and the mining sector’s proven track record of leveraging price rallies into substantial profits, remains a compelling proposition for those seeking to diversify and strengthen their investment portfolios in these turbulent times.