In the latest turn of events, the United States witnessed a surge in wholesale inflation numbers, causing a slight tremor within Wall Street’s confidence last week. Nevertheless, this has not dampened the spirits of investors who continue to see value in the gold market. Despite the unexpectedly high Producer Price Index (PPI) readings for July, gold has been steadfast, trading near unprecedented highs, with gold stocks, especially those belonging to the royalty and streaming sector, showcasing exceptional performance.

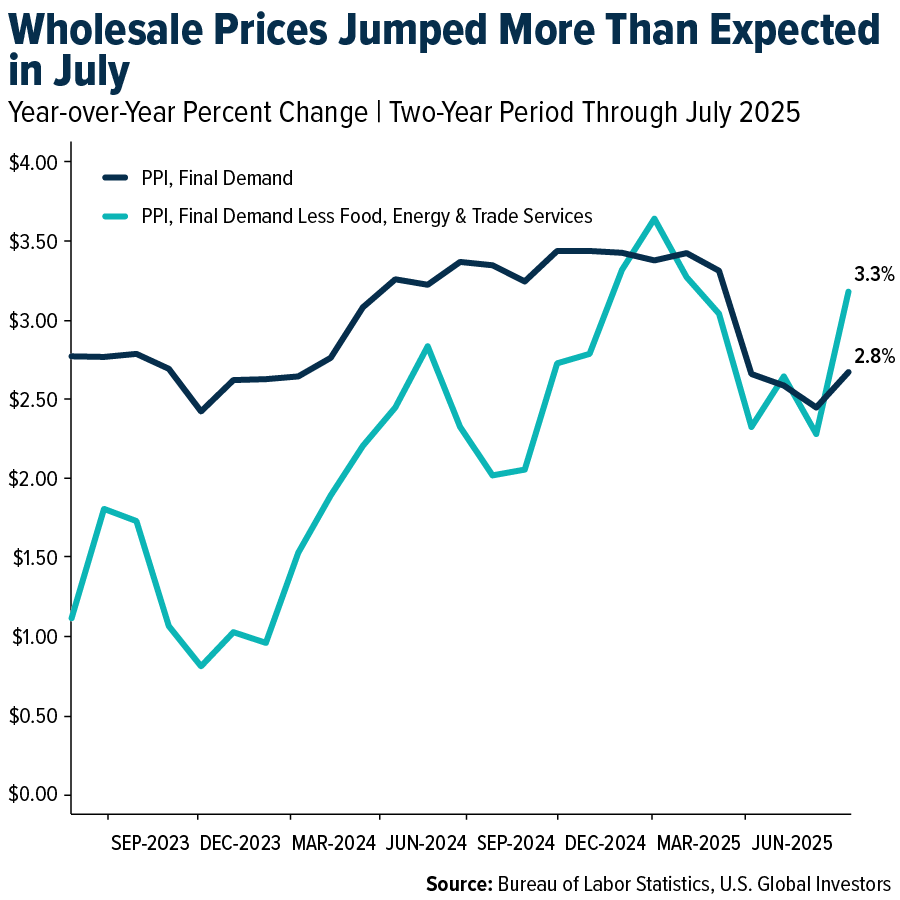

Historically, government policies have often been the harbingers of economic shifts. In July, the PPI, an indicator that gauges the average change over time in the selling prices received by domestic producers for their output, witnessed a 0.9% rise from June and a significant 3.3% increase from the previous year, marking the largest monthly surge in three years. The core PPI, which provides a cleaner look by excluding the volatile sectors of food, energy, and trade services, saw a 2.8% rise compared to the previous year.

A primary factor bolstering this increase was attributed to the services sector, which experienced a stark 1.1% hike last month. This suggests that businesses are transferring higher import costs, possibly due to tariffs, onto consumers – a scenario that Goldman Sachs had previously forecasted could substantially affect consumer spending by autumn.

This uptick in producer prices has led to a recalibration of expectations regarding interest rate cuts by the Federal Reserve. While the market still anticipates a reduction in borrowing costs come September, hopes for a significant half-point cut have waned.

Despite a strong push from the White House for aggressive actions from the Federal Reserve, it is plausible that the central bank could opt for a more cautious path, executing smaller, sequential rate cuts, especially in light of persistent inflation in specific sectors.

Gold’s Steadfast Appeal Amidst Fluctuating Economic Signals

The resilience of gold throughout 2025 has been remarkable, maintaining its allure amongst investors in what can be described as a volatile environment. The spot prices of gold have seen consolidation around the mid-$3,300s after reaching a peak of $3,500 per ounce in April, and even inching up to $3,439 by July 22nd. This stamina is fueled by various factors including inflationary worries, a weakening U.S. dollar, substantial central bank demand, and the anticipation of decreasing interest rates.

Gold’s shine has traditionally brightened during periods of uncertainty, be it economic, political, or geopolitical. The year has not been short of such disturbances, with increased tariff disputes, questions surrounding the Federal Reserve’s autonomy, and soaring levels of global debt, positioning gold as a preferred option for investors leaning towards tangible assets.

Data from the World Gold Council (WGC) indicates that in July alone, gold-backed exchange-traded funds (ETFs) amassed an additional $3.2 billion, elevating the total assets under management (AUM) to a record $386 billion. The global inflow of funds into gold ETFs is now trailing just behind 2020, positioning for the second strongest year on record.

A Closer Look at the Allure of Royalty and Streaming Companies

Our preference for royalty and streaming firms is no secret, and their recent quarterly achievements further validate our stance. These unique entities do not engage in mining operations directly. Instead, they provide critical upfront financing to mining companies, in return for the right to buy a part of the future production at a significantly reduced, predetermined price, either via royalties or streams.

This business model carries several attractive benefits, including a reduction in risk exposure. Royalty and streaming companies are shielded from the direct operational costs, thus remaining unaffected by hikes in labor and fuel expenses. Their investments span across numerous mines and regions, contributing to strong cash flow dynamics.

In essence, investing in royalty and streaming firms presents a balanced opportunity between directly owning bullion and investing in conventional mining stocks. They offer the prospects of appreciating gold prices, coupled with a buffer during downturns, making them a compelling proposition for investors chasing growth, income, and risk management in one package.

Mining Sector Gains Momentum

The strength exhibited by the broader gold industry has also spelt positive tidings for traditional miners. Analysts from UBS have upgraded their projections for the sector, crediting a regained confidence among investors driven by prudent capital management strategies. If gold prices sustain their current levels, this sector might witness an uptick in stock repurchases, expedited growth initiatives, and an increase in mergers and acquisitions (M&A) activities.

Navigating Tariffs, Inflation, and Gold’s Position

Amid rising inflation, partly due to tariffs, Goldman Sachs forecasts a notable shift in tariff burdens from businesses to consumers, with an anticipated impact on U.S. households by autumn. This scenario could further push service-related PPI components and, potentially, consumer prices later in the year.

For investors, this presents a challenging landscape. On one hand, higher inflation readings could prompt the Federal Reserve to slow down on rate cuts, potentially capping gold’s upside in the short term. On the other hand, enduring inflation and potential policy missteps underscore gold’s crucial role as a financial hedge.

Gold has historically thrived in periods of negative real interest rates, where inflation surpasses nominal yields. Should tariffs and other factors perpetuate high inflation while the Federal Reserve opts for easing, we might witness this dynamic unfold once more.

With robust central bank demand, steady inflows into ETFs, and impressive free cash flow generation from royalty and streaming companies, the gold market’s outlook remains bullish. For those looking to tap into this trend, royalty and streaming companies offer an enticing blend of growth prospects, income potential, and strategic risk management.

The Producer Price Index (PPI) remains a critical measure, reflecting the average movement over time in the selling prices from domestic production perspectives. Understanding these indices, alongside the broader economic indicators and market dynamics, is crucial for investors aiming to navigate the complexities of investing in gold and related assets in these turbulent times.