In the intricate world of financial markets, the behavior of gold prices has been a subject of interest among investors and traders alike. After experiencing a slump at the start of the trading session, gold prices surged during the Asian trading hours, erasing the losses recorded on the previous Friday. The yellow metal, which is traditionally seen as a safe haven asset, had fallen by 1.8% in the last week, interrupting a consecutive two-week rally. Nonetheless, it continued to fluctuate within the previous ranges, indicating a lack of a definitive short-term trend.

Over the last quarter, the trajectory of gold prices has seemingly plateaued, leaving market observers pondering the future direction of this precious commodity. An interplay of factors has contributed to this stagnation. On one front, the impetus for profit-taking has restrained gold from capitalizing on its significant gains witnessed in preceding quarters. Conversely, a concoction of factors such as a weak US dollar, consistent purchasing by central banks, and enduring demand for safe-haven assets amid uncertainties surrounding global trade and the ongoing conflict in Ukraine, have provided a cushion, keeping gold prices near their zenith.

Given the ambiguous short-term outlook, it becomes imperative to adopt a wider lens and delve into the long-term technical analysis to glean insights into gold’s future trajectory.

### Technical Analysis: Navigating Through Long-term Paradigms

Gold’s journey in the financial markets has been nothing short of extraordinary, reaching unprecedented heights with only minor interruptions along its path. As we venture into the second half of the year, the quintessential question that arises is whether gold’s ascent will persist or if a correction is on the horizon.

Market participants typically adhere to the current trend barring significant reasons to alter their course. However, the relentless climb of gold prices has commenced to evoke scepticism, with certain momentum indicators hinting at potential caution. Observations of bearish patterns in monthly candlestick formations have yet to translate into a tangible downturn:

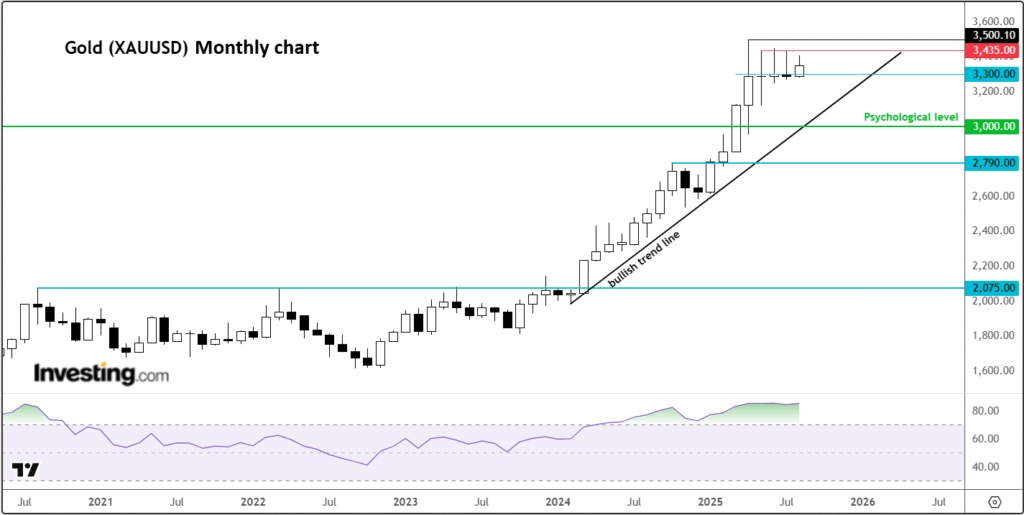

In recent months, the presence of doji-like candles on the monthly chart has been noticeable. Such formations are often interpreted as signals of market peaks or temporary reversals, yet a follow-through to the downside has not materialized. Should the prices breach and sustain below the $3,300 threshold, it would serve as a stark warning for traders.

Furthermore, the monthly Relative Strength Index (RSI) has signalled “overbought” conditions since April, marking territories previously reached during the COVID-19 induced rally. A noteworthy point is that gold required an extended period for consolidation before embarking on its next upward journey after similarly high RSI readings were observed in the past.

### A Glance at the Weekly Chart: A Bullish Continuance?

Transitioning to the weekly chart offers a slightly more forgiving perspective. Following gold’s peak in April, the RSI has moderated, suggesting a cooling phase through consolidation rather than a sharp sell-off, traditionally seen as a bullish indicator.

A praiseworthy mention is gold’s position in relation to the 200-week moving average, which underscores the magnitude of its rally. Any significant retracement to realign with this long-term average seems improbable in the immediate future, though a moderate pullback, allowing the moving average to catch up, appears to be a plausible scenario.

In the short term, pivotal support and resistance levels are poised at $3,300 and the range between $3,435 to $3,500, respectively.

### Deciphering Gold’s Mixed Technical Signals

To conclude, gold’s current technical landscape presents a conundrum, balancing between bullish and bearish signals. While the allure of gold as a safe haven may have momentarily peaked, factors such as central bank purchasing and fiscal uncertainties in the US could potentially fuel future bullish sentiment. As it stands, adopting a strategy favoring the acquisition of gold on dips, albeit with vigilance towards the overstretched technical indicators, seems prudent.

Investing in gold or any asset class requires a multifaceted approach, considering a broad array of technical, economical, and geopolitical factors. Investors ought to navigate these waters with caution, reflecting on their risk tolerance and investment horizon.

Lastly, for those seeking to enhance their investment decision-making, platforms like InvestingPro offer a suite of tools leveraging artificial intelligence and financial modelling to discern high-potential investment opportunities, offering insights ranging from stock valuations to financial health scores.

Disclaimer: This narrative is crafted for informational purposes, not as a directive for investment. The landscape of investment is multifarious and fraught with risk; therefore, each decision bears its own set of consequences, lying solely with the investor.

—

The foregoing analysis is crafted to provide a comprehensive viewpoint on gold’s price dynamics and potential forecasting without requiring the reader to have followed recent news closely. It incorporates vital details alongside broader market perspectives to offer a structured analysis suitable for both seasoned and novice readers.