Gold’s Journey: A Delicate Balance Between Bulls and Bears

In the ever-fluctuating world of financial markets, gold has always held a unique place. Often seen as a safe haven in times of uncertainty, its value is influenced by a myriad of factors, from geopolitical tensions to economic indicators. Recently, the precious metal has been navigating through a complex landscape, marked by both challenges and opportunities.

After a somewhat tepid start, gold prices experienced a notable turnaround during Asian trading hours, erasing the losses witnessed on Friday. Despite a 1.8% decline last week, halting a two-week ascent, gold remains within a familiar trading range, highlighting a lack of clear short-term direction. This recent performance prompts a closer examination of gold’s journey and what the future may hold for this age-old reserve of value.

In the past three months, gold prices have shown remarkable resilience, maintaining their ground amidst various market forces. On one side, profit-taking attempts have restrained the metal from surging beyond the impressive gains of previous quarters. Conversely, a cocktail of factors including currency fluctuations, robust central bank acquisitions, and persistent demand for safe-haven assets owing to trade uncertainties and the conflict in Ukraine, have provided a sturdy floor beneath gold prices, close to record highs.

Navigating Through Uncertainty: A Technical Perspective

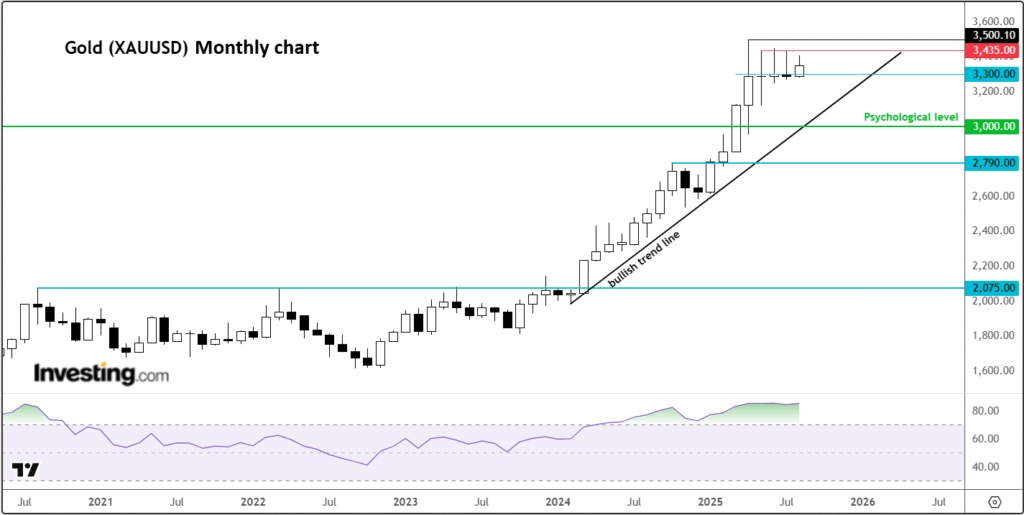

To grasp the broader picture and envisage gold’s trajectory, it’s insightful to delve into a technical analysis, examining key long-term levels and factors.

Gold’s Journey: Charting New Frontiers

Gold has embarked on an extraordinary rally, setting new benchmarks with minimal interruptions. As we move into the latter half of the year, the pressing question is whether this upward momentum can sustain or if a retracement is on the horizon.

Market participants often align with the prevailing trend until a compelling counter-narrative emerges. However, gold’s non-stop ascent has started to prompt some scrutiny, with momentum indicators signaling caution. Despite observing several bearish monthly candle formations, an immediate downtrend has yet to materialize.

In recent months, the occurrence of doji-like candles on gold’s monthly chart—typically associated with market peaks—has not translated into a definitive downside reversal. Yet, should prices breach and sustain below the $3,300 threshold, it could serve as a significant cautionary signal for traders.

The monthly Relative Strength Index (RSI), remaining in the “overbought” zone since April 2024 and peaking above 85, echoes sentiments from the COVID-19 driven rally—a period that necessitated over three years of consolidation before gold could reassert its upward climb. This pattern mirrors the situation in 2011, when a similar RSI amplitude prefaced a notable peak, suggesting that surpassing 80 often presages a cooling-off phase, be it through sideways movement or a retreat.

Despite these warnings, gold’s weekly chart paints a more optimistic picture. Following its peak in April, the RSI moderated from the high 80s to around 63—a high yet less concerning figure—through consolidation rather than a sharp sell-off, hinting at underlying bullish momentum. This observation, coupled with prices soaring above the 200-week moving average by approximately $1,100, underscores the significant journey gold has embarked upon.

Looking Ahead: Deciphering Gold’s Mixed Messages

As we stand at this crossroads, gold’s future seems delicately balanced. While the allure of safe-haven assets may have plateaued for the time being, factors like central bank purchasing and persistent fiscal uncertainties in the US could continue to fuel bullish sentiments. Given these circumstances, adopting a strategy of buying on dips, albeit with caution towards overextended technical indicators, appears prudent.

As readers navigate these turbulent waters, it’s imperative to leverage sophisticated tools and resources that can aid in making informed investment decisions. InvestingPro offers a comprehensive suite of features, including AI-driven picks, valuation models, and advanced screeners, designed to enhance your investing journey.

In conclusion, gold’s path is fraught with conflicting technical signals and macroeconomic influences, requiring investors to tread carefully but also stay open to opportunities. Amidst these uncertain times, the precious metal continues to play its centuries-old role as a bastion of stability and value, a testament to its enduring appeal in the financial world.

Disclaimer: This article provides an informational perspective on gold’s market dynamics and does not constitute investment advice or a recommendation to engage in any specific investment strategy. Every investment involves risk, and decisions should be based on individual financial circumstances and objectives.