In anticipation of the Federal Reserve’s gathering in Jackson, Wyoming, commencing on Thursday, August 21, the discourse will predominantly orbit around inflation. Despite the mixed signals from recent updates on price levels, various indicators provoke thought regarding the advisability of reducing interest rates at the forthcoming policy assembly next month—an idea that has recently garnered widespread agreement.

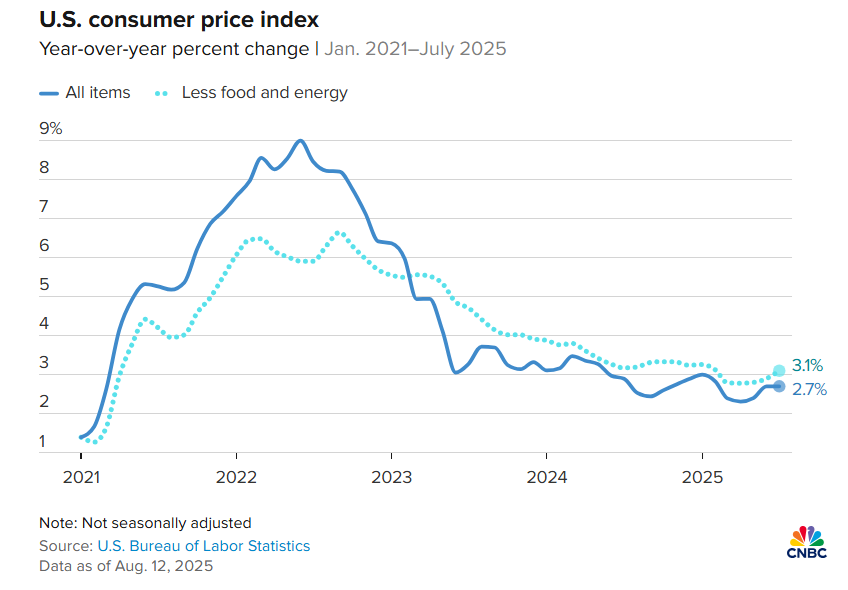

The recent data concerning the Consumer Price Index (CPI) has offered a gleam of hope for those with an optimistic view on the inflation trajectory. The CPI recorded a 2.7% rise in July compared to the same month the previous year, maintaining the pace observed in June. This consistency has led some analysts to suggest that tariffs have only exerted a minor influence on prices, thereby bolstering the argument for the Federal Reserve to proceed with a rate cut at the September 17 Federal Open Market Committee (FOMC) meeting.

However, detractors urge caution, pointing to the core CPI—which excludes the often unpredictable food and energy sectors—as a more dependable gauge of inflation trends. This index revealed an inflation acceleration to an annual rate of 3.1%, marking the highest rate since February and exceeding the Federal Reserve’s inflation target of 2.0% by a significant margin.

Another noteworthy measure is the Atlanta Fed’s Sticky CPI, which tracks the price movements of goods and services that are less prone to frequent changes. This index indicated a pronounced increase in pricing pressure in July, strengthening for the second consecutive month to a year-over-year rise of 3.4%. This trend suggests an upward pressure on inflation expectations, making the Sticky CPI an invaluable tool for understanding the broader inflationary landscape.

Moreover, the Producer Price Index (PPI) in July showed a notable surge, rising by 0.9% for the month—the most significant monthly gain seen in three years. This heightened the year-over-year trend to 3.3%, the highest level since February. Clark Geranen, chief market strategist at CalBay Investments, commented on this phenomenon, stating, “The fact that PPI was stronger than expected and CPI has been relatively soft suggests that businesses are shouldering much of the tariff costs rather than transferring them onto consumers. However, this situation may soon shift, with consumers bearing the brunt of these expenses.”

In light of these developments, consumer inflation expectations have rebounded, as reflected in new survey data from the University of Michigan. The US Sentiment Index revealed a decrease in August, marking the first decline in four months. The report attributes this deterioration primarily to escalating concerns about inflation.

Concurrently, vulnerabilities in the labor market have emerged, complicating the Federal Reserve’s decision-making process. July saw a tepid increase in hiring, with only 73,000 new jobs, suggesting potential headwinds for economic growth.

Recent statements from different Federal Reserve officials highlight the dichotomy of views regarding the economic outlook. NBC News relayed opinions from the Fed’s ranks, illustrating the balance they are attempting to strike between inflationary pressures and labor market dynamics. Michelle Bowman, a member of the Fed’s governing board, emphasized the importance of focusing on the employment mandate in light of persistent inflationary trends and signs of labor market fragility. On the contrary, Austan Goolsbee, President of the Federal Reserve’s Chicago branch, downplayed the hiring slowdown, attributing it partly to reduced immigration due to the current administration’s policies, rather than to broader economic weakness. He also cited the still-low unemployment rate of 4.2% as proof of a robust job market.

Despite these diverging perspectives, the market continues to anticipate a quarter-point rate cut at the next meeting, influenced by the prevailing narrative of a decelerating economy. However, forthcoming inflation and employment data preceding the Federal Reserve’s next gathering could sway this outlook significantly. While the central bank typically avoids basing policy decisions on single data sets, the upcoming CPI and PPI reports for August could prove to be pivotal.

The pivotal question remains whether the Federal Reserve will opt for a rate cut should consumer inflation exhibit sustained pressure. Perhaps, insights from the Federal Reserve’s meeting in Jackson Hole later this week will shed light on the future monetary policy direction, offering clues on how the “Gnomes of Washington” might act in this complex economic landscape.