In today’s financial climate, a key event that has garnered attention is what might seem at first glance a mundane affair titled “Economic Outlook and Framework Review.” Yet, the implications of Federal Reserve Chairman Jerome Powell’s forthcoming speech are far from mundane or trivial. This Friday, Powell is set to deliver insights that will undoubtedly ripple through the fabric of economic policy discussions, although we should temper expectations for specific details on the Federal Reserve’s future moves.

The global economic landscape has encountered turbulent waters, notably marked by a deceleration in job growth coupled with persistently high inflation rates. These phenomena place the Federal Reserve in a precarious position, balancing its dual objectives of fostering maximum employment and ensuring price stability. Chairman Powell’s address will likely serve as a foundational stone, laying out how the Fed interprets recent economic data within the scope of its broader policy framework.

A focal point of Powell’s analysis will undeniably be the labor market, especially considering this will be his first public commentary following the release of the July employment report. This report notably revised earlier job growth figures for May and June downwards. Powell is expected to shed light on supply-side dynamics, such as the impact of reduced immigration and an aging workforce, and their potential to influence labor demand negatively.

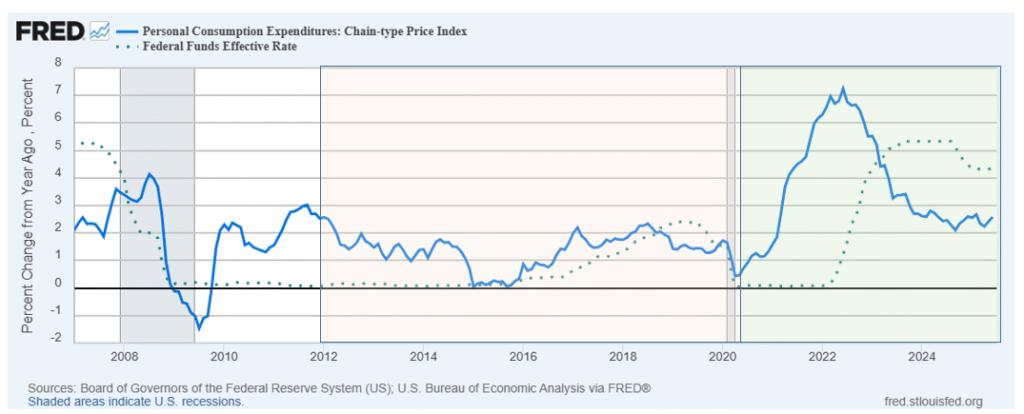

When addressing inflation, Powell’s depiction of the core inflation trajectory—tariffs aside—will be as crucial as any commentary on the tariffs themselves. The acceleration in non-housing services inflation observed in July presents a troubling signal, particularly as it can’t be directly attributed to tariffs and signifies enduring inflationary pressures.

Powell’s stance may give off a hawkish vibe, signaling a pronounced concern over inflation at a juncture where financial markets are keenly anticipating rate cuts. Yet, this perspective truly encapsulates the Fed’s task of navigating the treacherous waters between its two main objectives.

The Imperative of Evolving the Framework

Embarking on a discourse regarding modifications to the monetary policy framework, especially at a juncture that potentially marks the tail end of Powell’s tenure as Fed Chair, might seem ill-timed. However, it is essential to recognize that the monetary policy framework, often encapsulated as the “Statement on Longer-Run Goals and Monetary Policy Strategy,” is a collective agreement of the Committee rather than a reflection of the Chair’s individual perspective. This framework underpins the strategic and principle-based approach to policy-making and serves as a touchstone for accountability. Powell, having guided the Federal Reserve through the initial framework review back in 2020, is aptly positioned to articulate the necessary adjustments stemming from the lessons learned over the previous five years.

The Federal Reserve’s adherence to transparency is a cornerstone of its policy dissemination practice. This commitment is critical not just for facilitating informed decision-making among households and businesses but also for enhancing the monetary policy’s effectiveness and ensuring the Fed’s accountability within a democratic framework.

Confronting Assumptions and Adjusting Strategies

The unpredictable nature of global economic factors has made the Federal Reserve’s journey anything but straightforward. The framework revisions in 2020 were predicated on expectations that the prevailing low-inflation and low-interest scenario post the 2008 financial crisis would persist. However, the unforeseen economic upheaval brought on by the pandemic catapulted inflation to the forefront of policy challenges, diverging significantly from the anticipated risks.

This divergent economic scenario underscores the necessity for a flexible and dynamic policy framework capable of addressing both inflationary pressures and employment challenges. The modifications anticipated in Powell’s forthcoming speech are likely to realign the Fed’s strategies, ensuring they are equipped to manage symmetric risks.

Looking Ahead: Challenges and Adaptations

The forthcoming framework adjustments are poised to encapsulate the insights gleaned from the past half-decade. The essence of these modifications will likely rest on reinforcing the Fed’s commitment to a 2% inflation target while recalibrating its strategies to address the nuanced challenges of a transforming labor market and the intricate dance of balancing inflationary pressures against employment objectives.

Powell’s imminent speech is perceived as an attempt to inject clarity into an economic narrative fraught with complexity and uncertainty. His tenure as Fed Chair has been characterized by a steadfast commitment to clear communication and strategic foresight. Navigating the competing demands of the Fed’s dual mandate amid an evolving economic tableau will be a testament to Powell’s leadership and the adaptability of the Federal Reserve’s policy framework.

In conclusion, as the financial community awaits Powell’s address, it is clear that the interplay between employment, inflation, and monetary policy is entering a new era. The Federal Reserve’s approach in the upcoming months will not only reflect its commitment to transparency and accountability but will also demonstrate a readiness to recalibrate strategies in response to an ever-changing economic landscape.