Throughout this week, the price of gold stayed below the mark of $3,340 per ounce, setting a trajectory to conclude its first negative performance after three consecutive weeks of gains. This decline in value was primarily prompted by the stronger-than-anticipated economic indicators from the United States, which dampened the market’s anticipation for a swift reduction in interest rates by the Federal Reserve.

In the heart of June, retail sales across the US surprisingly exceeded expectations, an indicator of robust consumer confidence and spending power. Similarly, unemployment rates fell to their lowest in three months, further underscoring the resilience of the US economy amidst the shadows of persistent trade disagreements on the global stage.

Amidst these economic developments, Adriana Kugler, a distinguished member of the Federal Reserve’s Board of Governors, voiced a prudent view. She advocated for the maintenance of the existing interest rate levels in the near future, prioritizing a cautious approach in light of the unfolding economic landscape. Conversely, Mary Daly, the President of the Federal Reserve Bank of San Francisco, held a more accommodative stance, predicting two cuts to the interest rate by the close of the year.

Gold’s allure is not merely rooted in economic machinations but also in the geopolitical sphere. Amid escalating trade tensions and the unpredictability introduced by US President Donald Trump’s announcements concerning impending tariffs on over 150 trading partners, investors and market participants gravitate towards gold. This precious metal, renowned for its defensive asset status, has become a preferred vehicle for wealth preservation and a hedge against global instability and uncertainties.

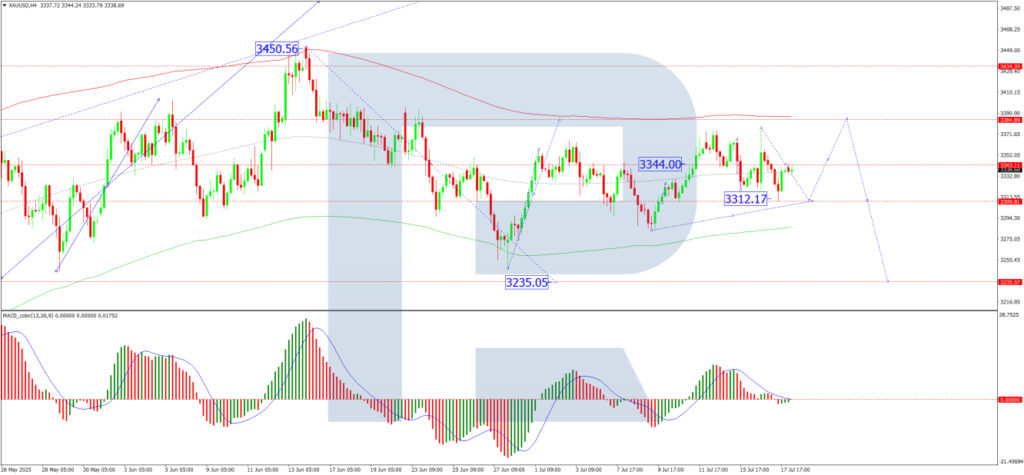

Delving into the technical analysis of XAU/USD (Gold/US Dollar), the market dynamics of gold prices showcased a phase of consolidation around $3,344 on the 4-hour (H4) chart, with the price fluctuating within a range that dipped as low as $3,312. Recent activities saw the price retesting the $3,344 mark, indicating a potential for either an upward or downward movement, contingent on market forces.

In scenarios where bullish sentiment prevails, a breakout above the $3,344 threshold could catalyze a surge towards $3,384. Conversely, should the bearish outlook take dominance, a downward breakout might precipitate a decline towards the $3,235 mark. The Moving Average Convergence Divergence (MACD) indicator, with its signal line positioned above zero and exhibiting an upward trajectory, lends support to this prognosis.

Shifting focus to the 1-hour (H1) chart, a brief examination reveals that after experiencing a decline to $3,310, the market rebounded, meeting the $3,344 level once again, thereby recalibrating towards the midpoint of the observed consolidation range. Given this equilibrium, the market is currently at a crossroads, with potential for advancement towards $3,384 or a retreat towards $3,235, depending on which direction breaks the ongoing consolidation. The Stochastic oscillator, trending upwards from 20 towards 80, aligns with the possibility of both eventualities.

In encapsulating our analysis, it’s evident that while gold faces immediate bearish pressures due to the resilient US economic performance, its long-term prospects remain bolstered by the enveloping cloud of trade and geopolitical uncertainties. For traders and investors seeking to navigate this precious metal’s market dynamics, a vigilant watch over the aforementioned technical levels is imperative to capitalize on emergent breakout opportunities, whether they unfold in an upward or downward trajectory.

It’s paramount to acknowledge that the intricacies and nuances surrounding the gold market and its corresponding US economic context present a complex landscape. Investors must navigate this terrain with a clear understanding that while technical and fundamental analysis can guide decision-making, the unpredictable nature of geopolitical and economic events can rapidly shift market sentiment and outcomes. Therefore, engaging with the gold market, like any investment, requires a judicious assessment of risk, an understanding of market forces, and an agile approach to adjusting one’s strategy in light of new information and emerging trends.

Disclaimer: This analysis represents the author’s personal perspective and should not be construed as trading advice. The responsibility for trading results lies solely with the individual, and RoboForex assumes no liability for any financial decisions or outcomes resulting from reliance on the information presented herein.