The global oil market finds itself at a crossroads, navigating through a maze of geopolitical tensions, economic sanctions, and shifting trade dynamics. With stakes higher than ever, the significance of understanding the nuances of this market cannot be overstated. As the world’s eyes turn to the ongoing developments, let’s unravel the intricacies of these factors and their potential impact on oil prices, with a particular focus on recent events that have shaped the markets.

The Enduring Stalemate in Oil Prices

In recent trading sessions, global oil prices have been locked in a remarkably narrow band, oscillating between the 100 and 200-day Moving Averages (MAs). This trend echoes the sentiment observed in the previous week, indicating a market in search of a catalyst potent enough to break this impasse and chart a definitive course.

The Ripple Effects of EU Sanctions on Russian Oil Exports

In a move that underscored the geopolitical dimensions of the oil market, the European Union, on a recent Friday, implemented its 18th package of sanctions against Russia, in response to the latter’s military actions in Ukraine. This latest tranche included measures against Nayara Energy, an Indian entity engaged in exporting oil products derived from Russian crude. However, these sanctions, while politically significant, are anticipated to exert a limited impact on global oil price dynamics. The looming uncertainty over tariffs continues to weigh heavily on market sentiment, fuelling concerns over demand and subsequently curbing upward price momentum.

Amid these developments, Kremlin spokesperson Dmitry Peskov disclosed that Russia has cultivated a degree of resilience against Western sanctions, indicating a potentially diminishing impact of such measures over time.

Complicating the geopolitical landscape further, former U.S. President Donald Trump hinted last week at the possibility of imposing sanctions on entities purchasing Russian oil, should Russia fail to adhere to a peace agreement within a stipulated 50-day window.

The Iranian Equation

Concurrently, Iran finds itself in a precarious position, facing oil sanctions while engaging in nuclear negotiations with Britain, France, and Germany in Istanbul. These discussions come on the heels of warnings from the European trio about the potential reinstatement of international sanctions against Iran if negotiations falter. The outcome of these talks could significantly influence oil markets, though the medium-term effects remain uncertain. Like Russia, Iran has demonstrated a capacity to adapt to sanctions, developing strategies to mitigate their impact.

China’s Conundrum: A Balancing Act Between Import and Export

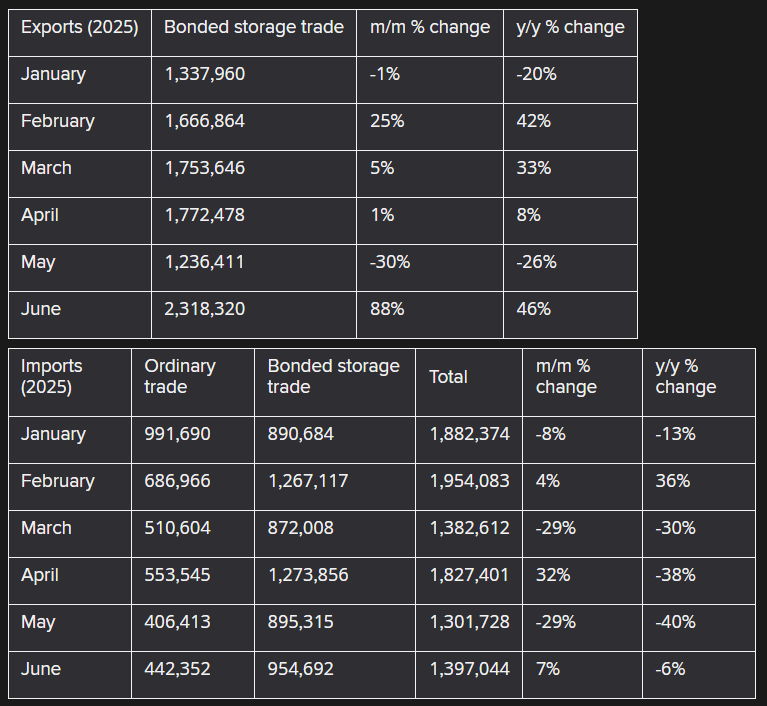

Charting eastward, China’s oil market dynamics present an intriguing study in resilience and adaptation. June witnessed a rebound in China’s fuel oil imports, following a decline in May. This resurgence, marked by a 7% increase from May (though still 6% lower than the previous year), was spurred by the Shandong provincial government’s decision to amplify tax rebates on fuel oil imports for select independent refineries. This policy adjustment came in the wake of diminished demand due to heightened import tariffs and decreased tax rebates earlier in the year. Despite this uptick, the spectre of trade uncertainties casts a long shadow over future demand and price directions.

Saudi Arabia’s Strategic Pivot

On the Western front, Saudi Arabia’s oil export strategy depicts a kingdom in pursuit of market dominance, with exports in May hitting a three-month zenith. According to the Joint Organizations Data Initiative (JODI), this increase was part of a broader effort, alongside OPEC+ allies, to recapture market share. May saw oil exports from the kingdom ascendant, indicating a strategic shift aimed at bolstering Saudi Arabia’s standing on the global stage.

Technical Analysis: The Search for Direction

From a technical standpoint, the oil market’s immediate future appears mired in uncertainty, with prices tightly ensnared between the 100 and 200-day MAs. The market’s vacillation points to a profound sense of indecision among traders, underscored by the sporadic emergence of buying and selling pressures. For a decisive breakout in either direction, the market is in dire need of a catalyst. Should prices dip below the immediate support level, it could herald further declines. Conversely, a surge above the 200-day MA might pave the way for significant upside potential, possibly extending towards psychologically important benchmarks.

In Conclusion

As the world grapples with the complexities of geopolitics, sanctions, and the never-ending quest for energy security, the oil market remains a barometer of global economic health and political stability. With every fluctuation, it narrates a story of nations, economies, and the unrelenting march towards progress, amidst the shadows of uncertainty and strife. In this intricate dance of supply, demand, and political maneuvering, the ultimate outcome remains as uncertain as it is fascinating, painting a picture of a world in perpetual motion, always on the brink of the next great discovery or conflict.