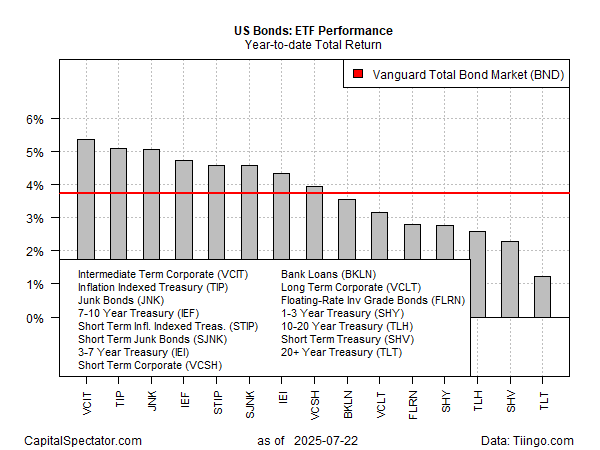

In the intricate world of financial markets, the bond sector is currently displaying an unexpected robustness, navigating through the choppy waters of tariff-induced inflation concerns with adept resilience. At the forefront of this steadfast performance in 2020 are medium-term corporate bonds, as evidenced by the performance of a cohort of Exchange-Traded Funds (ETFs) that track a variety of US fixed income securities, up to the closing of markets on Tuesday, July 22nd.

The Vanguard Intermediate Corporate Bond ETF, trading under its ticker on the NASDAQ, emerges as the year’s star performer, boasting a year-to-date advance of 5.4%. This gain, marginally surpassing that of its closest competitor, the inflation-indexed Treasuries (TIP), illustrates a buoyant trend within the bond markets amidst the broader economic uncertainties.

The performance snapshot provided for the US bond ETFs underlines an encouraging scenario where the major sectors within the bond market have registered gains so far this year. Notably lagging behind, though still in positive terrain, are the long-term Treasuries, witnessing a modest ascent of 1.2% during the same period.

This upward trajectory in bond prices prompts a deeper exploration of the underlying causes. A prevailing narrative attributed the bond market’s bullish tone to a receding fear among investors that the tariffs introduced by President Trump’s administration would trigger a significant spike in inflation.

However, a closer examination of the broader economic backdrop reveals a more complex picture. Insights from the Yale Budget Lab highlight that consumers are currently facing an overall average effective tariff rate of 20.6%—a figure echoing the economic climate of 1910. Even after adjustments for consumption shifts, the average tariff rate stands at 19.7%, reaching heights last seen in 1933. These statistics signal imminent inflationary pressures, yet to be fully captured in official data.

Adding to the discourse, Jason Miller, a professor of supply chain management at Michigan State University, observes, “We’re witnessing the initial stages of the tariff effects unfolding,” indicating a looming inflationary trend yet to hit full stride.

The conjecture of impending inflation poses significant implications for the bond market. Higher inflation directly challenges the attractiveness of bonds by diminishing the real value of their fixed payout rates, casting a shadow of risk that the market currently seems to discount.

Contrasting this seemingly dismissive stance towards tariff-related inflation risks within the broader bond market is the rally among inflation-indexed Treasuries. The iShares TIPS Bond ETF, standing as the year’s second-strongest bond market performer, hints at an undercurrent of concern that tariff-induced inflation remains a valid threat.

Neel Mukherjee, chief investment officer at TIAA Wealth Management, acknowledges the unexpectedness of the situation, stating, “Inflation still hasn’t been impacted by these tariffs, which has surprised many. However, the Federal Reserve’s focus remains on inflation due to concerns over goods inflation, which is expected to accelerate.”

While the discussion around direct inflation risks persists, another dimension influencing bond prices deserves attention—the prospect of an economic slowdown. With growing apprehension that subdued growth or potentially more dire economic scenarios may be on the horizon, there’s a gravitation towards safe-haven bonds.

In this complex milieu, some economists envisage the onset of stagflation—a toxic combination of slower growth and higher inflation. Michael Hicks, an economics professor at Ball State University, elucidates, “Following Trump’s Liberation Day tariffs, the United States has shed 14,000 factory jobs in just two months. This economic contraction is reflective of the theoretical outcomes anticipated from tariffs for decades. The price hikes resulting from tariffs don’t constitute traditional inflation. Instead, what we’re seeing—rising prices amidst a weakening economy—is known as stagflation, a phenomenon that rendered the 1970s particularly bleak.”

In sum, the bond market is navigating a multifaceted landscape shaped by tariff policies, inflationary expectations, and economic growth prospects. With medium-term corporate bonds leading the way, the resilience exhibited by the bond market provides a fascinating snapshot of investor sentiment and economic complexities in the era of tariffs and trade uncertainties. As the situation evolves, the bond market’s ability to adapt and respond will be closely watched by investors and analysts alike, offering insights into broader economic trends and future prospects.