In the landscape of global financial markets, precious metals have long been regarded as a bulwark against inflation and uncertainty. Among these, gold has traditionally held the crown, revered for its intrinsic value and safe-haven appeal. The second quarter of the 25th year marked a historical zenith for this venerable asset, as prices soared to unprecedented levels, reaching the $3,484 per ounce mark for the first time. This article delves into the intricate tapestry of factors that propelled gold to these new heights, painting a picture of the undercurrents shaping global finance.

### The Ascent of Gold: A Synopsis

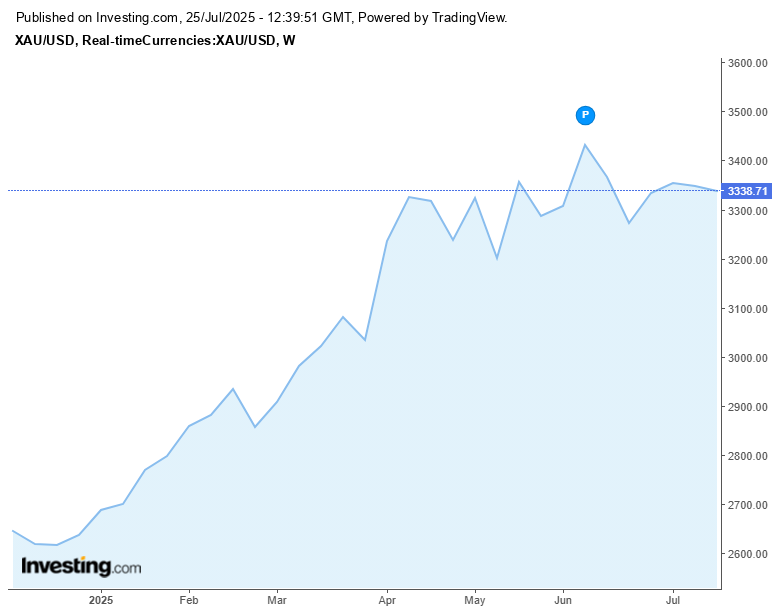

The journey of gold prices through the second quarter was nothing short of remarkable. Commencing the year at $2,658.04 per ounce, gold embarked on a steady ascent, reaching $3,138.24 by the dawn of April. An early April wobble saw prices momentarily retract below the $3,000 threshold. This, however, proved to be a temporary blip as the metal rapidly recuperated, peaking at $3,484.40 on April 21, and even grazing $3,500 in intra-day trading. By the end of June, the price stood at $3,303.30, encapsulating a period marked by volatility but underscored by a pronounced upward trend.

This meteoric rise was fuelled by a concoction of tariff threats, geopolitical unrest, and a nebulous financial landscape. A detailed exploration of these factors offers insight into the dynamics at play.

### Unveiling the Catalysts

#### The Impetus of Tariff Policies

The initial spark for the surge was ignited by the announcement of sweeping U.S. tariff policies on April 2, instigating global market trepidation. Investors, jittery over escalating yields prompted by the mass offloading of U.S. treasuries, gravitated towards gold, seeking solace in its stability. Despite a temporary halt in tariff enactments offering a momentary respite, the prevailing uncertainty perpetuated elevated prices.

#### Geopolitical Volatility

Notably, geopolitical tensions played a significant role in buoying gold demand. The Israeli offensives against Iranian nuclear facilities on June 12, alongside continuous regional skirmishes, amplified the clamour for gold. This geopolitical chessboard, marked by tentative peace and sporadic conflict, underscored gold’s allure as a sanctuary during turmoil.

#### Central Bank Acquisitions and Investor Interest

Central banks, sensing the shifting sands, augmented their gold reserves, purchasing 244 metric tons in the first quarter alone – a figure 24% higher than the five-year average – followed by an additional 20 metric tons in May. Concurrently, a swell in retail and Exchange-Traded Fund (ETF) investments, amounting to $21 billion in North America, $6 billion in Europe, and $11 billion in Asia for the first half of the year, signalled a burgeoning fascination with gold.

### Navigating Persistent Risks and Opportunities

As we gaze into the horizon, the elements propelling gold’s ascent show little sign of abating. The extension of tariff deadlines to August 1, following a July 9 postponement, looms as a potential catalyst for another price rally, should hostilities escalate. Meanwhile, existing tariffs could incrementally elevate prices, potentially influencing the Federal Reserve’s monetary policy decisions and further invigorating gold demand, especially from central banks.

The depreciation of the U.S. dollar, which has declined by 11% year-to-date, embellishes gold’s appeal for international investors, a trend likely to endure. Additionally, the perpetual simmer of geopolitical tensions and the anticipation of higher inflation rates fortify gold’s position as the quintessential refuge amidst financial tempests.

### In Conclusion

The narrative of gold’s performance in the second quarter underscores its perennial role as a hedge against uncertainty. With prices steadfastly above the $3,300 mark and the looming spectre of tariffs and geopolitical discord, gold emerges as a compelling avenue for portfolio diversification. The forthcoming tariff update on August 1 warrants particular attention, poised as it may be as a pivotal moment in this saga.

This surge in gold prices, set against a backdrop of global instability, encapsulates a story of human sentiment, policy implications, and the ceaseless quest for security in an unpredictable world. As we advance, the role of gold, with its storied past and inevitable embeddedness in the fabric of global finance, remains a testament to its enduring value.