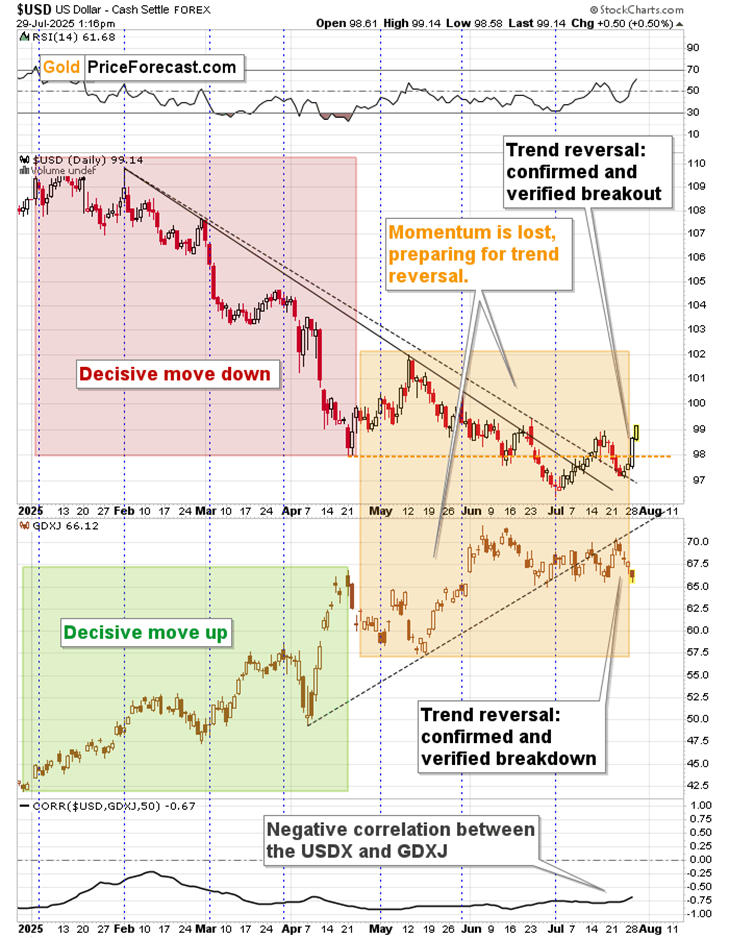

In the rapidly changing dynamics of the financial markets, there’s a growing consensus that a significant shift in trends is underway, signaling a return to conditions not seen since the spring. This alteration is most notably observed in the movements of the US Dollar (USD) and the VanEck Junior Gold Miners ETF (GDXJ), where their recent activities underscore a pivotal change in market sentiment.

The foreign exchange markets have vividly illustrated this shift, with the USD Index surpassing the 99 mark for the first time within the current month. This movement is not just a trivial fluctuation; it signals a robust resurgence of the USD, emphasizing its strength against a basket of other major currencies. Such a resurgence of the dollar has far-reaching implications, particularly for commodities and assets priced in USD, including gold and other precious metals.

In a parallel development, the GDXJ, which tracks the performance of junior gold mining companies, has been experiencing a contrasting fate. Even before the unfolding of today’s market events, the ETF demonstrated a marked decline, touching new lows for the month, thereby corroborating the observations regarding the changing market trend. This decline was notably significant as it established a new monthly closing low, and broke below a crucial flag pattern that had been forming. This pattern break, more pronounced than a similar occurrence in mid-July, signifies a bearish outlook for GDXJ, potentially indicating further declines.

The recent movements of the USD and GDXJ are reminiscent of their respective performances back in April, where a notable slide in the USD’s value coincided with a rally in GDXJ’s fortunes. However, the current market conditions suggest a potential reversal of these earlier trends, with the possibility of the USD’s rally gaining momentum and GDXJ’s value declining further, potentially reaching lows not seen since April. Historical data suggest that such reversals could lead to a sharp downturn for assets like GDXJ, with investor sentiment swinging dramatically as the market reacts to the strengthening dollar.

Interestingly, periods of diminished volatility, such as the one experienced by GDXJ in recent weeks, are often precursors to more significant market movements. It appears that the financial markets are poised for notable shifts, with the USD’s breakout and GDXJ’s breakdown providing clear indicators of the directions these movements are likely to take.

Moreover, similar trends are observable in other commodity markets, including that of platinum and silver, which have also shown signs of impending significant moves. Specifically, the silver market, tracked through instruments like the SILJ ETF, which focuses on junior silver mining stocks, has displayed early signs of a downturn. A recent spike in trading volume for SILJ, reminiscent of conditions observed at the peak of 2021, suggests a growing interest that typically precedes downward movements in market prices.

In light of these developments, investors and market watchers should exercise caution and closely monitor these emerging trends. Historically, shifts in the USD’s value have had wide-ranging implications for commodities and equities markets alike. For those invested in or considering investments in the commodities sector, particularly in precious metals, the current market dynamics underline the importance of staying informed and agile in their investment strategies. The unfolding trends underscore not just the cyclical nature of financial markets but also the intricate interplay between different market forces and asset classes.

In conclusion, as we witness the return to the market conditions last seen in April, it is crucial to acknowledge the complexity and fluidity of financial markets. The strengthening USD alongside declines in commodity ETFs such as GDXJ and SILJ points to a broader shift in market sentiment and strategy. Understanding and adapting to these changes will be key for investors aiming to navigate the uncertainties of the financial markets successfully.