In the ever-evolving landscape of the global energy market, the fluctuations in crude oil inventories serve as a key indicator of demand, supply chain stability, and economic health. This week, the American Petroleum Institute (API), a respected industry body that tracks oil supply data, reported a significant discrepancy in the United States’ crude oil inventories.

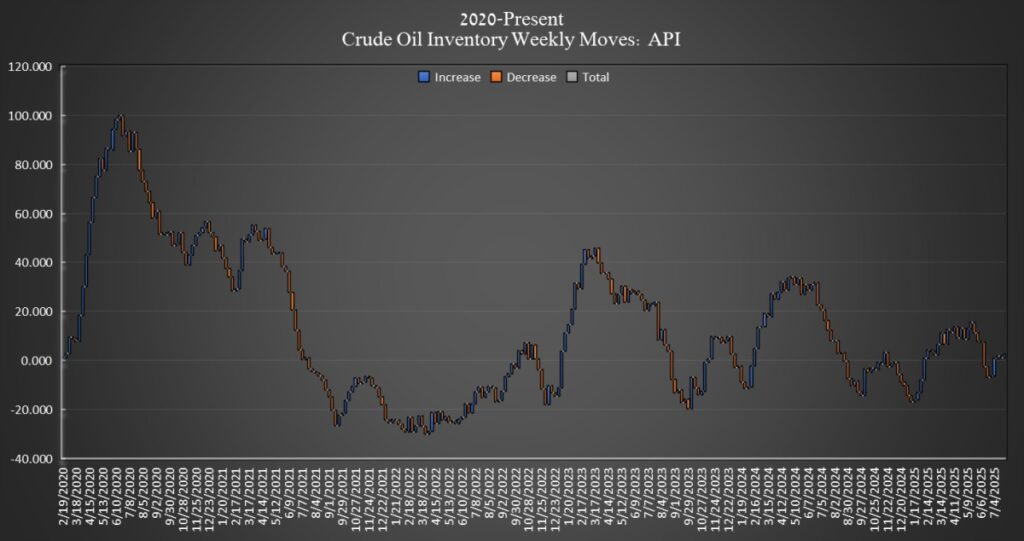

For the week concluding on July 25, the API reported an unexpected increase in crude oil stocks, with inventories swelling by approximately 1.539 million barrels. This outcome stands in sharp relief to the anticipations of industry analysts, who had projected a substantial drawdown of 2.5 million barrels. This deviation is not merely a statistical discrepancy but highlights the complexities and unpredictabilities inherent in the global oil market.

Throughout the year, a cumulative addition nearing 13 million barrels has been noted in the crude oil inventories, based on meticulous calculations derived from API data. This trend underscores a broader narrative about the supply and demand dynamics shaping the global economy.

In a related development, the Department of Energy (DoE) in the United States shed light on another facet of the country’s oil reserves. The Strategic Petroleum Reserve (SPR), a critical asset for national security and economic stability, experienced a notable if modest, augmentation in its stocks. Specifically, the SPR’s inventory levels increased by 200,000 barrels, reaching 402.7 million barrels for the week ending on July 25. This increment follows a similar rise from the preceding week, signaling a gradual but steady reinforcement of the reserve’s capacity.

However, it’s essential to contextualize this growth within the broader historical trajectory of the SPR’s inventory levels. Over the past year, the reserve has been on a slow but persistent path to recovery, following significant withdrawals under the Biden Administration. Despite recent additions, the SPR’s current inventory levels remain considerably lower than their pre-withdrawal figures, reflecting the strategic decisions and challenges the nation has faced in managing its oil reserves.

Market reactions to these developments have been palpably positive, with notable upswings in oil prices. By 3:32 pm ET, crude oil was trading at $72.67, marking a 3.75% increase and representing a nearly $4 uptick from the previous week’s prices. Similarly, West Texas Intermediate (WTI) crude also enjoyed gains, trading up 3.90% at $69.31.

Beyond crude oil, the week’s data on other petroleum derivatives also provided insights into the broader energy market landscape. Gasoline inventories experienced a draw of 1.739 million barrels, indicating a sustained demand juxtaposed against the backdrop of a slight surplus in inventory levels compared to the five-year average. On the other hand, distillate inventories, which include heating oil and diesel, rose dramatically by 4.189 million barrels, continuing a trend from the previous week. This surge in distillate stocks, however, occurs in a context where inventory levels are still 19% below the five-year average, pointing to underlying demand pressures and supply chain constraints.

Cushing, Oklahoma, a pivotal node in the United States’ oil infrastructure as the main delivery point for U.S. futures contracts, also saw its inventories increase. Stocks at Cushing rose by 465,000 barrels over the week, continuing a pattern of builds that reflect the dynamic interplay of storage, transportation, and market demand in the oil sector.

The recent developments in the United States’ oil inventories reflect a complex interplay of market forces, policy decisions, and global economic trends. The unexpected increase in crude inventories contradicts analysts’ expectations and underscores the unpredictable nature of the oil markets. Similarly, the strategic augmentation of the SPR highlights governmental efforts to bolster national energy security amidst fluctuating global oil dynamics. These trends, coupled with the reactive shifts in product-specific inventories like gasoline and distillates, offer a rich tapestry of insights into the state of the global energy economy. As the world continues to navigate the challenges of energy security, supply chain stability, and economic recovery, the movements within the oil market serve as a critical barometer for policymakers, industry stakeholders, and analysts alike.