As we venture into the 31st week of the market, a remarkable balance prevails, with price stability becoming a notable feature along with a continuing uptrend in storage levels. This period is indicative of the market’s response to various economic and environmental stimuli, shedding light on trends and patterns that have characterized the past while hinting at future trajectories.

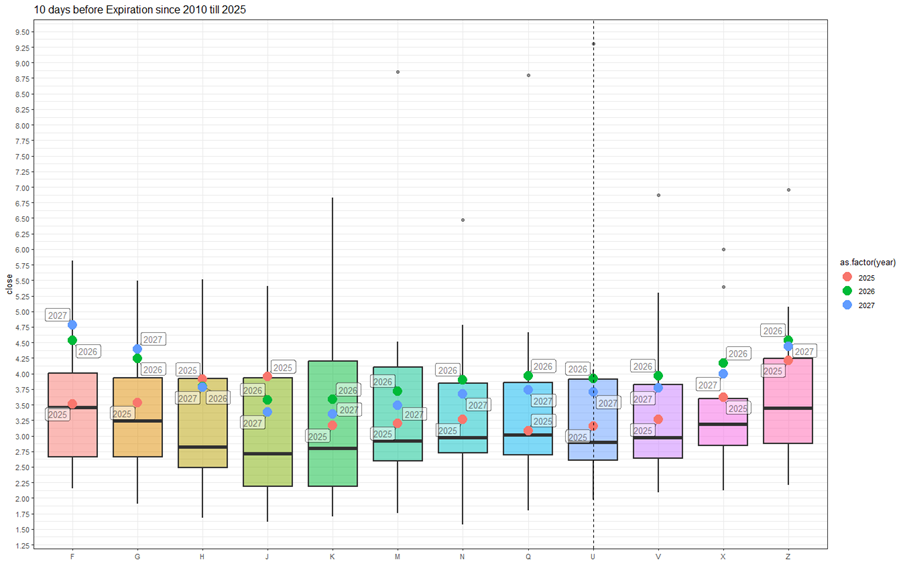

The closure of Contract Q marks a significant juncture, aligning perfectly with the 15-year median, a hallmark of market consistency. Simultaneously, Contract U’s near-median trading underscores a continuing trend of moderation. The outlook for the autumn contracts of 2025, which are trading slightly above the median yet within the interquartile range, suggests a stable yet cautious market sentiment.

However, the contracts for the winter of 2026-27 paint a different picture, trading above the upper quartile. This denotes a market still grappling with uncertainties regarding supply adequacy and the potential impact of weather conditions. The projections for a 39 billion cubic feet (BCF) storage increment during the week spanning July 21-27 are a testament to the inventory’s robustness, surpassing the five-year median largely due to effective injection strategies.

Yet, the landscape is not without its challenges. A notable surge in the supply-demand differential, propelled by increased consumption in power generation and the industrial sector, marks a pivotal shift. This comes amidst a decrease in LNG exports, reflecting evolving dynamics within global energy markets. These shifts are further nuanced by regional weather patterns and their implications on energy demand and supply logistics.

Historical comparisons provide a context for understanding. An examination of price dispersion in the lead-up to contract expirations since 2010 reveals the market’s current steadiness in a broader temporal framework. The alignment of recent contract expirations with the long-term median underscores a return to a semblance of equilibrium after periods of volatility.

Similarly, a forward curve analysis contrasting the 2025 contract prices with those of the preceding years indicates a convergence. While there’s a noticeable skew in pricing for contracts closer to delivery and those further out in the timeline, it reflects the market’s nuanced anticipations of future supply and demand dynamics.

The repository of current stocks, alongside forecasts, adds another layer of insight. The consistent above-median fill rate, accentuated by the anticipated rise in storage, positions the market well for potential peaks akin to those experienced in 2024. Nonetheless, meteorological conditions and their ensuing impacts on consumption patterns remain pivotal considerations.

Data on Heating Degree Days (HDD) and Cooling Degree Days (CDD) from the National Oceanic and Atmospheric Administration (NOAA) lends further granularity to this analysis. The expectation of HDD+CDD growth, juxtaposed with actual weather stabilization, epitomizes the dynamic interplay between anticipated and real-world conditions. This interplay is crucial for market actors to navigate the evolving landscape effectively.

Regional analyses amplify this understanding by detailing geographic discrepancies in HDD+CDD levels, further tailoring the market outlook. The disparity in conditions across regions underscores the complexity of forecasting and the importance of localized data in strategic decision-making.

Furthermore, the sharp ascendance in the supply-demand difference signifies a crucial moment for the market. It highlights the responsiveness of consumption patterns to external stimuli, such as fluctuations in LNG exports, and underscores the intricacies of balancing supply with evolving demand landscapes.

This exploration into the fabric of the market is enriched by collaborative analysis, with insights from Anastasia Volkova, a distinguished analyst from the London School of Economics. By understanding the multifaceted dimensions of market dynamics, from pricing trends and contract analyses to regional weather implications and supply-demand intricacies, one gains a comprehensive view of the energy landscape.

Such an analysis is not merely retrospective; it offers a lens through which to anticipate future movements. As the market navigates through periods of stability and turbulence, the insights gleaned from historical and current data become invaluable navigational aids. They allow stakeholders to not just react but strategically align with an ever-changing energy paradigm, shaping a path forward amidst uncertainties and opportunities alike.