In recent times, the investment world has witnessed a staggering surge in gold prices, surpassing the $3,500 per ounce mark. This remarkable ascendancy prompts a vital inquiry regarding the potential of silver, a metal that has notably lagged in performance, to catch up with its illustrious counterpart. Over the past decade and a half, silver’s market price has not seen the same level of growth as gold, leaving investors and market analysts pondering the possibilities of a reversal in fortunes.

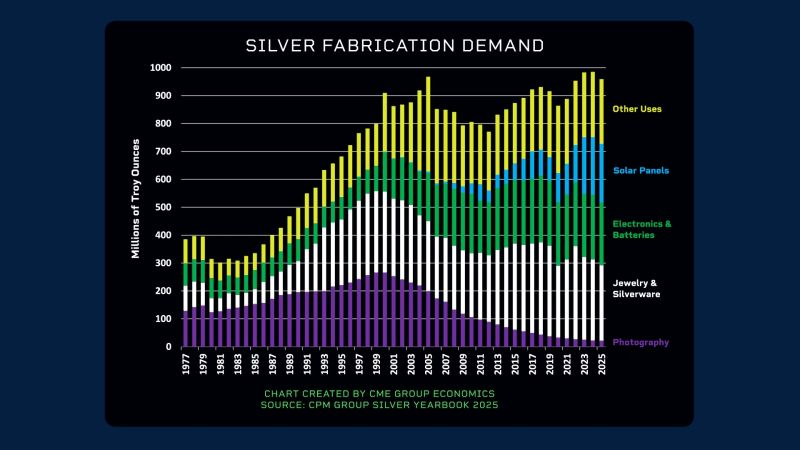

Diving into the historical context, a significant factor contributing to silver’s underwhelming performance juxtaposed with gold can be attributed to the rapid evolution of technology. The advent of smartphones, for instance, catalyzed a monumental shift away from traditional photographic methods that heavily relied on silver-based plates for image development. In the year 2000, photographic uses accounted for nearly a quarter of the world’s silver consumption. Fast forward to the present, and this has plummeted to just about 3%, depicting a drastic reduction in demand owing to technological advancements.

However, the narrative surrounding silver is not all bleak. There’s a silver lining, quite literally, as we delve into its burgeoning industrial demand. The resurgence of silver’s utility is notably evident in the domain of renewable energy technology. Approximately 16% of global silver is now consumed in the production of solar panels, underscoring its integral role in the push towards sustainable energy solutions. Additionally, the burgeoning field of battery technology has emerged as a new frontier for silver application. This pivot towards energy transition presents a potential avenue for recouping some of the demand that has been eroded over the years.

Notwithstanding these promising avenues, it’s essential to contrast silver’s demand dynamics with that of gold. A unique facet of gold’s enduring appeal lies in its demand by central banks across the globe. Since 2008, central banks have consistently augmented their gold reserves, reversing their previous stance as net sellers. This continuous accumulation of gold by central banks effectively constrains the market supply, a trend that has remained unbroken for well over a decade. By contrast, the silver market has witnessed a more than 35% increase in supply during the same period, predominantly unfettered by centralized acquisition strategies.

The implications of these divergent paths are manifold. Even as the supply-demand dynamics evolve, silver remains relatively undervalued when juxtaposed with gold, especially when historical standards are taken into consideration.

Exploring the demand side of the equation, gold and silver share a synergic relationship through the jewelry market, being coveted metals for crafting exquisite adornments. Nonetheless, a stark divergence exists between their industrial applications. Gold, despite its esteemed status, finds limited utility in industrial applications, a stark contrast to silver’s diverse industrial presence.

To encapsulate, the journey of silver in the economic landscape is emblematic of resilience and adaptability. Despite facing formidable challenges from technological shifts that constrained traditional demand avenues, silver is carving out its niche in the rapidly evolving eco-friendly technology sectors. As it continues to play a pivotal role in renewable energy and battery technology, the white metal’s prospects seem increasingly promising. Investors and market spectators alike keenly observe the unfolding dynamics, as silver endeavours to bridge the performance gap that has long defined its comparison with gold. With its intrinsic value underscored by widening industrial applications, the narrative of silver is far from concluded. In this era of energy transition and technological innovation, silver stands on the cusp of potentially redefining its market stature and, by extension, its legacy in the annals of precious metals.