Market Review: An Insight Into Recent Developments

In our previous discourse on market trends, we shed light on the promising pattern of a bullish flag, with crucial support cemented at the Value Area Low of the third-quarter micro composite. As markets evolved, a brief retraction was observed, only for prices to surge past the Value Area High of the Q3 micro composite, flirting momentarily with the $70 mark. However, this climb failed to find a permanent foothold, leading to a regression back to the levels observed at the outset of the year, signalling a period of market consolidation.

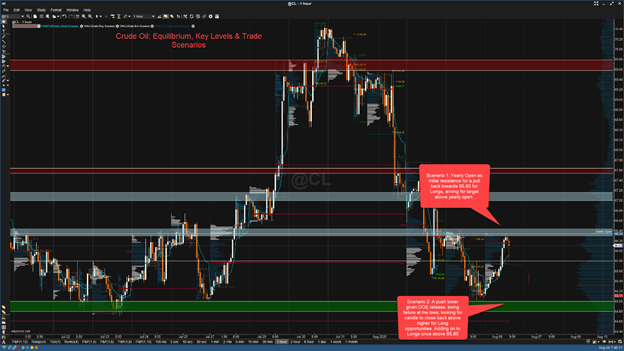

Current Dynamics of the Crude Oil Market

As we find ourselves in the present scenario, crude oil presents a strikingly balanced market profile. A noteworthy observation is the convergence of the composite Volume Points of Control (VPOC) for both annual and quarterly frameworks, an unambiguous indicator of a market in equilibrium concerning trader positioning.

Evaluating Market Performance

The price activity in the ensuing sessions has been predominantly shaped by the shifting landscapes of global demand, which remains exceedingly susceptible to a complex web of factors. These include the broader macroeconomic climate, geopolitical turbulences, and policy adjustments by the V8 members concerning their production quotas. In spite of several challenges, such as the ongoing tariff standoffs, Russian sanctions, and escalating trade tensions, crude oil markets have displayed an admirable level of robustness. This resilience is underscored by the asset’s performance, consistently hovering above the $65 marker.

Forward-Looking Statements

The immediate focal point now shifts to an impending data release set for 9:30 a.m. CT today. This announcement is eagerly anticipated, as it could potentially serve as a crucial influencer in establishing the near-term directional bias of the market.

Unveiling Key Technical Indicators

In the course of our analysis, a number of pivotal technical levels have come to the forefront:

- The third-quarter micro composite Value Area High (Q3 mCVAH) stands at 67.28.

- The Neutral Zone is delineated between 66.45 and 66.30.

- The Yearly Open is pegged at 66.34.

- Intermediate Support finds its place at 65.80.

- The composite Volume Point of Control (CVPOC) and micro CVPOC (mCVPOC) is marked at 65.54.

- The third-quarter micro composite Value Area Low (Q3 mCVAL) is observed at 64.95.

- The Support Zone ranges from 65.00 to 64.80.

Trading Scenarios to Consider

In navigating these waters, there are key scenarios traders might find beneficial:

-

Scenario 1 — Rejection at the Yearly Open: Traders should closely monitor the Yearly Open (66.34) as a potential resistance level. A failure to breach this threshold could lead to a tactical retreat toward the Line in the Sand (LIS), paving the way for opportunistic long positions with a target set above the year’s commencement.

-

Scenario 2 — A DOE-Driven Flush & Recovery: The release of DOE data might catalyze a downward momentum. In such an event, a vigilant eye should be kept for a potential swing failure at recent nadirs. A decisive close above prior levels could manifest a viable long position, gaining further credibility if accompanied by sustained price movements beyond 65.80.

Contextualizing the Recent Market Trends

At the core of these developments lies the intricate interplay between supply and demand forces, geopolitical dynamics, and policy directives. The global oil markets operate within an intricate ecosystem, heavily influenced by the broader economic narratives and the strategic maneuvers of sovereign states and alliances.

The resilience of crude oil, even in the face of adversities, is a testament to the inherent volatility and the opportunity-rich nature of commodity markets. It underscores the perpetual cycle of boom and bust that defines not just crude oil but commodities at large.

Conclusion

Navigating the crude oil market, thus, requires a nuanced understanding of these multifaceted variables. By dissecting the market’s technical structure and assessing the potential impact of upcoming data releases, traders and investors can make informed decisions, steering through the tumultuous yet rewarding waters of the commodity markets. The scenarios outlined herewith serve as a guide, illuminating paths through the often unpredictable terrain of crude oil trading, emphasizing the importance of vigilance, adaptability, and informed decision-making in the quest for profitability.