In a significant economic maneuver, the United States under the leadership of President Donald Trump has initiated a new series of “reciprocal” tariffs, effective from today. This move has reignited conversations and analyses surrounding the impact of tariffs on import costs and the potential ripple effect on inflation rates, albeit potentially temporarily. The anticipation surrounding the implications of these tariffs is high, with the consumer price index (CPI) data for July, eagerly awaited for release on Tuesday, August 12, serving as a critical marker for economists and policymakers alike.

Beth Hammack, serving as the president and CEO of the Federal Reserve Bank of Cleveland, earlier in the week, shed light on the possible inflationary trajectory in light of these tariffs. She posited that inflation rates might experience an uptick this year, a consequence attributed to businesses adjusting their pricing strategies to offset the increased costs attributable to the heightened tariffs. Hammack elaborated on the resistance businesses have shown towards passing these additional costs onto consumers, stemming from apprehensions regarding potential demand reduction. However, as businesses work through their pre-tariff inventory stockpiles, the reality of incorporating tariffs into consumer prices seems imminent.

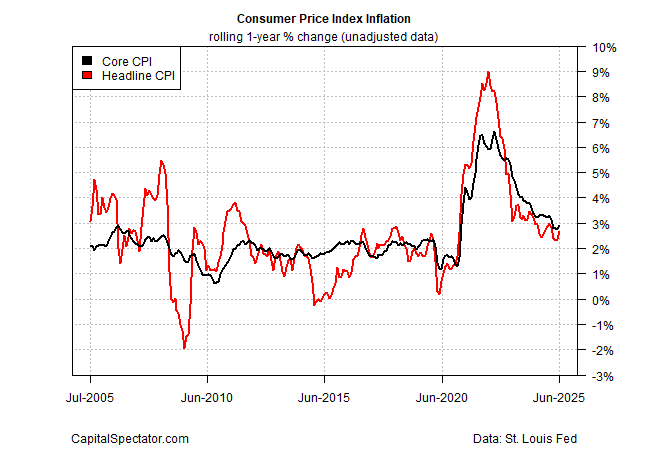

The upcoming CPI update next week is thus anticipated with keen interest, serving as a bellwether for the tangible impacts of tariff-induced cost escalations on the broader economy. To furnish some context and set the stage for the expectations surrounding this release, a review of the CPI data to date is instrumental. An analysis of the year-over-year CPI through June highlighted a discernible uptrend, with headline and core CPI registering increases to 2.7% and 2.9% respectively. Noteworthy is the fact that these figures represent the first consecutive annual increase for both metrics in over three years. Yet, despite these incremental adjustments, the overall inflation narrative remains largely unchanged on a broader scale.

The focus, however, narrows down to the core CPI data, which excludes the more volatile components of food and energy prices, providing a clearer view of the underlying inflation trends. Predictive models currently do not forecast significant fluctuations in the core CPI figures for July compared to the same period in the previous year.

Market sentiment, encapsulated by betting markets and investor expectations, seems to align with the notion of a stable inflation trajectory, with forecasts suggesting a maintenance of the year-over-year headline CPI increase at around 2.7%. Additional projections, including those from Polymarket, hint at a slightly elevated inflation rate for July, positing a 2.8% year-over-year change.

Despite the heightened tariffs, many analysts maintain that the inflationary effects tied to such tariffs are likely to manifest gradually within the economic data. Therefore, while the upcoming CPI update is surrounded by much anticipation, it might not yet serve as the definitive litmus test for assessing the full extent of the inflationary impact brought about by the new tariff implementations.

This backdrop of evolving trade policies and their economic implications provides a crucial moment of reflection for policymakers, businesses, and consumers alike. Understanding the nuanced dynamics at play, the strategic rationales behind tariff impositions, and their anticipated effects becomes paramount. As the United States navigates this intricate landscape of international trade, the outcomes of such policy choices will undoubtedly contribute to an ongoing debate about the most effective avenues for fostering economic growth, stability, and prosperity in an increasingly interconnected global economy.