In the ever-evolving economic landscape, the allure of dividend-paying stocks remains a cornerstone for investors seeking stable returns amidst market fluctuations. Historical data compiled through rigorous analysis by Hartford Funds, in an insightful partnership with Ned Davis Research, delineates a compelling narrative about the performance of these assets. Between the years 1973 and 2024, dividend-yielding assets averaged an annualized yield of 9.2%. This not only underscores their profitability but also highlights their reduced volatility compared to the benchmark index.

Contrastingly, non-dividend-paying stocks painted a different picture over the same period. Their annualized return stood at a modest 4.31%, accompanied by higher volatility. This bifurcation in performance is critical, underscoring the resiliency of dividend stocks against market turbulence. Consequently, amidst this backdrop, we sought to identify three notable stocks that not only offer a robust dividend but also trade at attractive valuations and enjoy broader market support.

Leading our curated list is Enterprise Products Partners LP, a stalwart in the energy sector with a lineage tracing back to 1968. Based in Houston, Texas, the company has carved a niche in the transportation, storage, and processing of vital energy commodities including natural gas, crude oil, and petrochemicals. Its robust business model has facilitated a consistent dividend increase over the past 27 years, with a current yield standing impressively at 7%.

Enterprise Products Partners is distinguished by its cash flow predictability, a trait that is somewhat rare in the volatile energy market. This predictability stems from its fixed contracts with drilling companies, which insulate it from market price fluctuations and inflationary pressures. The company’s forward-looking ventures are noteworthy, with over half a dozen major projects under construction totalling an investment of $5.6 billion. These projects, primarily focused on expanding its liquefied natural gas operations, are poised to significantly boost its cash flows by the end of 2026.

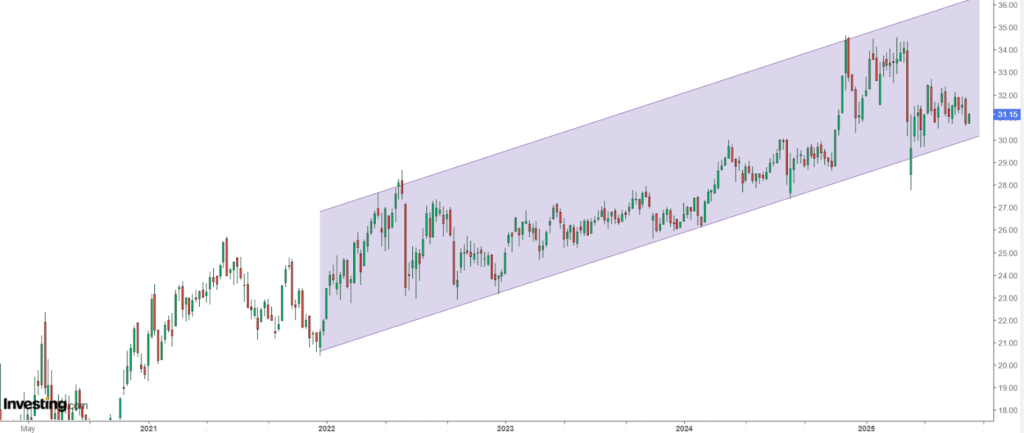

Similarly, Stanley Black & Decker’s evolution is a testament to resilience and strategic foresight. Originating in 1843 as Stanley Works and later merging with Black & Decker in 2010, this New Britain, Connecticut-based company epitomizes excellence in the manufacturing and distributing arena for DIY and commercial tools and products. Despite sales witnessing a marginal 2% year-on-year decline, the company’s net profit witnessed a sharp increase, with expectations for earnings per share to grow by 5.7% and 28.2% in the subsequent years.

The company’s determined focus on supply chain transformation and cost-saving measures has yielded significant savings, with a global cost reduction program initiated in 2022 already realizing around $1.8 billion in savings. By relocating production out of China, the company is adeptly mitigating tariff impacts, dovetailing into its operational improvements and margin expansions.

MetLife presents a fascinating case within the insurance sector, straddling the realms of value and growth. Its forward price-to-earnings ratio notably falls below the sector average, signalling potential undervaluation despite analysts forecasting substantial earnings growth. Noteworthily, MetLife has sustained a tradition of rewarding shareholders, with a dividend increase streak spanning 12 consecutive years and uninterrupted payouts for over 26 years.

As we dwell on the prowess of dividend-paying stocks, it’s essential to arm oneself with tools that offer a deep dive into the financial health and potential of these assets. InvestingPro emerges as a vanguard in this context, offering members a suite of resources designed to hone investing decisions. From AI-driven picks to comprehensive models for assessing fair value and financial health, InvestingPro facilitates an informed investment journey.

In sum, the narrative around dividend-paying stocks is one of resilience, stability, and strategic foresight. Companies like Enterprise Products Partners, Stanley Black & Decker, and MetLife underscore the broader market’s appreciation for assets that not only promise but deliver consistent returns. For investors, aligning with platforms that offer nuanced insights and tools for evaluating such assets is indispensable for navigating the complexities of modern markets.