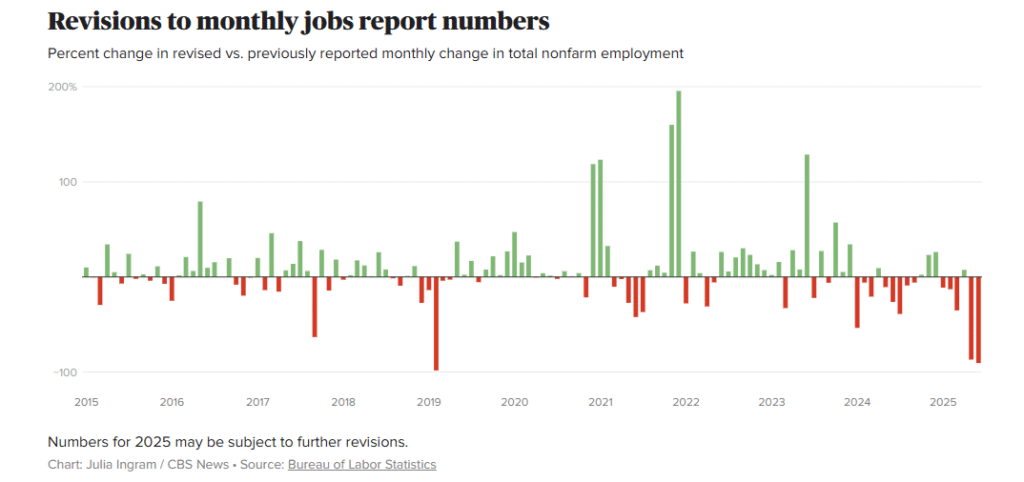

The American economy is evidencing a tangible deceleration in its pace of growth, particularly reflected in the domain of employment. The most recent report for July underscored this downtrend with a modest addition of merely 73,000 jobs, falling conspicuously short of the anticipated 110,000. This situation becomes more pronounced upon revisiting the figures for May and June, which saw a significant downward revision by 258,000 – marking the most substantial rollback since the 2008 financial crisis. This trend is not merely an anomaly but a clear indication of the broader economic temperature.

Unemployment experienced a slight uptick to 4.2 percent, with the labour force participation hovering unchanged at 62.2 percent. At the outset, these numbers might not trigger alarms; however, a deeper look reveals concerning trends. Stagnant labour force participation points to a notable absence of the working-age population re-entering the job market in meaningful numbers. Furthermore, the proportion of individuals engaged in full-time work, a critical driver for personal consumption and, by extension, inflation, remains enfeebled. This situation naturally begets a scenario where, absent a robust full-time workforce, personal consumption — and, consequently, inflation — is poised to dwindle.

Adding to the dilemma is the waning momentum of wage growth. Monthly increases in average hourly earnings gently nudged at 0.3 percent, but this growth decelerates significantly when viewed through an annual lens, settling at 3.9 percent. This deceleration, especially at a time when inflation remains obstinately high across services and essential goods, directly corrodes real income growth, setting the stage for tightened household budgets and, therefore, constricted discretionary spending witnessed in the latter half of 2025.

Delving into the sector-specific dynamics, the employment landscape is noticeably shifting. While healthcare and government sectors continue to add jobs — a characteristic of non-cyclical industries — manufacturing and professional services display stark contrasts. Manufacturing has taken a hit, a direct reflection of dwindled orders and a slowdown in global trade activities. Professional and business services hiring has hit a plateau, alluding to the broader transition of the labour market from a post-pandemic recovery phase to a phase characterised by inherently slower growth. This realignment across sectors is not a fleeting adjustment but a fundamental recalibration of hiring expectations.

Further corroborating the slowdown narrative is the Purchasing Managers’ Index (PMI) for July, which descended to 48.0, marking the fifth consecutive month of contraction. Activity within both the manufacturing and services domains is losing vigour, with manufacturing particularly hard hit, as suggested by the New Orders Index plummeting to 43.4 percent. This is not merely symbolic but indicative of active job shedding, underscoring a profound demand weakness which is further exemplified in the stagnating performance of the services sector, barely maintaining an expansion stance.

The onset of the second half of 2025 painted a grim picture of economic recuperation. While the Gross Domestic Product (GDP) witnessed a rebound to 3.0 percent in Q2 2025 following a contraction, this growth was not driven by sustainable factors. An increase in consumer spending, the primary growth engine, was largely fueled by depleting savings and escalated credit use, reflecting not an actual increase in real wage growth but a leveraging of future financial stability for present consumption. Additionally, a sharp fall in imports, though technically uplifting for the GDP, signals a deeper malaise of weakening domestic demand and distorted trade flows attributable to continued tariff impositions.

Looking ahead, the forecasts for the latter half of 2025 are anything but optimistic. With most analysts projecting a GDP growth decelerating to 1.5 percent or even lower, the imminent slowdown portends significant challenges for the broader economic landscape. This bleak outlook is further exacerbated by anticipations of corporate earnings being squeezed by a double whammy of rising costs and softening demand — a scenario where only entities with resilient pricing mechanisms and efficient operational models could potentially navigate through unscathed.

As we peel back the layers of this economic narrative unveiling before us, the underlying message is resoundingly clear. The American economy is teetering on the cusp of a substantive slowdown, with employment gains grinding to a halt, manufacturing and services sectors teetering on the edge of contraction, and corporate margins under unprecedented pressure. The implications for investors are profound. In such times, strategic portfolio management — pivoting towards defensive sectors, maintaining liquidity, and adopting a nimble approach to asset allocation — becomes imperative.

This recalibration of economic expectation and investment strategy marks a critical juncture in the American economic saga — a juncture that necessitates astute observation, prudent decision-making, and strategic foresight. As the economic landscape evolves, so too must our strategies for navigating it. The times ahead may be fraught with uncertainty, but with informed judgement and tactical adaptability, opportunities can be unearthed even in the most challenging circumstances.