As the financial landscape opens the curtain on a new week, all eyes are turned toward a series of significant events poised to shape market dynamics. Among these critical milestones are the looming US-China trade deal deadline in July, coupled with the much-anticipated Friday meeting between US President Donald Trump and Russian President Vladimir Putin. The US dollar, meanwhile, treads cautiously, its movements constrained, hovering just above the 98 mark, despite making subtle advances toward the 98.5 resistance level.

The backdrop to this cautious market sentiment stems partly from the previous week’s underwhelming employment figures and the interim appointment of Stephen Miran to the Federal Reserve. These factors have ignited speculation of a potential interest rate cut come September, adding a layer of anticipation to the week’s proceedings.

The Spotlight on Inflation Data

A particularly notable event this week is the release of the July Consumer Price Index (CPI) data. Observers have been tracking the inflation figures closely, noting a consistent rise since April. Expectations are set for the inflation rate to touch 2.8% in July, with core inflation also predicted to climb to 3%. Analysts at Deutsche Bank have forecasted a tempered progression, projecting a 0.1% month-on-month increase in headline CPI and a 0.21% rise in core CPI, mirroring last month’s pace.

Should the inflation data fall short of market forecasts, it could amplify calls for the Federal Reserve to trim interest rates, potentially triggering a sell-off in the US dollar. Conversely, should inflation exceed expectations, it could validate the Fed’s stringent policy stance, providing a temporary uplift to the dollar’s fortunes.

US-China Trade Negotiations and Geopolitical Developments

Concurrently, US-China trade negotiations hang in the balance, with the August 12 deadline set by President Trump fast approaching. The market is braced for a possible 90-day extension, a development that could enhance risk appetite. However, the imposition of new tariffs might stoke inflationary pressures. In further developments, tech giants NVIDIA and Advanced Micro Devices have consented to relinquish 15% of their China sales revenue to the US government, a move that has stirred the tech sector.

Adding to the geopolitical tapestry, news of a scheduled meeting in Alaska between President Trump and President Putin to discuss Ukraine on August 15 has heightened geopolitical tensions. Should the meeting broadcast a message of peace, it could bolster global risk appetite. If not, the clamor for safe-haven assets is likely to intensify.

A Week Packed with Data

Beyond inflation figures, the Producer Price Index (PPI) and retail sales data await release, promising further insights into the health of the US economy. Employment figures, industrial production, and consumer sentiment indicators are also on the docket. Internationally, economic indicators from Germany, the UK, the Eurozone, and Japan will be under scrutiny, offering a broader view of global economic health.

This barrage of economic data, interwoven with geopolitical developments, could precipitate volatile, short-term movements in the US dollar. The intricate dance between economic indicators and investor sentiment makes it challenging for the US dollar to carve a definitive path against its major counterparts.

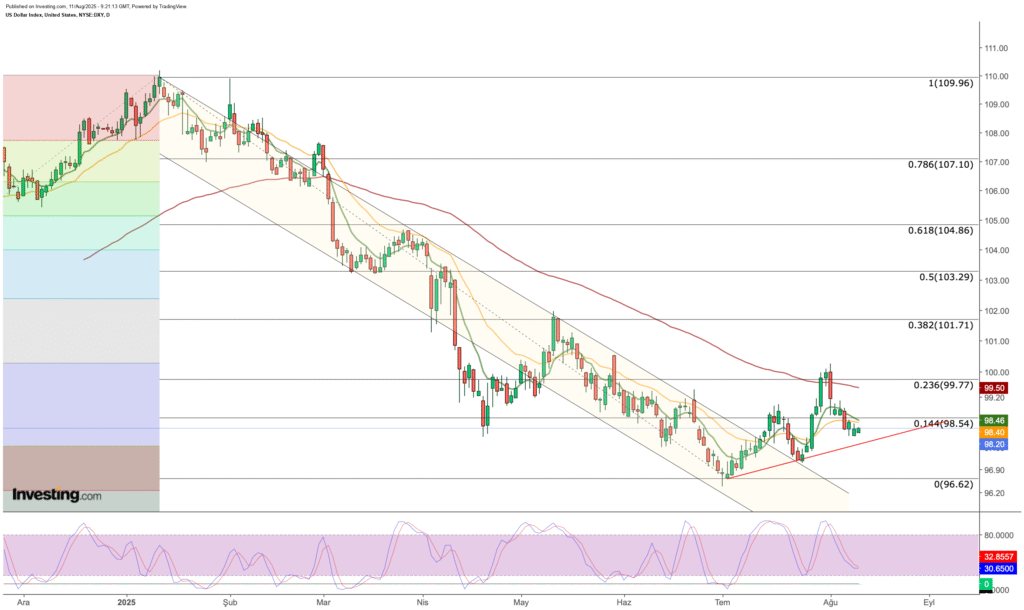

Technical Analysis of the US Dollar

Technically, the US dollar’s journey has been one of pause and contemplation. After a brief flirtation with the 100 psychological level, the currency found modest support near 98, following a slip below the 98.50 threshold. The upcoming week may test the dollar’s resilience; should it sustain above 97.8, the 98.50 level could once again become a pivotal marker. A successful breach could rejuvenate aspirations for a rally towards the 99.5 to 100 range. Failure, however, might exacerbate selling pressure, accelerating the descent towards 96.

While short-term indicators hint at a bearish outlook, as long as the dollar remains anchored above its rising support line from July, prospects for an upward trajectory remain. Positive inflation data and encouraging geopolitical news could serve as catalysts for a short-term uplift in the dollar’s fortunes.

Insightful Tools for the Avid Investor

For those looking to navigate these turbulent financial waters, InvestingPro offers a suite of robust tools designed to foster wiser, more prompt investment decisions. Leveraging over 25 years of financial data, our ProPicks AI employs a machine learning model to unearth high-potential stocks, using metrics trusted by major funds and seasoned investors. The InvestingPro Fair Value model demystifies stock valuation, blending insights from various industry-recognized models to present a professional-grade estimate of a stock’s true worth.

Furthermore, our WarrenAI, with its financial market-specific training, extends 500 monthly prompts to Pro users, aiding them in drawing insightful market analyses. Also, our Financial Health Score condenses a company’s overall financial strength into a single, comprehensive figure. Coupled with the market’s top stock screener, featuring 167 customized metrics, InvestingPro equips investors to streamline their search for the next big investment.

As we stand on the precipice of a week fraught with potential market-moving developments, the confluence of economic data, geopolitical affairs, and trade negotiations promises to shape the course of the US dollar’s journey. Amidst this complexity, the adept investor remains vigilant, poised to decipher signals and navigate the uncertain tides of the global financial markets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice or an inducement to invest. Readers are advised that investments carry significant risks and the decision to invest should be thoroughly assessed against individual financial circumstances and objectives.