In the dynamic world of global finance, early trading on a recent Monday saw a notable shift in market sentiment. Both spot and futures markets for precious commodities experienced a downturn, declining by over 1% at the time this analysis was penned. This trend was not confined to precious metals alone; gold, a traditional bastion of security for investors during turbulent times, also witnessed its prices being pulled downward.

The backdrop to this volatility is a complex geopolitical tapestry, notably centered around the lingering Ukraine conflict. Speculation around a potential diplomatic breakthrough had diminished the allure of safe-haven assets, including gold. This shift came on the heels of an ambiguous conclusion to the previous week. Market whispers regarding adjustments to gold tariffs had initially propelled futures to peak unprecedented levels. In contrast, spot gold remained relatively unmoved, barely missing the critical threshold of $3,400. This figure stood as a crucial benchmark, particularly with the looming release of critically watched US inflation data and a series of financial reports that could significantly influence future market trends, including gold.

After a week marked by a weaker US dollar and subdued data points – despite an energetic equities market and a surge in risk inclination – Monday’s market correction seemed to wipe the gains off the table. A recalibration of trader positions followed an announcement by former US President Donald Trump regarding a proposed meeting with Russian President Vladimir Putin in Alaska, slated for 15 August, aimed at discussing a potential resolution to the war.

Despite the day’s setbacks, the price of gold hovered within a familiar range. A persistent climate of trade uncertainties and anticipations of policy shifts by the US Federal Reserve – including possible interest rate cuts before the year’s conclusion – provided a floor beneath the price movements.

The focal point of the week’s financial calendar was undeniably the US inflation data, closely followed by additional key economic indicators. As inflation continues to carry significant weight in the Federal Reserve’s policy considerations, market participants were keenly awaiting insights that could signal rising costs being passed on to consumers. Notably, the Consumer Price Index (CPI) had consistently fallen short of projections for five months in succession, a trend that was under threat of reversal.

Investor attention was also divisible between the anticipation of Federal Reserve policy adjustments and an assessment of the broader economic climate. Speculation was rife that soft employment figures could prompt the Fed to initiate easing measures as soon as September, with the potential for further rate reductions before year-end. Underpinning these expectations were indicators such as sluggish service sector performance and hints from Fed policymakers surrounding multiple rate cuts within the year.

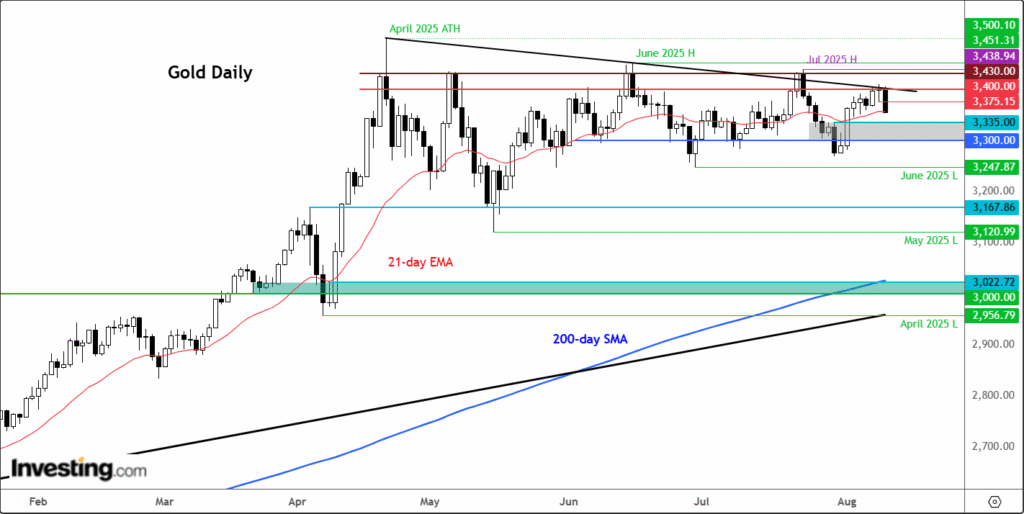

The technical outlook for gold suggested a period of uncertainty ahead. A descending trend line, tracking the metal’s price from a high in April through subsequent peaks, indicated potential resistance at the $3,400 level. Yet, the possibility of breaching this resistance hinted at the prospect of new highs, while a failure could tilt the balance towards a bearish outlook.

As the investment community navigates these intricate dynamics, the broader implications on market trends and the strategic positioning of gold within investment portfolios merit close observation. In such complex times, tools and resources that aid in informed decision-making become invaluable. Services like InvestingPro offer a suite of analytical tools designed to empower investors with insights into stock potential, fair value estimations, and financial market trends, crafted to enhance the efficacy of investment strategies.

In essence, as the narrative of global finance continues to unfold with its inherent uncertainties and opportunities, the importance of comprehensive analysis and strategic foresight cannot be overstated. The trajectory of gold prices, framed against the broader economic and geopolitical landscape, encapsulates the intricate interplay of market forces, policy decisions, and investor sentiment that defines the investment world.