In recent developments within the financial and economic sectors of the United States, a significant appointment was made by President Donald Trump. The President appointed Stephen Miran, who was serving as the Chairman of the Council of Economic Advisers, to fulfill the remainder of the term initially held by Federal Reserve Governor Adriana Kugler. This decision is not just a routine appointment; it marks a continuity in the nation’s monetary and economic policymaking until January 31, 2026. Furthermore, the appointment underscores the ongoing effort by the administration to identify a permanent successor while ensuring stability within the Federal Reserve. The Senate is expected to expedite the confirmation process, aiming for completion before the Federal Open Market Committee’s (FOMC) meeting in September.

This strategic move by President Trump has the potential to reshape discussions and decisions within the FOMC, particularly concerning monetary policy. Speculation is rising that should the committee decide against lowering the federal funds rate (FFR) in its forthcoming September session, it could witness dissent from at least three of its members. The crux of the disagreement hinges on the labor market’s health, with a faction arguing that a visible weakening justifies a cut in the FFR. Conversely, should a decision be made to lower the rate, another group might emerge, countering that such a move could exacerbate inflation, hence deeming it undesirable.

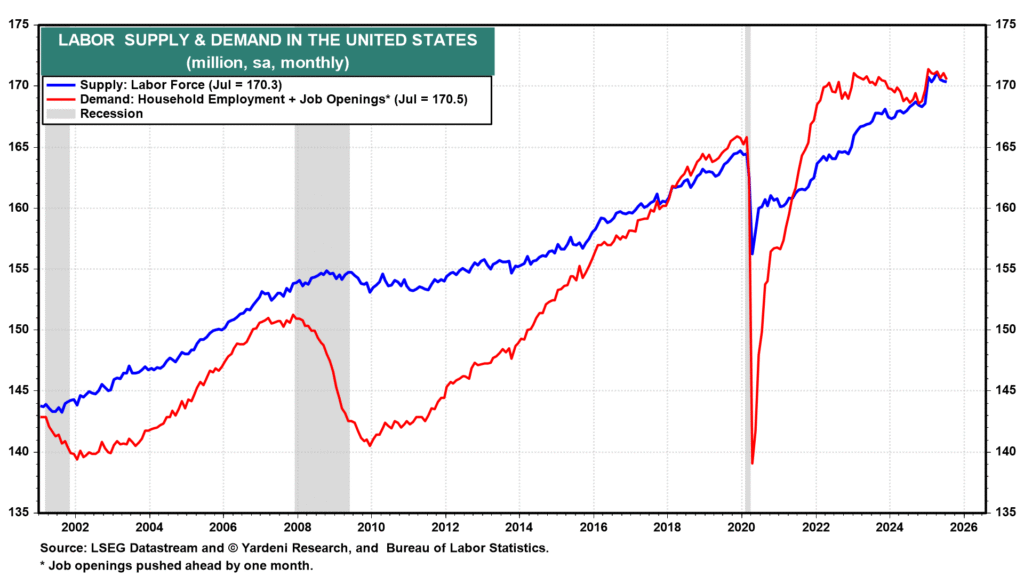

The ongoing debate throws into sharp relief the delicate balance the FOMC must maintain between stimulating economic growth and curbing inflation. At the heart of this discussion is whether the observed slack in employment figures is a consequence of diminishing demand for labor or a manifestation of a shrinking pool of available workers – it’s conceivable that both factors are at play simultaneously.

On one hand, the introduction and escalation of tariffs by the Trump administration since April have led to considerable unrest and uncertainty within the business community. Many employers opted to delay hiring, awaiting clearer insights into how these tariffs would impact their operations. This period of “Tariff Turmoil” has undoubtedly contributed to the current labor market dynamics. As visibility improves and businesses adapt to the evolving trade landscape, one anticipated outcome is a renewal in hiring activities. This would suggest that, conditioning on this increased certainty, a cut in the FFR may not be immediately warranted, a perspective likely to be challenged by some FOMC members.

On the other hand, the tightening of the U.S. labor market could be largely attributed to supply-side constraints. Notably, the Trump administration’s policies on immigration have led to a significant reduction in the growth of the labor force. These measures, including stringent border controls and increased deportations, have inadvertently contributed to the existing labor shortage, placing upward pressure on wages and, by extension, prices. This scenario further complicates the decision-making process for the Federal Reserve, which has to balance the opposing forces of stimulating economic growth and preventing wage-induced inflation.

Moreover, the case for a monetary policy adjustment gained momentum following a tepid July payroll report, compounded by downward revisions for May and June figures. The data revealed not just a slowdown in job creation but an elongation in the duration of unemployment, indicating that individuals are finding it increasingly challenging to secure employment.

An analysis of unemployment claims portrays a somewhat mixed picture. While layoffs remain low, indicative of a fundamentally robust labor market, the duration of unemployment benefits, capped at 26 weeks, has seen an uptick in individuals unemployed for longer periods. This trend raises concerns about the underlying health of the labor market and the effectiveness of current policies in fostering employment opportunities.

Given these complex dynamics, the FOMC’s upcoming decision in September is poised on a knife-edge. Factors such as inflation reports for July and August, which are expected to reflect the impact of tariffs, and the August payroll employment report, will play a crucial role in informing the committee’s direction. Should these indicators suggest an overheating economy, the committee might opt to maintain the current FFR, a decision unlikely to be without its detractors.

In sum, the interplay of economic policies, labor market dynamics, and monetary policy decisions underscore the intricate balance the Federal Reserve seeks to maintain. As the FOMC navigates these turbulent waters, the decisions made in the coming months will be pivotal in shaping the trajectory of the U.S. economy, with far-reaching implications for workers, businesses, and the broader economic landscape.