Throughout the early part of 2025, Tesla Inc. (NASDAQ: TSLA) experienced a rollercoaster of share price movements, epitomizing the volatility that can permeate the stock market. The company’s shares initiated the year on a downward trajectory, shedding value over the initial four months. It wasn’t until April that the stock found some semblance of stability, subsequently entering a phase of modest recovery that, unfortunately, lost momentum too soon.

By May, Tesla’s stock had settled into a pattern of lateral movement, oscillating around a critical pivot point situated in the vicinity of $320. By the time the stock market closed on Monday, with Tesla’s shares priced at $339.03, the year-to-date figure showcased a 16% decline—a telling indicator of the challenges the electric vehicle (EV) manufacturer had faced.

Investors navigating the tumultuous waters of Tesla’s stocks in 2025 were met with ample reasons for caution. A significant catalyst for the stock’s initial decline was Elon Musk’s foray into the Trump administration, pulling him away from the helm of Tesla. Musk’s divided focus was a source of concern for shareholders, sparking uncertainty regarding his capacity to steer Tesla effectively during his political engagement.

During Musk’s governmental tenure, his public stances — often polarizing — seemed to cast a shadow over Tesla’s brand, culminating in reported vandalism of Tesla vehicles and a perceptible dent in the company’s sales. Under mounting pressure from shareholders and cognizant of the reputational damage inflicted on Tesla, Musk made the decision to distance himself from his governmental responsibilities in April, ultimately resigning at May’s end. Despite this move, the anticipated positive impact on Tesla’s share price failed to materialize substantively.

Adding to the headwinds were suboptimal financial performances, with Tesla’s quarterly earnings for Q4 2024 and Q1 2025 falling short of market expectations in terms of both profitability and revenue. The Q2 2025 earnings report, although meeting analyst predictions, unveiled a year-over-year decline of 23% in earnings per share (EPS) and a nearly 12% fall in revenue, further compounding investor concerns.

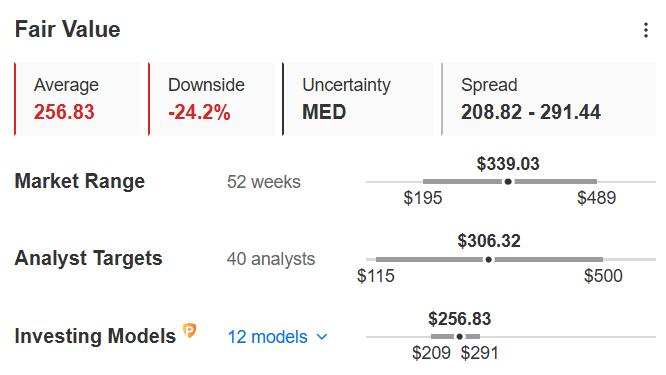

However, beneath the surface-level turmoil, a more fundamental issue pointed to Tesla’s inflated valuation. An analysis leveraging our Fair Value model—which aggregates up to 17 respected valuation methodologies—had already flagged Tesla as significantly overvalued by more than 30% as of December 2024, prior to Trump’s presidency. Trading near record highs at approximately $465, the InvestingPro Fair Value estimate had indicated a potential 33.54% downside, prophesizing the sharp decline Tesla was poised to undergo, eventually mirroring this prediction with a 30% drop post-warning.

Currently, with Tesla’s shares recalibrating to $339.03 and the latest Fair Value estimate indicating a true worth of $256.83, indications still point towards an overvaluation exceeding 24%. This suggests a lingering period of adjustment for Tesla’s stock valuation, necessitating a cautious approach from investors banking on a swift recovery based solely on fundamental analysis.

Against this backdrop, the pursuit of undervalued stocks becomes a strategic imperative for investors seeking lucrative opportunities. The Investing.com screener presently identifies 258 US stocks with over 50% upside potential, according to the InvestingPro Fair Value model. Coupled with this tool, our Undervalued Stocks page offers continuous updates on stocks flagged by the model as significantly undervalued, ensuring investors are well-informed about potential strong buys characterized by robust financial health.

In sum, the InvestingPro Fair Value is not merely a predictive tool but an indispensable resource for prudent investors. In the case of Tesla, leveraging this model could have provided investors the foresight to navigate the stock’s turbulent course in 2025 effectively. More broadly, Fair Value serves as a cornerstone for identifying undervalued gems in the stock market, potentially catalyzing significant returns for discerning investors.

The saga of Tesla in 2025 underlines the multifaceted challenges that can beset even the most promising of companies. From leadership distractions and reputational issues to fundamental questions of valuation, Tesla’s journey encapsulates the need for investors to employ a holistic approach, blending strategic caution with the analytical rigor provided by tools like the InvestingPro Fair Value. In the ever-evolving narrative of the financial markets, understanding the undercurrents shaping stock valuations is paramount, offering a compass by which to navigate the unpredictable waters of investment decisions.