In recent times, the dynamics of the gold market have undergone a rapid transformation, accelerating at an unparalleled pace. This remarkable trend was especially evident when, despite a significant drop in the fiat valuations of gold and silver bullion, gold mining companies experienced minimal losses, with some even witnessing a notable surge in their stock prices.

The strategic timing of various economic reports from the US, including the closely monitored CPI and PPI scheduled for release this week, has market analysts on their toes. Even if these reports turn out to be relatively mild, the specter of stagflation looms large, largely attributed to the accumulating burden of governmental tariff taxes. Moreover, subtle yet persistent increases in inflation are drawing US investment towards gold miners, a trend that coincides with faltering job growth.

The political landscape has not been oblivious to these developments. President Donald Trump, playfully dubbed “Super Donnie Man,” has made it clear that gold will not be ensnared by tariff taxes, underscoring his commitment to reinstating law and order while fostering a self-reliant nation. Nonetheless, when it comes to global economic dominance, the overwhelming debt burden shouldered by the US populace starkly limits its capacity to maintain its erstwhile leadership. The ascendant, gold-centric economies of China and India are poised to overtake, heralding a new era for gold price stabilization.

This prospective stability in gold pricing is a welcome change, particularly considering the exaggerated volatility often triggered by US economic indicators. Dramatic price fluctuations in response to rate adjustments or inflation reports are untenable for a healthy market. In contrast, the investors in China and India exhibit a markedly steady approach, unaffected by such transient economic shifts. This emerging stability is equally enticing for Western fund managers, who favor predictable markets for long-term investments in precious metals.

Ahead of the imminent institutional embrace of gold, astute investors in the West are advised to wisely allocate their resources towards miners to fully capitalize on the upcoming surge.

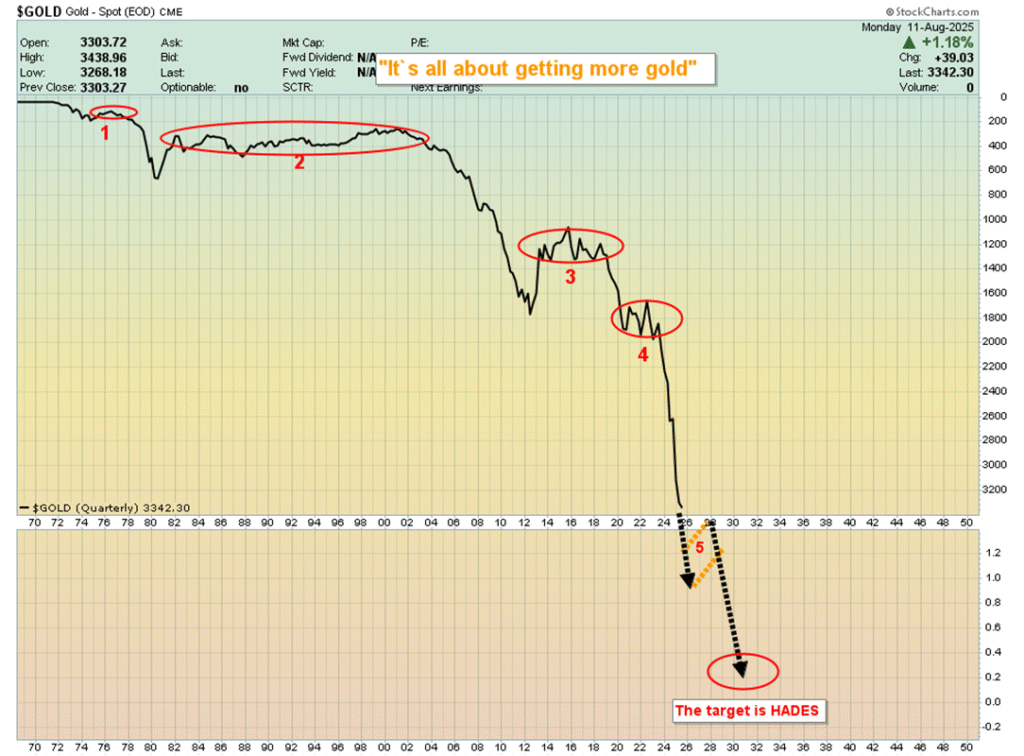

The debate on gold’s status in the US, particularly its re-legalization for private ownership in the early 1970s without reinstating it as the country’s currency, remains a contentious issue. The dominance of fiat currency pursuits over the acquisition of “supreme money” gold has skewed investor priorities. Instead of chasing fleeting fiat gains, investors would benefit significantly from focusing on accumulating gold, embracing strategic purchasing over speculative trading.

Furthermore, professional investors are already identifying key buy zones for gold, anticipating future market movements with strategic foresight. The $3,500-$3,300 range is poised to become a pivotal zone for accumulation, evidencing the depth of planning that goes into professional gold investment.

The vibrant activity in the Junior Silver Miners ETF and CDNX markets underscores a burgeoning interest in precious metal stocks. These sectors not only showcase resilience in the face of broader market downturns but also signal the potential for substantial returns, underscoring the multifaceted appeal of investing in junior mining stocks.

In addition to junior sectors, major mining stocks are not to be overlooked. The GDX, for instance, is showing patterns indicative of a robust market sentiment, rallying impressively even as gold prices experienced downturns.

Turning to the broader historical context, the trajectory of the US stock market, as depicted by the Shiller PE Ratio, reveals cyclical patterns of undervaluation and overvaluation, offering insights into long-term investment strategies.

As we stand on the brink of a new era characterized by the “Chindian Gold Bull,” the reevaluation of gold stocks is not just imminent but imperative. This evolution promises to redraw the contours of the gold market, presenting opportunities that were previously considered beyond the realm of possibility. For enthusiasts and investors alike, the message is clear: the time to embrace gold stocks is now, signaling the commencement of a golden era in investment.