The Evolving Landscape of Cryptocurrency Investing

In the dynamic world of cryptocurrency, investors and enthusiasts recently witnessed an ambitious attempt to elevate market prices to unprecedented heights. Despite this effort, the achievement of new all-time highs remains elusive for the moment. The appearance of a double peak in the market’s trajectory hints at potential fluctuations yet stops short of signalling an imminent major correction. The unfolding scenario suggests that patience is required to determine the extent to which sellers might influence market prices downward.

The Advent of the HYPER Project

As the cryptocurrency sector continues to expand and diversify, the HYPER project emerges as a noteworthy endeavor aimed at revolutionising crypto payments. This initiative seeks to amalgamate the robust security mechanisms of Bitcoin with the agility and cost-efficiency characteristic of networks such as Solana. By launching an initial coin offering (ICO), HYPER has positioned itself on the cusp of amassing $10 million in funding.

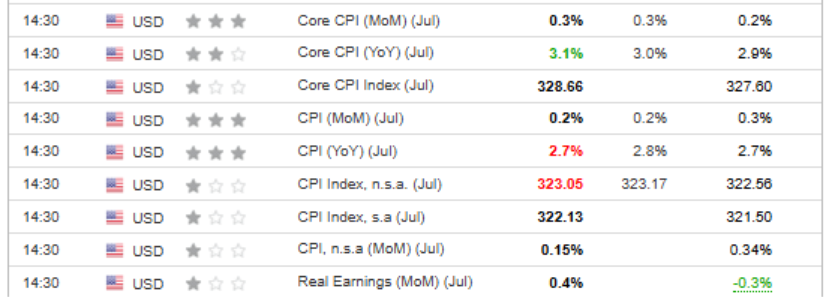

This financial milestone coincides with recent economic indicators from the United States, which presented a mixed picture of inflationary trends, thereby influencing the likelihood of further interest rate adjustments. Specifically, while overall inflation rates fell marginally short of expectations, the core inflation metric surpassed its target, leading to heightened speculation around monetary policy responses.

Envisioning HYPER’s Trajectory

At its core, Bitcoin continues to command respect as a digital safeguard against the diminishing purchasing power of conventional currencies. Nevertheless, its utility in everyday transactions is hampered by limitations related to transaction fees and processing times. HYPER aspires to address these challenges by fusing Bitcoin’s hallmark security with the enhanced efficiency and low costs of certain alternative networks. Utilizing Bitcoin’s second layer and empowered by the Solana Virtual Machine, HYPER intends to streamline the movement of BTC to a more nimble payment platform, promising an expedited transaction experience without undermining trust.

Though still in its pre-sale phase and without a definitive conclusion date, HYPER’s scalability is contingent on investor interest, suggesting its potential to be a pioneering force in merging the value preservation attributes of cryptocurrencies with pragmatic payment solutions.

Bitcoin’s Strategic Position

Bitcoin’s trajectory has momentarily plateaued as it grapples with the $123,000 resistance level, prompting speculation regarding a potential double top formation. Nonetheless, the preservation of the short-term uptrend signifies resilience among buyers, though a breach could precipitate a reevaluation of the $118,000 support level. Looking forward, the ambition to breach the $130,000 threshold underscores the optimistic outlook held by many in the medium to long term.

Ethereum’s Vigorous Ascent

Ethereum, meanwhile, has demonstrated revitalized vigor, transcending a period of stagnation to achieve a notable rally. This resurgence sent prices hurtling beyond the $4,000 barrier, an achievement reflecting burgeoning demand. The path now appears clear for an assault on Ethereum’s all-time high, just shy of the $5,000 mark, with short-term setbacks potentially offering strategic entry points for investors.

Empowering Investors with Advanced Tools

In a landscape as volatile and complex as cryptocurrency, resources that empower investors to make informed decisions are invaluable. Tools like ProPicks AI, which leverages extensive financial data and machine learning to identify high-potential investments, and the Fair Value Score, offering a comprehensive valuation based on multifaceted models, serve to enhance the strategic capabilities of investors. Additionally, applications such as WarrenAI provide tailored insights into financial markets, further augmenting an investor’s ability to navigate this challenging terrain effectively.

Amidst this backdrop, the caveat that investments in digital assets carry inherent risk is ever-present. Any decision to invest must be made with a clear understanding of these risks and an appreciation for the speculative nature of these assets.

Conclusion

The cryptocurrency market, with its blend of innovation and uncertainty, continues to captivate and challenge investors. The emergence of projects like HYPER underscores the ongoing evolution of this space, striving to resolve enduring issues while tapping into new opportunities. As we witness attempts to reach new market highs and the introduction of cutting-edge solutions, the importance of patience, research, and strategic investment has never been more pronounced.