On a crisp Thursday morning, a comprehensive collection of statistics regarding the United Kingdom was unveiled, providing insight that surpassed expectations across several metrics, with the notable exception of foreign trade data. Despite the impressive foundations laid out by these statistics, the British pound exhibited a surprising lack of momentum, raising eyebrows given its robust performance in recent weeks. This scenario not only highlights the intricate dance between economic indicators and currency valuation but also presents an opportunity to delve deeper into the mechanisms of market reactions and the broader economic landscape of the UK.

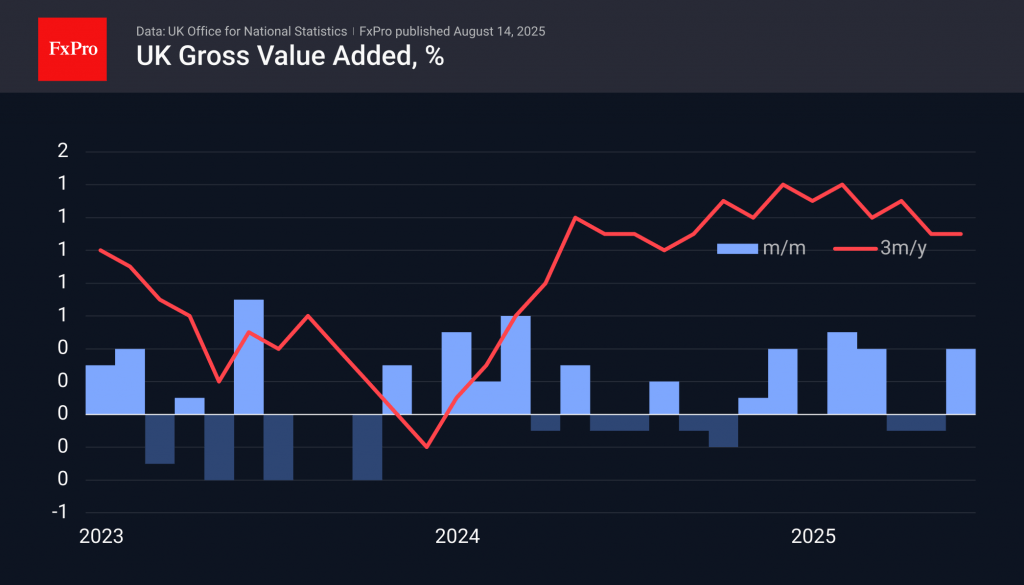

June’s economic data emerged as a beacon of optimism, with the monthly increase doubling the anticipated 0.2% to a hearty 0.4%. This growth wasn’t merely a flash in the pan; it marked itself on the quarter-on-quarter and year-on-year metrics as well, both registering at 0.4% and 1.2% respectively. The services sector, often hailed as the backbone of the British economy, continued to reinforce this notion by contributing positively to the overall economic panorama. With a June increase of 0.3%, following a modest 0.1% in May, the trajectory seems promising. In a similar vein, the industrial production index broke its stagnant stride with a 0.7% uptick in June, a notable achievement considering the preceding three-month aggregate decline of 1.5%.

In the quest to shed light on the broader context, the construction industry’s rebound becomes a focal point, illustrating the tangible benefits of monetary policy easing in fostering recovery. Its activity index, tracing a steady trajectory since the post-2013 economic resurgence post-mortgage crisis, tells a tale of slow yet stable recovery and adaptation.

Amid these economic narratives, the behaviour of the pound commands attention. From the 1st of August, it exhibited signs of revival, rising from the ashes at the Fibonacci support level of 61.8%, stretching from the troughs of January to the zenith at the beginning of July. This rebound – a 3.5% leap from 1.3140 to almost 1.3600 – appeared as a promising signal of resumed growth after a period of correction. However, true confirmation of this uptrend awaited surpassing the early July highs of 1.3800.

A closer analysis of this forex ballet reveals a potent wave of resistance encountered by the pound, especially in its dance against the dollar. Since the end of May, this resistance has repeatedly curtailed the pound’s ascendency, with the rare exception of a fleeting surge towards the end of June. Should the pound succeed in breaching this year’s highs, it would signify a groundbreaking shift with potential trajectories reaching 1.48–1.50, with significant milestones at 1.4250 along the journey.

The performance of the pound on that particular Thursday painted a mixed picture; it struggled for prominence against the strengthening dollar, evidencing an apparent weariness from its earlier climbs throughout the month. Contrastingly, against the euro, the pound demonstrated resilience, recoiling back to lows unseen since the early days of July, thus reaffirming the robustness of the two-year resistance it faced.

This exploration into the shifts and undercurrents within the UK’s economic landscape, and the corresponding reactions from the pound, offers a glimpse into the volatile dance of currencies amidst evolving economic narratives. The interplay between economic indicators and market sentiment underscores the complex, often unpredictable nature of financial markets, where past performance and future expectations collide to shape the present valuations. As this saga unfolds, it serves as a testament to the enduring dynamism and resilience of the UK’s economy, navigating through uncertainties and opportunities alike.