Amid the dynamic landscape of global finance, Japan’s latest economic indicators have not only surpassed expectations but have also intensified speculation regarding the Bank of Japan’s (BoJ) monetary policy direction. Nevertheless, the course of these speculations is significantly intertwined with the economic pulse of the United States, casting a spotlight on forthcoming American retail sales and import price data.

In a surprising revelation from Japan, the nation’s Q2 GDP growth registered at 0.3% quarter-on-quarter, a figure that elegantly triples prior anticipations. This robust economic performance stems primarily from vibrant trade dynamics and buoyant consumer spending, both of which have defied earlier projections. With the trade sector making a commendable contribution of 0.3 percentage points to this growth, bolstered by a 2% surge in exports despite the looming shadows of U.S. tariffs, Japan’s economic resilience shines through. Concurrently, private consumption, which forms the bedrock of Japan’s economic activities, surged by 0.2%—a figure that doubles expectations and underscores the importance of consumer spending as a pivotal inflationary force.

The positive trajectory of Japan’s economy was further evidenced by the GDP deflator. Although there was a slight deceleration to a 3% increase from a year earlier, down from the previous quarter, the continued strength in both trade and inflation augments the case for potential rate adjustments by the BoJ. These developments align intriguingly with remarks from U.S. Treasury Secretary Scott Bessent, who recently hinted at the Japanese central bank’s need to proactively combat inflation.

This landscape sets a complex backdrop for the BoJ, amidst which global attention pivots towards the U.S., where imminent economic data releases loom large. The interconnectedness between the two economies becomes particularly poignant in the context of the USD/JPY exchange rate, which remains significantly influenced by American economic indicators and policy decisions.

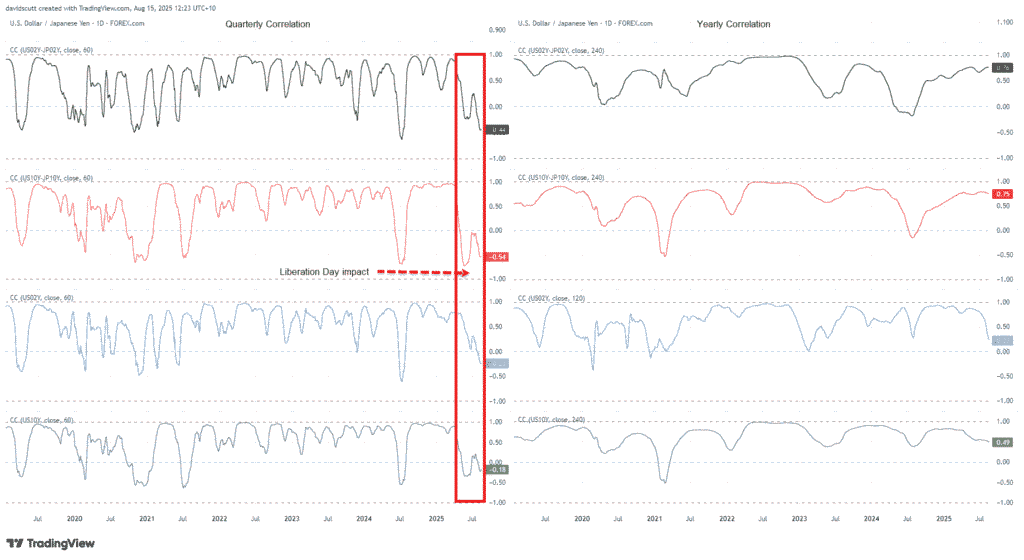

Analyzing this delicate interplay further, it’s evident through comprehensive correlation studies that movements in the USD/JPY exchange rate are often closely synced with shifts in U.S.-Japan yield spreads and U.S. treasury yields, although this relationship can exhibit variability as demonstrated by fluctuations earlier in the year. Despite this complexity, the overarching influence of the U.S. economic landscape on the USD/JPY dynamics is undeniable, underscoring the criticality of upcoming U.S. retail sales and import price data.

These imminent data releases are poised to offer deeper insights into the ramifications of heightened tariffs on upstream price pressures and consumer behavior. Following a recent surge in the service price index, which mirrored detailed findings in broader inflation reports, an unexpected uptick in these metrics could further fuel bullish trends for the USD/JPY as we approach the weekend.

Complicating matters is the looming Trump-Putin summit in Alaska, an event shrouded in uncertainty and potential geopolitical ramifications. However, with limited expectations for substantial progress, its impact on currency hedging activities may remain circumscribed.

In recent times, the USD/JPY pair has exhibited unusual volatility, reflecting the broader uncertainties clouding the U.S. economic forecast. While the labour market shows signs of cooling with a slowdown in employment growth, wage and services inflation remain persistent. This paradoxical situation leaves traders and analysts cautiously watching the Federal Reserve’s next moves, especially with a rate pause anticipated for the first time this year in September.

The prevailing choppy trade pattern in USD/JPY, characterized by narrow trading ranges and an absence of clear momentum indicators, underscores the intricate web of factors influencing currency movements. This complexity necessitates a keen focus on forthcoming economic data, which could break the current trading stalemate and redefine support and resistance levels for the currency pair.

As global economies navigate through these tumultuous waters, the interplay between Japan’s monetary policy decisions and the behemoth of U.S. economic indicators will continue to fascinate and challenge market participants, policymakers, and observers alike. In this intricate dance of economic forces, the resilience of consumer behavior, trade dynamics, and the strategic moves of central banks converge, crafting a narrative rich with both uncertainties and opportunities.