Imagine diving into an opportunity where you could secure investments yielding dividends of 7.5% or more, and what’s more intriguing? These dividends are exempt from tax. This scenario might seem like a rare find in today’s bustling stock market, which has seen significant inflation, reducing the number of income-generating options from companies listed on the S&P 500. The inverse correlation between yields and share prices has made high-yield investments scarce, thereby spotlighting the allure of tax-free dividends, particularly those emanating from municipal bonds.

Municipal bonds, or “munis,” represent debt securities issued by state and local governments to finance public infrastructure projects. Not only do they contribute to the development of communities, but they also offer an attractive yield, often surpassing those of 10-year Treasury notes by 200 basis points. This makes them an enticing prospect for investors seeking robust returns.

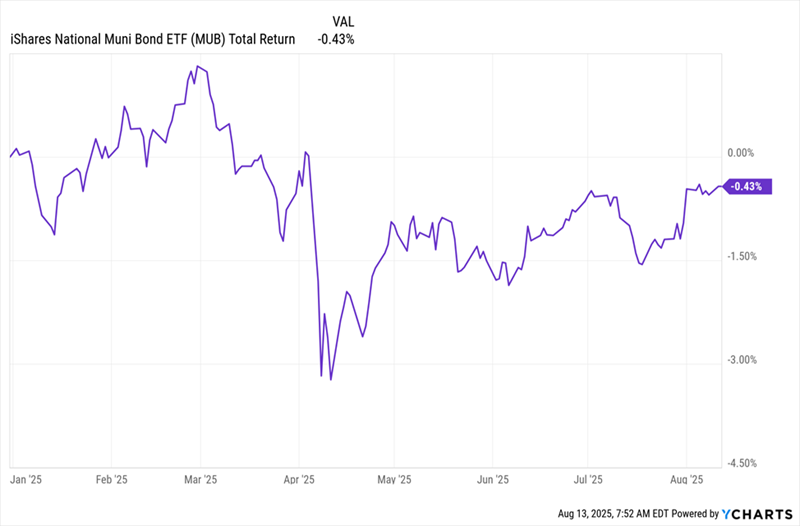

As the markets evolve, municipal bonds have demonstrated commendable performance, albeit with notable periods of undervaluation. For instance, while the S&P 500 has boasted returns of approximately 10% within a specific timeframe, the benchmark Exchange-Traded Fund (ETF) for munis has not emulated this growth, remaining relatively stagnant. This disparity suggests that despite the market’s fluctuations, municipal bonds remain an undervalued asset with potential for revaluation.

The valuation gap between municipal bonds and blue-chip stocks or high-yielding closed-end funds (CEFs) can be attributed to differing investment priorities. While blue chips and CEFs are typically sought after for long-term capital growth, munis appeal to investors requiring immediate cash flow. This need for liquidity, coupled with the challenges retail investors face in accessing individual munis and the modest yield provided by ETFs such as MUB, underscores the advantages of opting for CEFs. These funds not only offer higher dividends but also bring the expertise of human managers who can navigate the issuance of lucrative new bonds, a benefit unavailable to ETF investors.

Focusing on tax considerations amplifies the value proposition of municipal bonds. For instance, a Californian in the highest tax bracket could find a 5% yield from a muni bond effectively offering returns akin to an 8.2% yield from U.S. Treasuries or even 10% from corporate bonds, once adjusted for tax implications. The tax-advantaged status of munis not only suits those in higher tax brackets but also provides a strategic investment option for all, especially during times of market volatility when the demand for safer assets tends to increase.

A practical illustration of the benefits of investing in municipal bonds through CEFs can be observed with funds such as VCV. This particular fund eclipses the yield of MUB significantly with a 7.5% dividend yield, prior to tax advantages, and has outperformed the muni benchmark over the long run. For those seeking broader exposure beyond state-specific options, national funds like RMMZ offer an 8% yield, surpassing both MUB and VCV. Additionally, RMMZ’s trading discount presents a favorable buying opportunity that might not last, as narrowing spreads could lead to price appreciation.

Moreover, RMMZ stands out for its focus on investment-grade securities, distancing itself from the speculative high-yield bonds that characterize many CEFs. This strategic positioning suggests a safer investment route for those seeking to enjoy substantial dividends while awaiting favorable shifts in interest rates to enhance the value of their tax-free municipal bond investments further.

It’s essential to acknowledge the expertise of contrarian income investors like Brett Owens and Michael Foster, who navigate the U.S. markets in search of undervalued stocks and funds, including munis. Their strategies highlight the importance of looking beyond conventional wisdom to uncover investment opportunities capable of delivering secure and substantial returns.

In summary, municipal bonds offer a compelling investment case, particularly through CEFs, for those seeking high, tax-free yields in a market where such opportunities are increasingly rare. The strategic advantages of munis, coupled with the current undervaluation relative to other asset classes, underscore their potential as a key component of a diversified investment portfolio aimed at both capital preservation and income generation.