Understanding the USD/JPY Currency Dynamics: An Overview

In the realm of currency trading, each month tends to carry its unique characteristics, influencing traders’ strategies and market movements. August, for instance, has revealed a straightforward yet effective playbook for those invested in the USD/JPY currency pair: purchasing when the price dips below 147.00 and selling upon rallies that exceed 148.00. This approach’s success hinges significantly on external factors such as announcements from influential figures like Jerome Powell, the Federal Reserve Chairman, or unexpected political developments. Unless these occur, the 147–148 trading range is anticipated to hold firm throughout the week.

### Background on USD/JPY’s August Performance

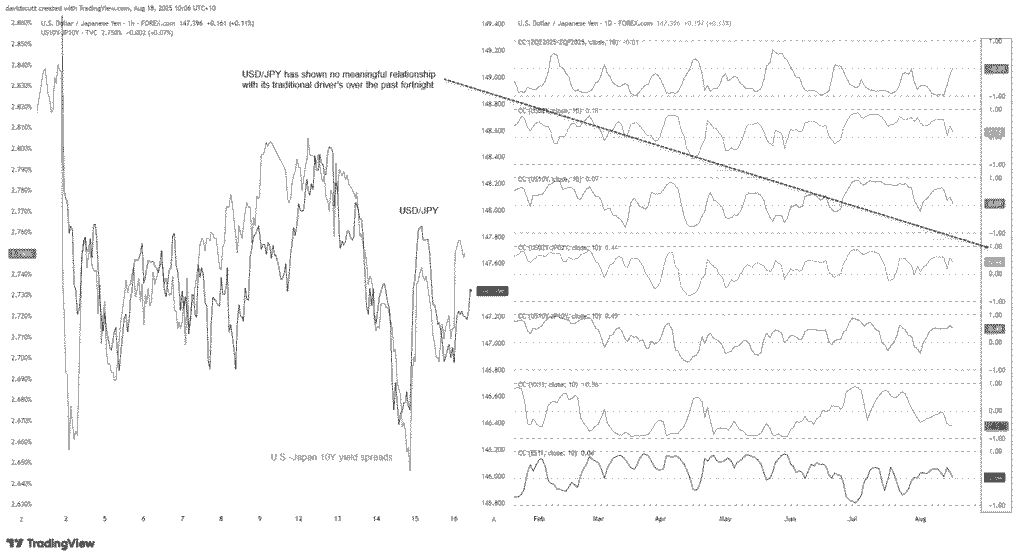

Traditionally, various factors drive the USD/JPY currency pair, including rate differentials, market volatility, and global risk sentiment. However, August has seen a departure from these norms, with the pair exhibiting a decoupling from these conventional influencers. This change is underscored by correlation analyses, which show only a faint link between the currency pair and the U.S.-China yield spread, an anomaly when compared to historical data.

As we navigate through the “dog days” of August, a period typically marked by lethargy and inertia, market participants seem hesitant to make significant moves in the forex and rate markets. This reluctance is partly due to a global economic calendar relatively light on impactful data, especially from key players such as the U.S. and China. While certain releases, like the S&P’s flash global Purchasing Managers’ Index (PMI) and Japan’s trade data, might generate headlines, they are unlikely to substantially influence the USD/JPY’s trajectory.

### The Week Ahead: Key Events and Potentials for Volatility

Looking forward, geopolitical developments might introduce some volatility into the market. An example would be the scheduled meeting between Donald Trump and Ukrainian President Volodymyr Zelenskyy in Washington. Unless this meeting results in a significant geopolitical stir, it is expected to have minimal impact on the currency pair’s movement. The week’s most anticipated event is Powell’s speech at the Jackson Hole economic symposium. Historically, this occasion has delivered mixed outcomes regarding its market impact – sometimes significant, other times negligible, particularly outside periods of financial crisis.

This year, the intrigue surrounding Powell’s address is amplified by ongoing debates over the Federal Reserve’s independence and the widespread expectation of forthcoming interest rate cuts, despite emerging evidence of reaccelerating inflation, especially within the service sector. Moreover, the dovish sentiment prevalent in market pricing is largely influenced by perceptions of a weakening U.S. labor market, as suggested by the disappointing July jobs report.

### Anticipating Powell’s Position

A pivotal question now is how Powell will respond to the prevailing narrative, particularly given the symposium’s focus on “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” There’s speculation that Powell might acknowledge the need for a rate cut in the coming month or alternatively, he could highlight other factors, beyond labor market conditions, to explain the deceleration in payroll growth. His stance on the evolution of the U.S. labor market will be crucial in shaping expectations for U.S. interest rates and, by extension, the direction of the USD/JPY.

### Continuing Market Strategy: The 147-148 Playbook

For traders, the ongoing strategy involves leveraging the currency pair’s bounded fluctuation between 147.00 and 148.00. This tactic is predicated on the absence of a major disruptive event before Powell’s speech. With support levels identified at 146.00 and 144.40 and resistance expected around 149.00 and 151.00, traders will closely monitor momentum indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) for potential shifts in market sentiment. However, the current neutrality of these indicators emphasizes the continued reliance on price action over directional bias.

### Conclusion

In summation, the USD/JPY currency pair presents a unique case study in forex trading, reflecting the complex interplay between economic indicators, geopolitical events, and market psychology. As we await pivotal developments like Powell’s upcoming speech, the intricate dance of the currency markets continues, offering opportunities and risks for the astute trader. Whether August’s playbook will hold or be disrupted remains to be seen, underscoring the dynamic and unpredictable nature of global financial markets.