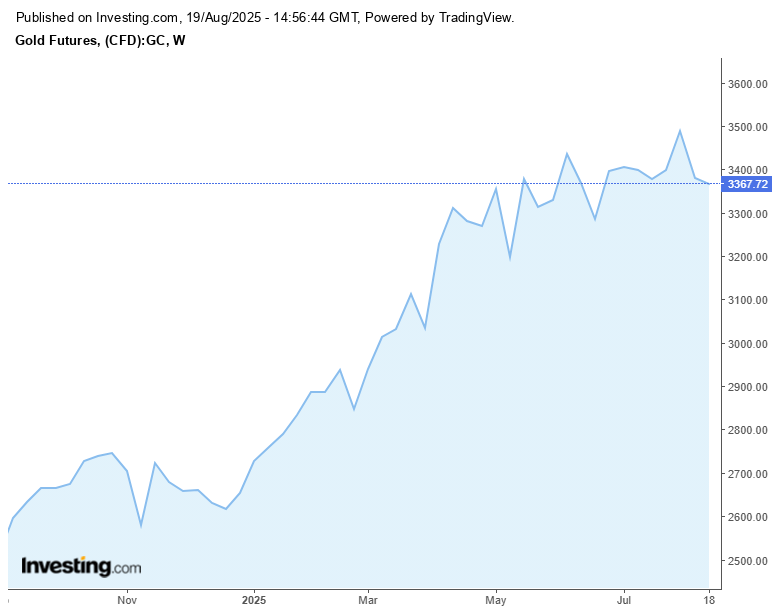

In the unfolding landscape of global finance, gold has taken center stage, arresting the attention of investors and market analysts alike. Its meteoric ascent to over $3,500 per troy ounce by April, marking a notable 25% increase in less than half a year, has sparked conversations and speculation across financial circles. This follows a sustained period of growth, where gold rose from $1,000 to $2,000 over the span of 12 years, concluding in 2020, before surging to $3,000 in the subsequent five years. By August, the price had stabilized near this zenith, signifying a pivotal moment for investment strategies and an impetus to dissect the underpinnings of this remarkable trend.

For potential investors, the avenues for engaging with this precious metal are manifold. Among these, physical gold, including bullion, stands out as a tangible asset that resonates with those seeking a more solid investment, especially in an era marred by economic upheavals. Though, it warrants mentioning, the upkeep of its physical condition is vital to preserving its intrinsic value. On the other hand, gold exchange-traded funds (ETFs) present a liquid alternative, drawing a staggering $21.1 billion in new investments during the first quarter of 2025 alone — marking the most significant influx seen since the early months of 2022. Meanwhile, shares in gold mining companies offer another entry point, albeit their inherent volatility demands a discerning eye, making them a less favorable choice for the unseasoned investor. Each of these investment vehicles caters to varying degrees of risk tolerance, with ETFs striking a balance between convenience and market exposure.

Several critical factors contribute to gold’s towering valuation in the current financial zeitgeist. Notably, central banks across the globe have ramped up their gold purchases, with 43% indicating plans to increase their reserves, and a further 73% anticipating a decrease in their dollar holdings. This pivot underscores gold’s enduring allure as a bulwark against economic instability.

The weakening of the U.S. dollar, which has seen an 8% devaluation since January 2025, in spite of Treasury yields hovering between 4.5-5%, reflects dwindling confidence in the American economic stronghold, exacerbated by recent political unease, trade contentions, and escalating budget deficits. This trend is further bolstered by banking sectors in the Middle East and India aligning with European attitudes, thereby amplifying demand. Moreover, hints by the Federal Reserve at impending rate cuts — traditionally a boon for non-yielding assets like gold — have further augmented its appeal.

Looking forward, projections suggest that gold may find a stable footing between $3,300 and $3,500, though some investment banks posit a potential ascent to $3,600 or even a staggering $4,000. This optimism is echoed in a recent HSBC survey, which revealed affluent investors have increased their gold allocations to 11% in 2025, a significant leap from 5%. The undercurrents of global uncertainty, including the specter of a U.S. recession and continued central bank purchasing habits, hint at a sustained underpinning for gold’s value. Market sentiment, especially anticipation of rate reductions, plays a crucial role, with the potential to propel prices even higher if these predictions materialize.

However, this optimism is not without its caveats. The volatile nature of economic conditions poses a risk of eroding gains should the landscape improve unexpectedly. Regulatory changes or shifts in central bank policies could disrupt demand dynamics, while the emergence of alternative safe havens, such as silver or cryptocurrencies, threatens to siphon interest away from gold. These considerations are imperative, as gold’s trajectory is intimately tied to broader macroeconomic trends and shifts in monetary policy.

The gold market’s resurgence is emblematic of deeper economic shifts and an investor’s quest for stability in tumultuous times. Its story is a tapestry of historical resilience, nuanced investment strategies, and a barometer for global economic health. As we stand on the cusp of potential shifts in market dynamics, gold remains a fascinating subject of study and interest for investors, analysts, and economic observers alike, offering a unique lens through which to view the unfolding narrative of global finance.