In the dynamic world of foreign exchange, the USD/JPY currency pair found itself hovering around the 147.50 mark on Wednesday, persevering through a session marked by a decline despite Japan’s concerning trade statistics. This event occurs in the shadow of economic indicators revealing a challenging panorama for Japan’s foreign trade, with exports experiencing a significant drop of 2.6% year-on-year in July. This downturn is noted as the sharpest in over four years, a direct repercussion of the tariffs imposed by the United States. On the flip side of the trade ledger, imports also retreated, down by 7.5%, marking the fourth contraction since the year’s dawn. Despite these dire figures, the outcomes were somewhat of a silver lining, having surpassed the bleak forecasts which anticipated a more severe 10.4% decline.

In a contrasting vein, a gleam of resilience shone through June’s order equipment statistics—an essential barometer for capital investment—which unexpectedly surged following a two-month period of shrinkage. This uptick signals a possible steadfastness in corporate spending amid turbulent trade ties with the United States.

The backdrop of these developments is framed by widespread speculation regarding the Bank of Japan’s imminent monetary policy decisions. Governor Kazuo Ueda treads a line of caution, underscoring that the inflation rate loiters beneath the 2.0% benchmark goal, a situation complicating the central bank’s future moves.

Adding another layer to the economic tapestry, the yen has witnessed a surge in demand, albeit temporarily, as a safe-haven asset amidst global uncertainties, subsequently buoying its value.

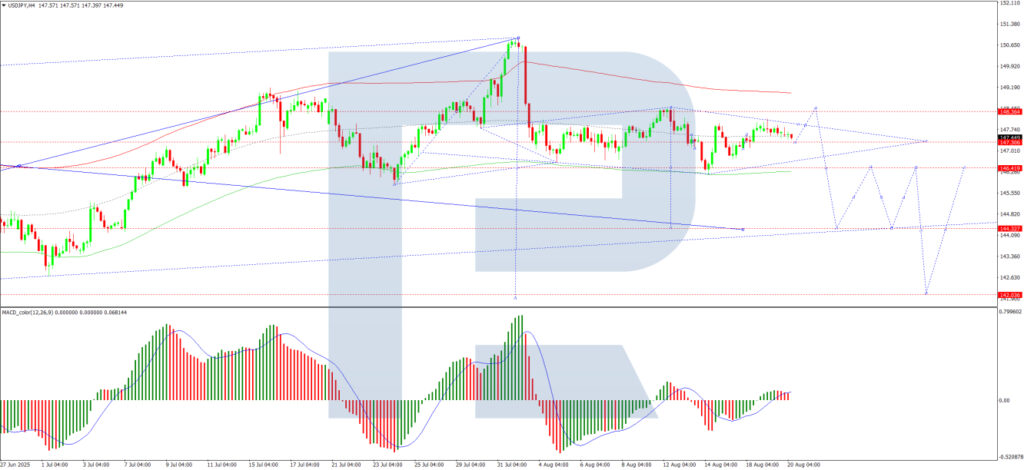

Shifting focus to the analytical dimension, the technical analysis of USD/JPY paints a picture of a currency pair caught in a downward trajectory. The H4 chart anticipates a descent towards the 146.14 level, with a potential for a brief rebound to 147.30. Yet, the overarching sentiment tilts towards a further dip to 145.45, possibly extending the bearish wave to 144.30. This trend garners support from the MACD indicator, whose signal line occupies a position below zero—tilted downards—signifying a continuation of the downward momentum.

In a more granular view on the H1 chart, the USD/JPY assembles a downward wave pattern aiming for 146.12. The day’s outlook considers a short-lived upward nudge to 147.12, with room for an upward linkage to 147.60. However, following this temporary ascension, the pathway is projected to lead downwards, first to 146.60, before delving deeper to 146.12, enunciating a bearish trend. The Stochastic oscillator corroborates this narrative, with its signal line swaying below the 50 mark, sharply angled towards 20, reflecting a robust bearish inclination.

Summarily, despite the underwhelming trade statistics, the USD/JPY pairing’s decline is cushioned by optimistic investment data and escalating demand for the yen as a bastion of safety. Technical indicators forecast a sustained downward trend, targeting key levels at 146.14, 145.45, and 144.30, with interim rebounds anticipated to be ephemeral in nature.

This article offers an analysis entrenched in the author’s perspectives and should not be construed as direct trading counsel. RoboForex disclaims any responsibility for trading outcomes derived from recommendations and reviews contained within this analysis.