The prestigious Economic Symposium, convened annually by the Federal Reserve Bank of Kansas City, is slated for its forthcoming assembly from Thursday to Saturday, taking place amidst the natural splendour of Jackson Lake Lodge, located within the vast expanses of Grand Teton National Park in Wyoming.

At the core of this summit, the spotlight invariably falls on the Federal Reserve Chair Jerome Powell, whose address is eagerly anticipated. Scheduled for Friday at 10:00 AM ET, Powell’s oration this year is branded under the theme “Economic Outlook and Framework Review”. Given the mounting speculation around the Federal Reserve’s policy trajectory, Powell’s terms, which are set to conclude in May 2026, imbue this discussion with heightened significance. This context makes his forthcoming discourse at Jackson Hole possibly his last, magnifying its implications for financial markets, policymakers, and analysts who are keenly seeking guidance on the U.S. central bank’s forthcoming strategies.

Powell’s orations at Jackson Hole have traditionally served as critical junctures for unveiling Federal Reserve policy directions. The year 2022 witnessed a decidedly hawkish stance from him, underscoring a commitment to combat inflation without reservation. The subsequent year, 2023, Powell reiterated the necessity for a restrictive policy framework whilst acknowledging strides made in curbing inflationary pressures. By 2024, his rhetoric evolved to signal the initiation of rate reductions, famously asserting, “The time has come for policy to adjust,” a precursor to a significant 50 basis-point cut actioned in September.

In the current financial climate, with stock markets flirting with unprecedented heights and investors largely forecasting the Federal Open Market Committee (FOMC) to embrace at least two quarter percentage point rate cuts within the year, the resonance and tone of Powell’s discourse could potentially catalyze significant fluctuations across diverse asset categories.

The anticipation builds around Powell’s capacity to navigate the delicate balance between maintaining a ‘balanced’ outlook versus veering towards a more hawkish stance. Bank of America posits that Powell might adopt a stance that is more nuanced than market anticipations currently suggest, potentially challenging the burgeoning consensus around a rate cut in September. The symposium’s chosen theme this year, “Labor Markets in Transition,” hints at Powell focusing on the complexities surrounding job market fluctuations and labor supply concerns, factors that continue to obscure the economic landscape.

The Bank of America characterizes the Jackson Hole Symposium as akin to a “mini FOMC meeting,” a critical intermediary touchpoint for markets in the extended interlude up to the next Federal Gathering in September.

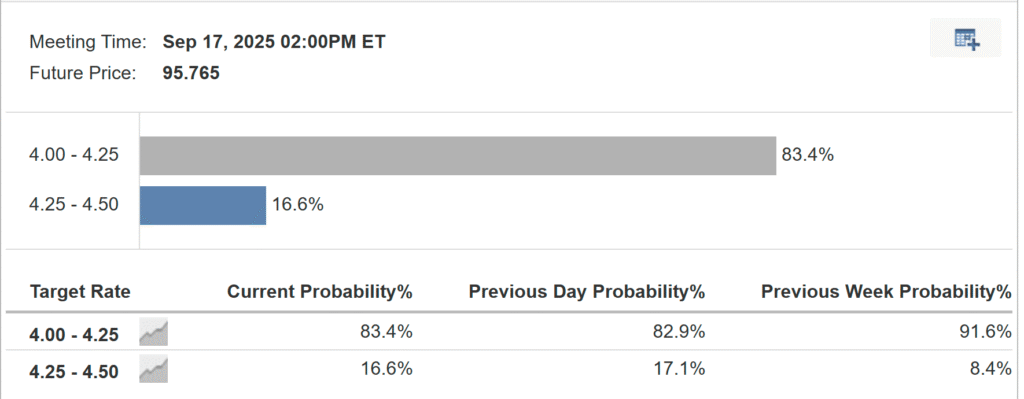

As market participants keenly await Powell’s articulation, expectations around the likelihood of a 25 basis point reduction in rates by the forthcoming month have soared, evidenced by an 83% probability metric as of Wednesday morning.

The current economic environment further complicates the Federal Reserve’s policymaking calculus. Recent inflation metrics exceeding the Fed’s 2% benchmark have stirred stagflation anxieties, compounded by the introduction of new tariffs under President Trump’s administration, thereby muddying the waters of policy direction.

In addressing these crisscrossing economic signals, Powell stands at a crucial juncture. The key question revolves around whether persistent inflationary pressures, counterbalanced by emerging signs of a ‘cooling’ labor market (as characterized by Minneapolis Fed’s Neal Kashkari), would necessitate an easing of policy stances.

Amidst this backdrop, while equity markets are buoyed to historical peaks, there’s a cautionary tone from Deutsche Bank, suggesting that risk assets might not be fully priced for potential shifts. Investor sentiment, as per the American Association of Individual Investors, suggests a reticent outlook, which paradoxically, might lean in favor of an uplift if Powell’s commentary sways less dovish than anticipated.

As we edge closer to Powell’s address, the financial community stands on tenterhooks, poised for signals that might delineate the Federal Reserve’s policy framework in the upcoming period. The nuances of Powell’s dialogue – acknowledging labor market vulnerabilities, maintaining a firm line against inflation, and avoiding definitive commitments for September – will critically shape market dynamics across stocks, bonds, and currency trade.

Investors are thus advised to brace for potential market volatility, attuning to Powell’s tone and choice of phrases for insights into the Federal Reserve’s prospective path.

For individuals looking to navigate these complex financial landscapes, InvestingPro offers an array of tools designed to empower investors with informed decision-making capabilities. This suite includes AI-managed stock market strategies, a decade’s worth of historical data across numerous global stocks, insights into investor and hedge fund positions, among other resources, all aimed at providing a leg-up in market performance.

As the economic symposium at Jackson Hole draws near, the investment community watches with bated breath, ready to dissect and interpret Jerome Powell’s words, which could very well chart the course of economic policy and market sentiment in the months to follow.