At the dawn of 2025, the financial landscapes of the world have continued to evolve, reflecting not only the cyclical nature of economics but also the influences of geopolitical shifts and critical policy changes across the globe. Among the noteworthy developments, the currency exchanges have proven to be a microcosm of the broader economic currents, with the euro to Canadian dollar exchange rate (EUR/CAD) capturing significant attention for its notable performance early in the year.

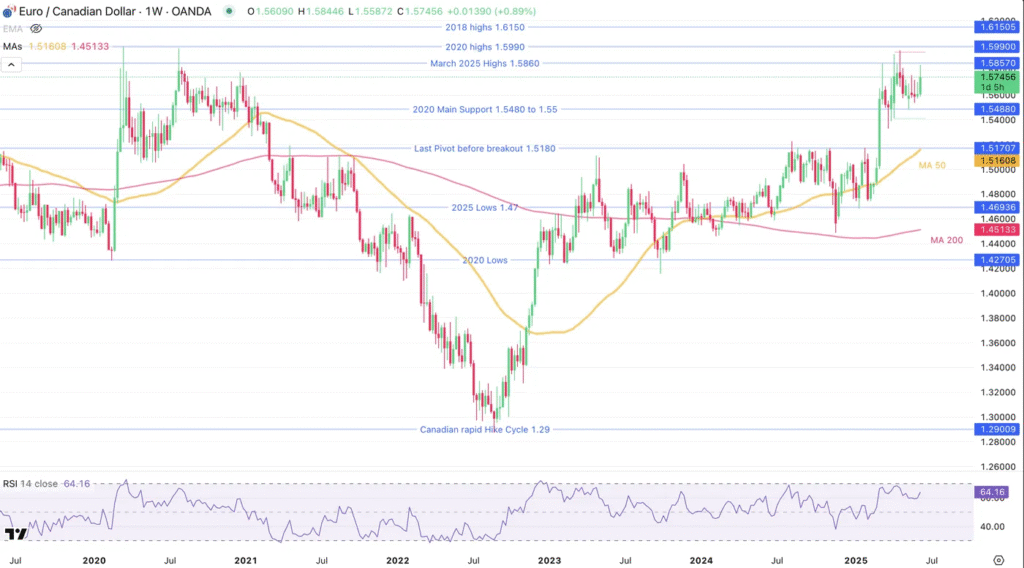

For the past four years, the EUR/CAD pair has navigated within the bounds of 1.40 to 1.50, a range that has witnessed its fair share of fluctuations reflecting the ongoing economic discourses between Europe and Canada. However, 2025 started with a remarkable breakout, as the pair tested its year-beginning highs, climbing beyond the familiar territory. This ascent was largely fueled by a concerted effort among European nations, who, in a harmonious pledge, have committed to elevating investments within the European Union, especially emphasizing infrastructure and military sectors. This strategic move is poised to strengthen the European economy and, by extension, the euro itself.

Echoing Europe’s move towards enhanced military expenditure, Mark Carney, in a notable announcement, declared Canada’s intention to augment its military spending to 2% of the country’s Gross Domestic Product (GDP). This significant leap is expected to bolster the Canadian dollar’s position on the global stage. However, the exact extent of this impact remains a point of keen speculation among market analysts and economists alike.

Meanwhile, on the geopolitical front, the negotiations concerning trade agreements between the United States and Canada are unfolding. These discussions are particularly crucial as they could have lasting implications on trade dynamics and, consequently, on currency valuations. Investors and market watchers are eagerly anticipating further developments, which could sway market sentiments to a considerable degree.

The Canadian dollar’s trajectory has not been entirely autonomous in recent weeks, showing a tendency to shadow the euro’s performance closely. This phenomenon underscores a broader market sensitivity to shifts in the geopolitical and economic landscapes, affecting not just the EUR/CAD pair but also other currencies in the Asian-Pacific region. These currencies have exhibited a synchronized movement, reflecting a collective response to the overarching global economic climate.

Turning our attention to the monetary policy domain, both the European Central Bank (ECB) and the Bank of Canada stand at a monetary policy crossroads. With current deposit rates pegged at 2% and 2.75% respectively, the stage is set for what might be the culmination of their rate-cutting cycles. Markets are rife with speculation, pricing in the possibility of one last rate cut from each institution by the closure of 2025. This anticipatory stance is emblematic of the broader market’s attempt to hedge against potential downturns in economic activities.

This juncture offers a rich tapestry for currency analysis, especially for the EUR/CAD pair. A dive into its weekly and intra-day timeframes reveals patterns and breakpoints crucial for understanding its near-term trajectory. Historically, following recovery from its 2022 lows, the pair exhibited consolidation within its four-year range before this year’s breakout. Analyses of overbought conditions and the Euro’s momentum provide a nuanced view of potential future movements. Key levels are under surveillance, indicating the areas where the currency pair’s journey might pivot.

Further, daily and 4-hour charts reveal the intricacies of its recent performance, highlighting attempts at breaking past established bounds, and hinting at underlying market sentiment. The interplay of moving averages, resistance points, and potential pattern formations offers traders and investors a roadmap for navigating the complexities of currency exchanges in these turbulent times.

As the financial world watches and waits, the EUR/CAD pair serves as a compelling narrative of economic resilience, policy impact, and the ever-present undercurrents of geopolitical developments. Safe trading indeed requires a discerning eye on these unfolding events and an understanding of their far-reaching implications for not just traders, but for the global economy as a whole. In essence, the story of the EUR/CAD exchange rate is a microcosm of the broader economic discourse, reflecting the intertwined fates of nations in an increasingly interconnected world.