The ongoing conflict between Israel and Iran has persisted into its fourth day, with both nations continuing their exchange of attacks on Monday. This prolonged engagement has raised fears of ushering in a sustained period of instability, not only in the region itself but also within the global economic landscape, which is already grappling with the repercussions of increased tariff risks.

At the heart of the economic concerns tied to the conflict between Israel and Iran is the potential for a significant surge in energy prices. Should this situation persist, it could result in heightened global inflation, affecting economies worldwide. Richard Bronze, who is the head of geopolitical analysis at the research firm Energy Aspects, pointed out that while Iran’s actions have primarily targeted Israel, there is growing apprehension regarding the broader Middle East’s energy infrastructure. Of particular concern is the Strait of Hormuz, a critical passage through which approximately one-third of the world’s seaborne oil and gas exports are shipped. Despite the tension, shipments through this narrow passage have so far remained uninterrupted.

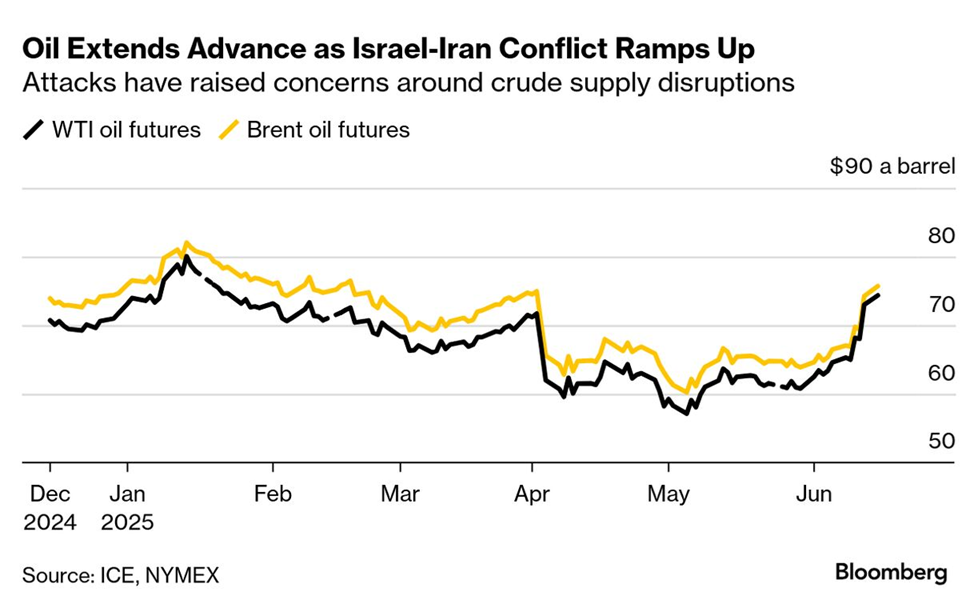

However, the atmosphere remains tense, with discussions within the Iranian parliament’s security commission about possibly closing the Strait of Hormuz being reported. This development has added another layer of uncertainty, contributing to an increase in oil prices since the outbreak of hostilities on Friday. Nonetheless, prices have, up to this point, stayed within the range that has been prevalent since the start of the year.

Analysts and market observers are closely monitoring the situation, with some optimism still lingering for a containment of the conflict and a swift resolution. Luis Costa, the global head of EM sovereign credit at Citigroup Global Markets, suggests that the market is considering all possible scenarios, including those with very adverse outcomes, but also holds hope for a quick and decisive resolution that could bring Iran to the negotiation table. Similarly, analysts from DBS in Singapore have noted that while Middle Eastern conflicts in the past have led to oil shocks, the market currently seems inclined towards less drastic outcomes with the present Israel-Iran conflict.

The main concern stems from the risk of a sustained increase in energy prices leading to higher inflation at a time when the global economy is already dealing with the inflationary pressures from tariffs. Although US consumer inflation has remained relatively modest, the full impact of these developments may take time to manifest completely.

Moreover, the ongoing conflict adds another layer of complexity to the economic outlook, potentially affecting consumer confidence, broader economic health, and the Federal Reserve’s policy decisions. While the Federal Reserve is expected to maintain its target rate in the upcoming policy announcement, there is keen interest in any comments from Fed Chairman Powell and any new economic forecasts that may be released.

Market reactions have so far been mixed, with some volatility observed as investors seek safe-haven assets. This week will be crucial in testing market risk appetite, with a particular focus on whether the US involvement in the conflict escalates, which could significantly adjust risk calculations.

As President Trump indicated over the weekend, the US is not currently involved in the conflict but has not ruled out the possibility of becoming engaged in the future. This uncertain stance only adds to the complex risk landscape that investors must navigate.

History suggests that markets tend to display initial volatile reactions to geopolitical events, but these often stabilize over time. As Jack Janasiewicz, a portfolio manager at Natixis Investment Managers in Boston, notes, the long-term effects of such geopolitical tensions tend to diminish, encouraging a longer-term perspective beyond the immediate market reactions.

In summary, the conflict between Israel and Iran presents a complex and potentially destabilizing situation, with implications for global energy markets, inflation rates, and broader economic stability. The days ahead will be critical in determining the direction of these developments and their long-term impact on the global economy.