In recent times, the financial markets have undergone a series of fluctuations, with technology stocks at the forefront of volatility and innovation. Within this dynamic landscape, an emerging sector that has captured the imagination of investors worldwide is quantum computing. This niche area of technology, characterized by its potential to revolutionize computing speeds and capabilities, experienced a notable surge in investor interest following remarks by a leading figure in the tech industry.

The spark for this heightened excitement came from comments made by Jensen Huang, the CEO of NVIDIA Corporation, a company that has been pioneering the artificial intelligence revolution. During a speech at NVIDIA’s GTC conference held in Paris, Huang suggested that quantum computing technologies were on the cusp of reaching a critical ‘inflection point.’ This statement resonated deeply within the investment community, leading to significant gains in quantum computing stocks. Notably, Quantum Computing Inc saw its stock price increase by over 25% in a single day, while Rigetti Computing Inc experienced an 11.39% uptick.

Jensen Huang’s influence in the technology sector cannot be understated. As the head of a company that has been a key driver of the AI revolution, his perspectives on emerging technologies carry substantial weight. In the past, his views have had a direct impact on market valuations, particularly for companies involved in quantum computing and autonomous vehicles. This recent affirmative stance on the progress of quantum computing represents a remarkable shift from his earlier, more cautious outlook, where he posited that the technology might take over two decades to fully mature. However, breakthroughs in the field have evidently led Huang to revise his perspective, much to the delight of investors.

The allure of quantum computing lies in its promise to dramatically outpace traditional computing methods, offering speeds and efficiencies that could transform various sectors, including medicine, logistics, and national security. This potential has led many investors to view it as the next frontier following the artificial intelligence revolution. Moreover, the synergy between AI and quantum computing suggests a mutually beneficial relationship, where advancements in one field could propel progress in the other, accelerating our journey towards achieving Artificial General Intelligence (AGI).

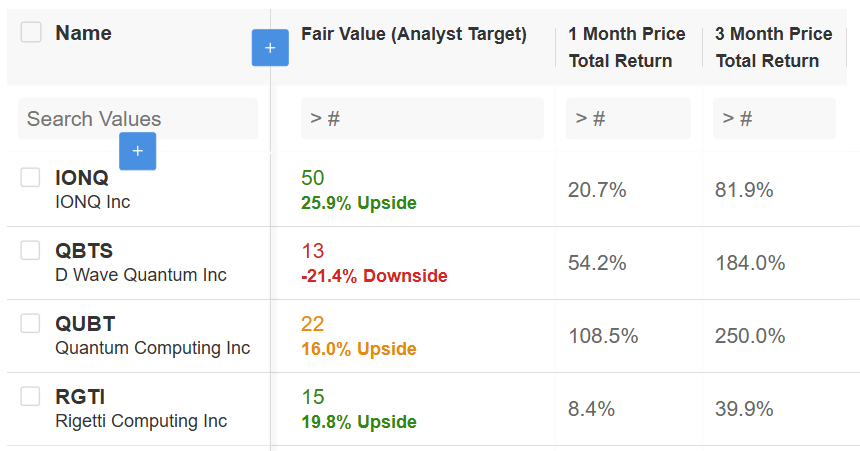

Despite the sector’s significant promise and recent performance—an astonishing 250% gain in Quantum Computing stock over the past three months and equally impressive rises in the valuations of other companies such as IONQ Inc and D-Wave Quantum Inc—investing in quantum computing remains a high-risk endeavor. The technology is still in its developmental stages, and while the recent rally has been extraordinary, there’s an inherent volatility that cannot be ignored.

Given these factors, investors interested in the quantum computing sector should exercise caution, balancing their portfolio to mitigate risk while still gaining exposure to this transformative technology. Tools such as the Defiance Quantum ETF provide an avenue for diversified investment, including stakes in key players in the quantum computing space alongside other tech giants working on or investing in quantum applications.

For those seeking guidance on navigating the risks and opportunities in technology investments, resources like the Tech Titans strategy offer curated selections of stocks with potential for growth. This type of resource can be invaluable in the current market climate, characterized by its volatility and rapid technological advancements.

In conclusion, while the future of quantum computing holds exciting possibilities, the path is fraught with uncertainties. The recent surge in stock prices following Jensen Huang’s comments underscores the market’s sensitivity to developments in this field. Investors keen on being part of this tech revolution must weigh the potential rewards against the risks, adopting a balanced approach to their investment strategy. As always, staying informed and leveraging expert insights can provide a keener edge in the evolving landscape of technology investments.