Amid turbulent times for the global economy, certain assets have stood out for their resilience, catching the eye of investors looking for stability. In the realm of precious metals, an asset class traditionally viewed as a safe haven during periods of uncertainty, silver has notably outshined expectations on numerous occasions, even when other assets seem to falter. This prompts the question: has silver become the new bulwark for those investing in the metals market?

The intrigue surrounding silver does not diminish the curiosity about other so-called “white metals,” such as platinum and palladium. These metals, while significant, often take a back seat to the more widely discussed gold and silver markets. To delve deeper into these questions, a closer examination of the long-term trends and comparisons between silver and gold is warranted.

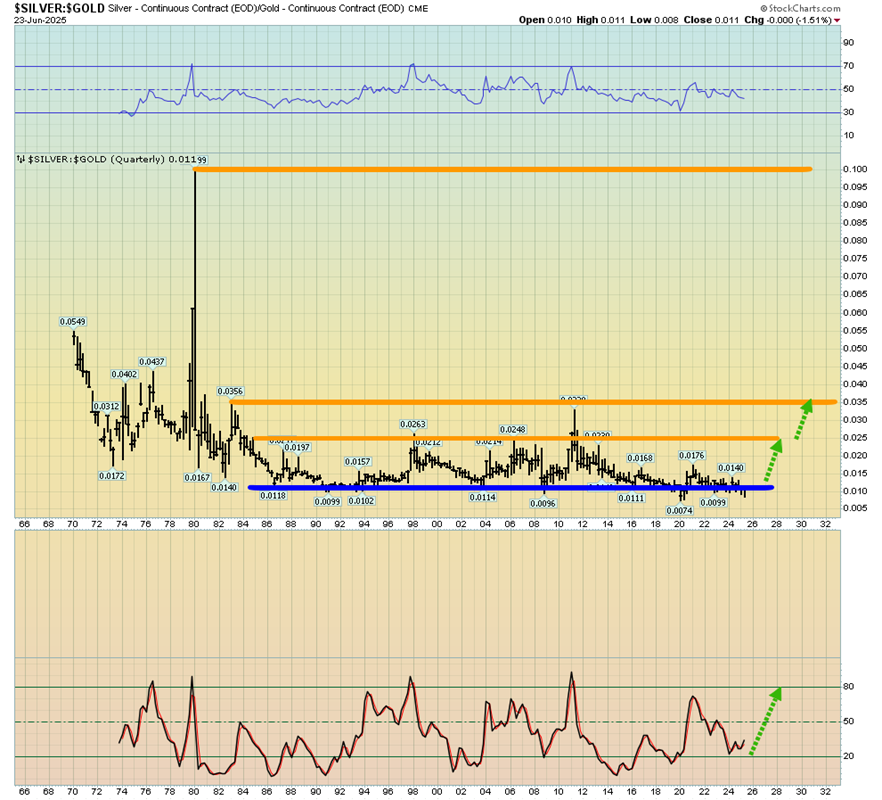

For many years, gold has been the quintessential safe haven, its value enduring through countless economic upheavals. However, the notion of a safe haven is complex and multifaceted. It is not the mere undervaluation of an asset that cements its status as a refuge during turbulent times. With that in mind, recent trends suggest that while silver could maintain its value or even appreciate in the upcoming months, gold may experience continued volatility. This intriguing dynamic hints at a potentially brighter future for silver, suggesting that both metals could see an uptick against fiat currencies as we move into autumn, with silver potentially outpacing gold.

This does not necessarily imply that silver is displacing gold as the go-to safe haven. Rather, it is carving out its niche as an exciting avenue for dynamic performance within the investing landscape. Investors and market analysts alike are keeping a watchful eye on this trend, pondering the tactical approaches to navigating these waters. Silver, with its potential to rally or dip, presents a unique opportunity, especially if it reaches the much-anticipated $35-$34 buying zone, which could represent an irresistible value proposition.

Moreover, the silver stock market deserves special attention, as it showcases signs of divergence from previous patterns. Whereas past rallies in silver stocks were marked by volatility reflective of a bearish sentiment, the current trend is more stable and sustained. Despite the high valuation levels indicated by oscillators, the absence of rampant speculation suggests a market grounded in solid fundamentals, rather than speculative frenzy. This has led to a focus on carefully selected silver stocks, particularly junior mining firms that present compelling value, as highlighted in specialized investment newsletters.

Turning our attention to platinum, the metal has experienced a “super surge” in recent months, as evidenced by the performance of physical platinum Exchange Traded Funds (ETFs). This surge is not merely a fleeting moment but a powerful rally from a decade-long technical foundation, suggesting a significant market realignment.

Palladium, albeit on a smaller scale than platinum, also reveals positive technical indicators, with expectations of substantial price appreciation. This robust outlook for palladium further enriches the landscape of white metal investments.

In the age of digital finance, high-quality FOREX platforms have democratized access to the trading of white metals and oil, offering narrow spreads and remarkable liquidity. However, a prudent approach would suggest focusing on ETFs and physical holdings for serious investment, leaving speculative trades to more discretionary capital.

The oil sector has also experienced monumental shifts, influenced by geopolitical events and policy changes that have dramatically impacted supply and pricing dynamics. With oil prices hovering around a delicate threshold, strategic investment opportunities emerge for those keen on exploring this volatile yet potentially rewarding market.

In a broader sense, the discussion inevitably circles back to gold, the epitome of monetary value across millennia. Despite recent technical patterns that might temper short-term enthusiasm, gold remains a central pillar of investment strategies, with specific price zones flagged for strategic buying.

The interplay between these diverse yet interconnected markets – silver, other white metals, and even oil – paints a complex picture of the current investment landscape. As we navigate through the fluctuating terrains of global finance, the evolving roles of these assets highlight a broader narrative of adaptation, strategic foresight, and the perpetual quest for stability amidst uncertainty.

In summary, the dynamics within the metals market, particularly the emergent prominence of silver, underscore a pivotal shift in investment paradigms. As investors grapple with the challenges of a rapidly changing economic environment, the allure of silver, alongside gold, platinum, palladium, and even oil, reaffirms the timeless quest for assets that offer both security and growth potential. In this intricate dance of value and perception, the metals market continues to offer intriguing opportunities for those willing to delve beyond the surface.