The narrative surrounding the United States’ financial strategy has taken a dramatic turn from optimism to concern, particularly within the bond market. Lenders are growing increasingly apprehensive about extending further credit to a nation with a debt surpassing $36 trillion, which continues to deepen with each passing fiscal year. The situation is a complex one, and this article aims to dissect its nuances, offering a comprehensive view for both seasoned followers and newcomers to this evolving story.

Before the introduction of the so-called “One Big Beautiful Bill Act” (OBBBA), the Congressional Budget Office (CBO), known for its optimistic financial forecasting, had already anticipated a federal deficit of $1.9 trillion by the year 2025. The passing of the OBBBA in the House has now led the CBO to revise its projections, estimating an increase of $3.8 trillion to the national debt over the next decade. This adjustment hints at the US staring down a $40 trillion fiscal abyss, with an annual deepening rate of roughly $2 trillion.

The bond market reacted to these projections with trepidation. Recent occurrences, such as the struggle the US faced in auctioning off $16 billion worth of bonds, underscored the market’s dwindling confidence. The lukewarm demand at these auctions bolsters the perception that with such fiscal imprudence, why would investors continue to buy U.S. Treasuries?

Mainstream analyses have quickly branded this situation as the United States entering the terminal phase of a “doom loop” for debtors, where soaring interest rates emerge as bond investors seek higher returns to mitigate the increasing credit risk associated with the nation’s deteriorating financial situation. This cycle of rising rates exacerbating debt, in turn inflaming demand for even higher rates, suggests a bleak outlook for bonds.

However, adopting a concept from billionaire investor Howard Marks, this interpretation merely scratches the surface. It fails to consider undercurrents shaping the bond market, crucial for a more layered understanding. In the real financial landscape, strategies such as the “Quiet Quantitative Easing” (QE) introduced under former Treasury Secretary Janet Yellen, play a pivotal role. Yellen initiated a shift towards issuing more short-term debt as opposed to long-dated Treasuries, effectively tightening the supply of the latter. This led to higher prices and lower yields for long-term bonds, given the unchanged demand.

By the end of 2019, short-term bills constituted a mere 15% of marketable U.S. debt. Yellen aimed to finance 75% of the deficit via short-end issuance by 2024. This strategy, as highlighted by economist Nouriel Roubini, was an intricately executed maneuver to subtly control long-term interest rates. Without such active Treasury issuance tactics, long-term yields would likely be 30 to 50 basis points higher, demonstrating the profound impact of these policies on market conditions.

Such measures have continued under current Treasury Secretary Scott Bessent, who despite criticism, has maintained a heavy reliance on short-term debt issuance. This reliance is strategically significant, especially as the Federal Reserve, under the leadership of Jay Powell, approaches a shift with President Trump’s term nearing its end and potential replacements being discussed. The anticipated change in Fed leadership could further influence short-term rates, bolstering the Treasury’s strategy of managing financing costs.

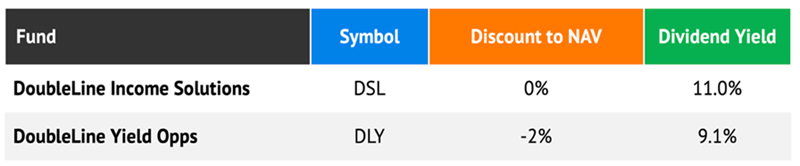

The nuanced dance between the Treasury and the Federal Reserve illustrates a sophisticated understanding of fiscal and monetary policy’s interplay. Critics who decry the doom loop often overlook these subtleties, missing opportunities for income in the bond market. DoubleLine bond funds, for example, have emerged attractive in this environment, supported by a controlled ceiling on long-term yields and a strengthening economy that belies fears of recession.

Amidst pronouncements of the bond market’s demise, a deeper investigation reveals a crafted strategy leveraging fiscal policy tools to navigate the challenges of national debt. While these measures do not erase the gravity of America’s financial obligations, they showcase the creativity and ingenuity at play within the U.S. Treasury and the Federal Reserve.

For investors, especially those with a contrarian outlook, understanding these dynamics opens avenues for strategic investment in an otherwise apprehensive market. As we continue to monitor these developments, it’s clear that the narrative surrounding the U.S. fiscal policy is far more complex and manageable than the mainstream gloom suggests.