In recent times, the global bond markets have been experiencing considerable tumult, with yields edging closely to the 5.10% region. This trend is not confined to a single country; it’s manifesting across various nations including Japan, where 30-year bond yields have exceeded the 3% threshold. Such a phenomenon indicates a heightened level of activity and concern within the bond markets worldwide.

The core issue at hand doesn’t solely revolve around the United States; it encapsulates a broader spectrum involving multiple countries that are following a similar economic trajectory as the U.S. These countries are navigating through a particularly unwelcoming policy mix that is becoming increasingly distasteful to the longer-end of the bond markets. This mix includes several key elements:

- A persistent core inflation rate that overshoots the target set by economic policymakers.

- Central banks across these nations are adopting a dovish outlook. This is characterized by their communication strategies that suggest a stance of keeping forward rates below what would be considered a neutral level.

- Simultaneously, governments are loosening their fiscal restraint, hence widening fiscal deficits.

Adding to the complexity of the situation is the emerging demand/supply imbalance in the bond markets. As fiscal deficits broaden, the availability of bonds in the market expands. Consequently, the marginal buyers of these bonds are now demanding higher yields as compensation. They are doing so due to the increased risks associated with the long-term bonds, especially given the uncertain economic cocktail described above.

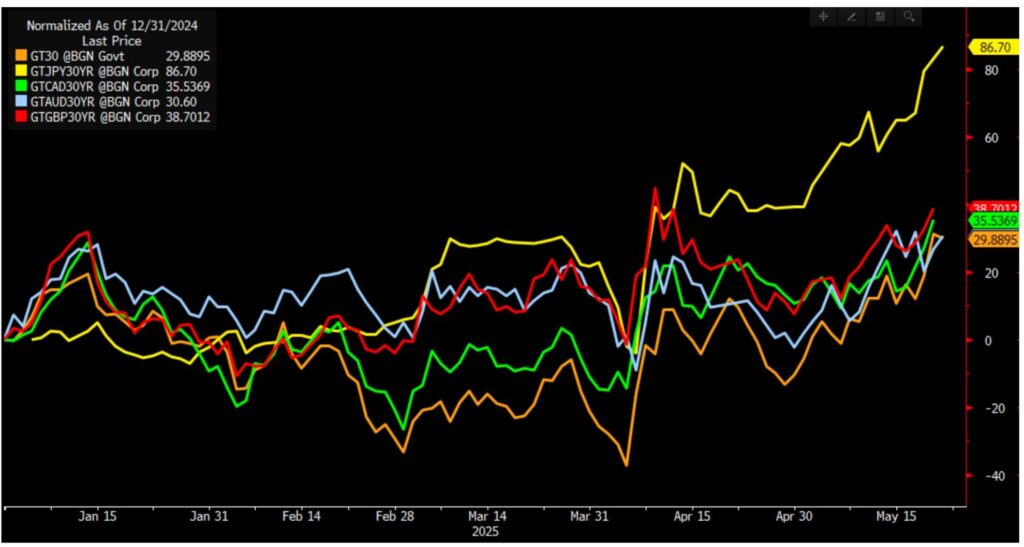

An illustrative chart demonstrating the year-to-date (YTD) increase in 30-year yields, expressed in basis points (bps), vividly portrays this trend for a select grouping of countries embodying the aforementioned policies. Among these countries are the United States, Japan, Canada, Australia, and the United Kingdom — each embarking on a trajectory of looser fiscal policy amid core inflation rates exceeding targets while their respective central banks continue to exhibit a proactive dovish stance.

One may wonder whether this trend in the bond market—a sort of revolt against the prevailing policy directions from governments and central banks—will persist. Will the mounting pressures from the bond markets compel a policy recalibration aimed at stabilizing these volatile dynamics?

As we delve deeper into understanding the intricacies of these developments, it’s pertinent to consider the backstory and the broader implications. The mechanics of the bond market are a reflection of the interplay between government policies, inflation expectations, and the perceptions and reactions of investors. Central banks, in aiming to stimulate economies during times of lower than desired inflation and slow growth, may adopt policies that keep interest rates low. However, when inflation begins to overshoot targets in a sustained manner, it raises the spectre of these institutions being behind the curve in adjusting policies to temper inflation.

The policies of fiscal expansion—increasing government spending beyond the immediate revenues—while intending to stimulate economic growth, also contribute to the expansion of public debt. As governments issue more bonds to finance these deficits, the supply of bonds increases. In a market where investors begin to seek higher yields for taking on the perceived increased risk—stemming from both inflationary pressures and the supply-demand dynamics—the yields on these bonds start to rise.

This narrative points to a fundamental economic conundrum: finding the right balance between stimulating growth and controlling inflation, all while managing public finances sustainably. The responses of governments and central banks to these bond market signals will be instrumental in shaping the economic landscape moving forward. The bond market’s reaction is not merely a financial expression but a signal of broader economic sentiments and expectations towards policy effectiveness and economic stability.

In this global economic theatre, the interconnectivity means that policies in one part of the world can have far-reaching impacts, influencing market sentiments and policy discussions elsewhere. As we continue to navigate through these turbulent economic waters, the unfolding events in the bond markets across these key countries will undoubtedly serve as a critical barometer for assessing the global economic climate and the potential for policy shifts aimed at restoring balance and stability in the international financial system.

***Disclaimer: This analysis is presented with the aim of providing a detailed and informative perspective on current economic developments. It draws upon information available up to the present point in time and aims to engage readers in a thoughtful consideration of the dynamics at play in the global economic arena.